Bottom Line Up Front (BLUF)

The Virginia Consumer Protection Act (VCPA) is a broad state law that protects consumers from deceptive or unfair business practices. For businesses in Northern Virginia – including Fairfax, Loudoun, Prince William, Arlington, Clarke, and Frederick counties – this means even unintentional misrepresentations or failures to disclose important information can lead to legal liability. The VCPA gives consumers powerful remedies (like attorney fees and treble damages) and is enforced both through private lawsuits and by state or local authorities.

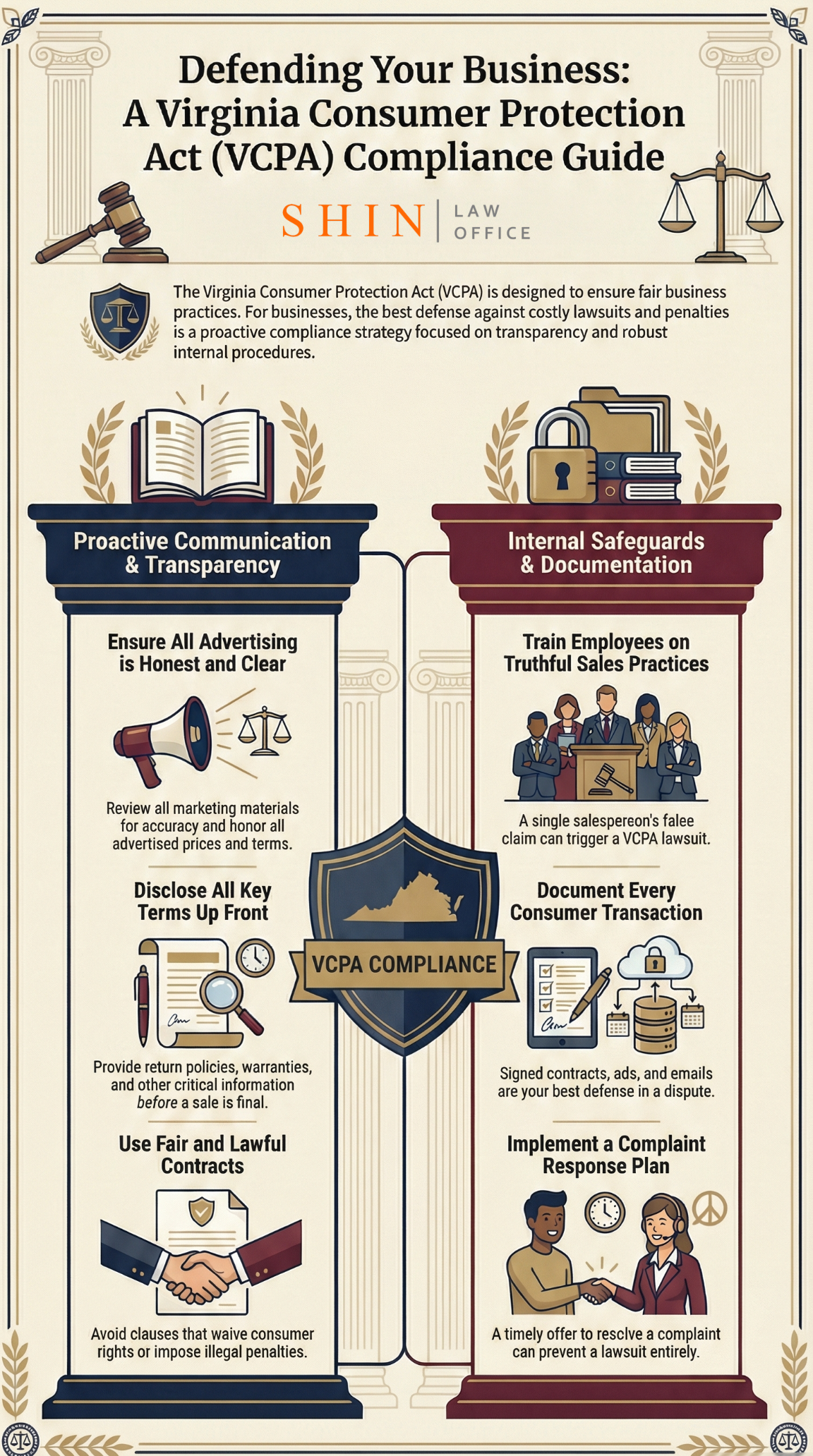

Bottom line: Companies must make VCPA compliance a priority and be prepared with strong defenses if a claim arises. This article provides an overview of the VCPA, common compliance risks for Virginia businesses, practical defenses (with case law and code citations), a Northern Virginia perspective, and a handy defense checklist – so you can protect your business and avoid costly consumer protection litigation.

Table of Contents

- Chapter 1: Overview of the Virginia Consumer Protection Act (VCPA)

- Chapter 2: Common VCPA Compliance Risks for Businesses

- Chapter 3: Defending Against VCPA Claims – Key Strategies

- Chapter 4: VCPA Enforcement in Northern Virginia (Local Perspective)

- Chapter 5: Defensive Checklist for Virginia Businesses

- FAQs – Virginia Consumer Protection Act

- References

1. Overview of the Virginia Consumer Protection Act (VCPA)

The Virginia Consumer Protection Act, codified at Va. Code § 59.1-196 et seq., is a remedial law intended to promote fair and ethical standards between businesses (called “suppliers”) and consumers. In plain terms, the VCPA makes it unlawful for a business to engage in a wide range of fraudulent, deceptive, or misleading practices in connection with consumer transactions. A “consumer transaction” is broadly defined as the sale, lease, or advertisement of goods or services for personal, family, or household use. This means everything from retail sales and home services to auto repairs and lending can fall under the VCPA’s scope, as long as the end customer is using the product or service primarily for personal or household purposes (not for resale or business use).

What practices does the VCPA prohibit? The law contains a laundry list of banned practices in Va. Code § 59.1-200. These include obvious frauds and misrepresentations – for example, lying about a product’s source, quality, or features – as well as more subtle “unfair” practices. Some illustrative examples explicitly outlawed are: misrepresenting the standard or grade of goods, advertising used or defective goods as if they were new without disclosure, “bait-and-switch” advertising (marketing a product with no intent to sell as advertised), false statements about price reductions or repairs, using fake invoices or documents to trick consumers, and failing to disclose material conditions (such as hidden fees or strict refund policies) up front. The Act also has a catch-all provision banning “any other deception, fraud, false pretense, false promise, or misrepresentation” in a consumer transaction. In short, if a business practice would mislead or unfairly affect a reasonable consumer, it’s likely prohibited by the VCPA.

How is the VCPA different from ordinary fraud? Importantly, the VCPA was designed to expand consumer remedies and relax the strict requirements of common-law fraud. In a landmark case, the Virginia Supreme Court noted that the VCPA “extends considerably beyond fraud” and was meant to make it easier for consumers to recover than under traditional fraud claims. For instance, a consumer suing under VCPA does not have to prove the business acted with fraudulent intent or knowledge of the falsity – an unintentional but materially misleading statement can still violate the Act. This is a lower bar than common-law fraud, which requires clear and convincing evidence of intentional misrepresentation and intent to deceive. However, Virginia courts have made clear that a VCPA plaintiff must show they suffered a loss resulting from the deceptive act. In other words, reliance and causation still matter: the consumer must have relied on the misrepresentation or unlawful practice to their detriment (e.g., they spent money or incurred harm as a result). If there’s no actual loss or causal link, there’s no VCPA liability even if the act was deceitful.

Who can sue and what can they recover? The VCPA gives a very broad right to sue – “any person” who suffers a loss from a violation can bring a claim. Typically, this will be the consumer who was wronged, but it could also be, say, a personal representative or other individual affected. Unlike some states, a consumer doesn’t have to have direct privity of contract with the business; if they were the one harmed by the deceptive practice, they have standing. Victims can recover actual damages, or $500 statutory damages per violation, whichever is greater. If the business’s conduct was willful (intentional or done with knowing disregard), the court may award up to triple the actual damages (or $1,000, whichever is higher) as punitive damages. Additionally, the statute entitles the winner to attorney’s fees and court costs. This fee-shifting is a big deal – it means a business losing a VCPA case will likely have to pay the consumer’s legal bills, which can sometimes exceed the actual damages. The prospect of attorneys’ fees and multiple damages gives consumers (and their lawyers) significant leverage, making VCPA claims especially potent. For example, in one recent case, a Virginia court ordered a defendant to pay nearly $160,000 to consumers for VCPA violations – illustrating how expensive these cases can get.

Are any transactions or businesses exempt? Yes – the VCPA carves out certain industries and activities. Virginia Code § 59.1-199 lists specific exemptions. For instance, banks, credit unions, insurance companies, public utilities, and real estate licensees (among others) are generally exempt from VCPA liability when acting in their regulated capacity. The rationale is that these industries are already subject to extensive state/federal regulation or have their own consumer protection regimes. The law also exempts transactions that are explicitly authorized by other laws or regulations (so a practice permitted by a federal regulator, for example, wouldn’t trigger VCPA liability). Certain landlord-tenant matters and real estate sales between individuals are also excluded (unless there was outright fraud). It’s important for a business to know if it falls into an exempt category – an exempt business or transaction is essentially shielded from VCPA lawsuits as a matter of law. However, these exemptions are narrowly interpreted. Simply being heavily regulated doesn’t automatically exempt a company unless the statute says so. Most ordinary retail businesses in Virginia are covered by the VCPA and cannot assume any blanket immunity.

In summary, the VCPA is a far-reaching consumer protection law that applies to a wide array of business conduct in Virginia. It provides powerful remedies to consumers and is construed liberally to achieve its remedial purpose. From a business standpoint, this means any misleading advertisement, inaccurate claim, or unfair sales tactic could land you in legal hot water.

2. Common VCPA Compliance Risks for Businesses

Virginia businesses must be proactive in identifying and managing practices that could violate the VCPA. Below are some of the most common compliance risks and pitfalls that can trigger VCPA complaints or lawsuits:

- False or Misleading Advertising: Making claims about your product or service that aren’t entirely true (or omitting important facts) is a classic VCPA violation. This includes exaggerations about quality or performance, fake “sale” prices, or the misuse of terms like “free” or “guaranteed.” For example, misrepresenting a product’s origin, quality, or benefits is explicitly unlawful. Advertising a discounted price when it’s not a real discount (false “was/now” pricing) or claiming an item is available at a low price when you don’t actually have enough stock (bait-and-switch) are also prohibited. Compliance tip: Ensure all marketing claims can be substantiated. Avoid hyperbole that could be construed as fact. Clearly disclose any conditions or limitations (for instance, “limited quantities” or “assembly required”) to prevent consumer confusion.

- Failure to Disclose Key Terms or Fees: Hiding the fine print can land a business in trouble. The VCPA requires clear disclosure of material terms, such as refund policies, return fees, warranty limitations, or any unusual conditions. For instance, a retailer must conspicuously post its return/refund policy if it doesn’t offer standard cash refunds. Similarly, all charges or fees in a consumer transaction should be transparent. Surprises later = angry customers (and potential lawsuits). Compliance tip: Be upfront. Provide written notices of return policies, warranty terms, and any extra fees (restocking fees, cancellation charges, delivery fees, etc.) before the sale is made. If selling online, don’t bury these disclosures in obscure links – make them clear and accessible.

- Selling Used or Defective Goods as New: The VCPA specifically forbids selling “used, secondhand, repossessed, defective, blemished, or reconditioned” goods without clearly identifying them as such. This is a common issue in industries like auto sales (e.g., selling a wrecked or flood-damaged car as “clean”) or electronics (reselling refurbished items as new). Likewise, if a product is a “second” or has imperfections, the advertisement must plainly say so. Compliance tip: Always accurately represent the condition of merchandise. If it’s pre-owned or has defects, prominently disclose that on the price tag or description. Keep documentation (like CarFax reports for vehicles or inspection records) to prove you informed the consumer of an item’s condition.

- Unfulfilled Promises and Guarantees: If your business offers guarantees, warranties, or promises results (“satisfaction guaranteed” or “we will save you 50% on your energy bill!”), failing to honor them can violate the VCPA. A “false promise” is in the statutory list of illegal practices. For example, a contractor who promises to use a certain quality of materials but actually uses subpar substitutes could be liable. Compliance tip: Don’t make promises you can’t keep. Set realistic customer expectations in writing. If you offer a warranty or guarantee, stand by it – and have clear terms so customers know what to expect. If circumstances change, communicate and get consent for any deviation from what was advertised or agreed.

- Improper Use of Contracts and Legal Clauses: The VCPA also targets sneaky contract and legal clauses. It’s unlawful to include void or unenforceable clauses in consumer contracts and then attempt to enforce them. For instance, using a contract with an illegal penalty or an unenforceable waiver of consumer rights can itself be a VCPA violation. An example would be a service contract that says “consumer waives all right to sue for any reason” or imposing excessive liquidated damages that violate other laws. Compliance tip: Have your consumer contracts reviewed by legal counsel. Remove any provisions that conflict with Virginia or federal law (like waiving implied warranties or certain remedies that by law cannot be waived). Using plain language contracts also helps ensure consumers aren’t misled about their rights.

- Violations of Specific Consumer Statutes: The VCPA incorporates several other Virginia consumer laws by reference. This means that if you violate those laws, it’s automatically a VCPA violation too. Examples include the Virginia Home Solicitation Sales Act, the Automobile Repair Facilities Act, the Health Club Act, the Lease-Purchase Agreement Act, and others. Each of these acts has its own requirements (e.g., certain disclosures for door-to-door sales, or estimates for auto repairs). Compliance tip: If your business falls into one of these categories (door-to-door sales, gym memberships, auto repair, rent-to-own contracts, etc.), make sure you know the specific rules that apply. Following those laws not only avoids their penalties but also keeps you clear of VCPA trouble. For instance, an auto repair shop that doesn’t provide a written estimate or authorization as required by the Automobile Repair Facilities Act could face a VCPA claim in addition to regulatory penalties.

- Poor Complaint Handling and Remedial Efforts: Sometimes, a small customer complaint can spiral into a lawsuit if not handled properly. Ignoring customer service issues – especially when a consumer feels misled or wronged – is risky. Virginia law even provides a mechanism (a “cure offer”, discussed later) for businesses to resolve a consumer’s issues before litigation. If you brush off a legitimate complaint, that customer may escalate the matter to an attorney or the Attorney General. Compliance tip: Treat consumer complaints seriously. Respond in writing, keep records, and if you discover a mistake or violation, try to make it right quickly (refund, repair, replacement, etc.). A sincere effort to fix a problem can sometimes dissuade a consumer from suing. It could also support a defense that the issue was inadvertent and corrected in good faith.

In essence, honesty and transparency are the best policy for Virginia businesses. Most VCPA compliance risks boil down to either giving consumers false impressions or not giving them information they should have. By training your staff, auditing your advertising and contracts, and resolving disputes amicably, you can greatly reduce the likelihood of a VCPA violation.

3. Defending Against VCPA Claims – Key Strategies

Facing a VCPA lawsuit or Attorney General investigation can be daunting, but businesses do have several defenses and strategies available. A successful defense can result in the claim being dismissed or liability being reduced. Here are the key defenses to know, supported by Virginia law:

- Transaction or Entity Outside VCPA Scope: One of the first questions is whether the VCPA even applies to the transaction. Remember, the Act covers only consumer transactions (primarily personal or household use). If the sale was a business-to-business transaction or for a commercial purpose, the VCPA does not apply. For example, if you sold equipment to another company for resale or use in their business, that’s not a consumer transaction and should be exempt from the VCPA’s reach. Additionally, if the defendant’s business falls under a statutory exemption (e.g., a bank or insurance company acting in its regulated capacity), that can be a complete defense. Defense tip: Argue lack of coverage early – often via a demurrer or motion to dismiss. If the plaintiff was not a “consumer” or the deal was not primarily for personal use, point that out clearly. Likewise, cite Va. Code § 59.1-199 if you’re an exempt entity or if the challenged conduct was explicitly allowed by another law. Courts have dismissed VCPA claims on these grounds when applicable.

- No Misrepresentation or Intent to Mislead: Not every unhappy customer equates to a VCPA violation. A business can defend itself by showing that its actions were not actually false, deceptive, or unfair under the Act. This is essentially arguing the facts: that you delivered what was promised, made all required disclosures, and did not mislead the consumer. Sometimes VCPA claims are based on misunderstandings or buyer’s remorse rather than true deception. By providing clear documentation – contracts, disclosures, marketing materials, email communications – a business can demonstrate that it acted honestly and in good faith. Defense tip: Keep good records! In a lawsuit, being able to produce the signed agreement with the refund policy the customer agreed to, or an email where you correctly answered their question about product features, can refute allegations of deception. If you can show the court that no misrepresentation or unlawful act occurred (i.e. the plaintiff’s claims are factually baseless), you can win on the merits or even get summary judgment before trial.

- Lack of Causation (No Reliance/No Loss): Even if a technical violation occurred, a plaintiff must prove they actually suffered a loss as a result. A savvy defense is to challenge causation and damages. Perhaps the consumer never relied on the supposed misrepresentation, or they didn’t incur any actual loss from it. Virginia courts require proof that the misrepresentation caused the consumer’s harm, which usually means the consumer relied on the false statement when deciding to purchase, leading to their loss. For example, if a consumer didn’t even read the advertisement or contract clause they complain about, it’s hard for them to claim it misled them. Or if they eventually got a full refund, they may have no compensable loss. Defense tip: Probe the plaintiff’s story for gaps: Did they read the disclaimer? Would they have bought the product anyway? Are their claimed damages speculative or self-inflicted? If you can break the chain between the alleged wrongful act and the consumer’s loss, the VCPA claim cannot stand (because the statute requires the loss be “as the result” of the violation).

- Statutory “Cure Offer” Defense: Virginia law offers businesses a unique opportunity to limit their exposure through a cure offer. Before the consumer files suit (or at least before you file your initial responsive pleading in court), you can send a written cure offer to the consumer, offering to remedy the problem and compensate them for their loss. If this cure offer meets certain requirements and the consumer unreasonably rejects it, the VCPA limits their recovery. Specifically, if the case goes to trial, the court can cap the consumer’s damages at the amount of the cure offer and bar them from recovering any attorneys’ fees or extra damages after the offer was made. In essence, the law encourages businesses to make things right early: it’s a “safe harbor” to prevent protracted litigation. Defense tip: Consider using the cure offer procedure as soon as you’re aware of a serious consumer complaint. Under Va. Code § 59.1-204(C), the cure offer must be delivered before your responsive pleading is filed. The offer should include not just compensation for the loss but also an additional amount (10% of the value or $500 minimum) for the consumer’s inconvenience and costs. If the consumer says no and then sues, you’ll be able to introduce the offer in court and potentially avoid paying their attorney fees or any treble damages. (Of course, if the consumer accepts the cure, the dispute ends without litigation – which is often the best outcome for all.)

- Statute of Limitations: Like any cause of action, VCPA claims have a time limit. The statute of limitations for a VCPA private action is generally two years after the cause of action accrues. In most cases, accrual will be when the misrepresentation or unlawful act occurred, and the consumer was harmed by it (Virginia follows an accrual rule for fraud-based claims at the time of injury, though there is a separate provision for the VCPA that essentially reinforces the two-year limit). If a consumer waits more than two years to sue after the incident (or, in some cases, after discovery of the incident), the claim can be dismissed as time-barred. Defense tip: Always check the dates. If the timeline of the complaint suggests the purchase or incident happened beyond the two-year window, raise the statute of limitations as an affirmative defense. In some cases, consumers try to argue tolling or continuous violation – those are technical exceptions. But Virginia’s courts have not been receptive to stretching the VCPA time limit. A claim filed “2 years and 1 day” after accrual will likely be thrown out.

- Good Faith & Unintentional Violation Defense: The VCPA includes a provision, Va. Code § 59.1-207, that essentially gives a safe harbor for unintentional violations in certain circumstances. If a business can prove by a preponderance of evidence that either (a) the violation was caused by an act or omission of someone else (e.g. a manufacturer or supplier) beyond the business’s control, or (b) the violation was a bona fide error despite the business having procedures in place to avoid such errors, then no liability for damages shall be imposed. In simpler terms, if you, as a retailer, unknowingly passed along a manufacturer’s false claim, or you made a one-off mistake despite having compliance protocols, you might escape liability under this section. However – and this is important – the statute also says the court can still order you to pay the consumer restitution and their attorneys’ fees even for an unintentional violation. So the “good faith” defense can get you out of paying damages, but you might still have to make the customer whole and cover legal costs if the court finds it fair. Defense tip: To invoke this, be prepared to show your compliance efforts. For example, did you have training and policies to prevent the kind of issue that occurred? Was the incident truly an accident or caused by a rogue employee or third-party supplier? Documented proof of internal controls and the lack of intent will be key. Even if this defense doesn’t wipe out the case entirely, raising your good faith efforts can favorably influence a judge or jury when deciding on willfulness and damages.

- No Double Recovery (Fraud vs. VCPA): Often, a consumer lawsuit will allege both common-law fraud and a VCPA count based on the same facts. Virginia law does not allow double-dipping on damages for the same misrepresentation. The plaintiff can present both claims, but if they win on both, they must elect their remedy – essentially choose either the fraud damages or the VCPA damages. This isn’t so much a defense as a limitation on recovery, but it’s useful to remember. You can use this in settlement negotiations to point out that the consumer won’t be able to stack multiple damages for the same conduct. Additionally, the burden of proof for common-law fraud is higher (clear and convincing), whereas under the VCPA it is preponderance. So a strategy might be to show the case is really a fraud claim that fails at the higher standard – which could, by implication, undercut the VCPA claim as well.

It’s also worth noting that consulting experienced legal counsel is crucial when facing a VCPA claim. An attorney versed in consumer protection law can identify nuanced defenses – for example, whether a federal law might preempt the VCPA in your case, or if the Attorney General’s involvement (in a government enforcement action) affects the timing of private claims.

4. VCPA Enforcement in Northern Virginia (Local Perspective)

Northern Virginia – especially Fairfax, Loudoun, Prince William, Arlington, Clarke, and Frederick Counties – is a bustling economic hub with a large consumer population. Not surprisingly, these counties see a fair share of VCPA-related activity, from private lawsuits in the local courts to enforcement actions by authorities. Here’s what businesses in these areas should keep in mind:

[Image of map of Northern Virginia counties]

Local Consumer Lawsuits: Consumers in Northern Virginia frequently turn to the VCPA when they feel wronged in transactions like auto sales, home improvement projects, retail purchases, and service contracts. For example, Fairfax County’s courts have heard VCPA cases on matters ranging from defective home construction to misrepresented services in senior living facilities. The Circuit Courts of each county (and sometimes the General District Courts for smaller claims) are the venues where these lawsuits are filed. Fairfax County, being the most populous, tends to have the highest volume of cases, but Loudoun, Prince William, and Arlington are not far behind, given their growth. Local tip: Businesses operating in these counties should be aware that juries and judges here have not been shy about enforcing the VCPA. In fact, Northern Virginia juries have returned significant verdicts in favor of consumers in recent years (including punitive treble damages in egregious cases of fraud). The community standards in these areas generally favor honest business practices, and a notable misdeed can result in reputational harm as well as legal liability. Pay attention to complaints – an unhappy customer in Fairfax might readily find a capable consumer protection lawyer in the DC metro area to take their case.

Role of the Virginia Attorney General and County Officials: The Virginia Attorney General’s Office has a Consumer Protection Section that actively enforces the VCPA across the Commonwealth. The AG can investigate businesses (through Civil Investigative Demands) and bring lawsuits for VCPA violations, seeking injunctions, restitution for consumers, and civil penalties. Notably, local Commonwealth’s Attorneys (and county/city attorneys) also have authority to enforce the VCPA and seek civil penalties for willful violations, with any penalties going to the state’s Literary Fund. In Northern Virginia, this means that the Commonwealth’s Attorney in, say, Fairfax or Loudoun could potentially file a VCPA action (though in practice the Attorney General usually takes the lead on consumer protection matters unless there’s a local angle).

One example of government action: the Attorney General might sue a home contractor for a pattern of defrauding consumers in Prince William County, or a used car dealership in Arlington for odometer fraud affecting multiple customers. These public enforcement actions can result in civil penalties of up to $2,500 per willful violation (or $5,000 for certain repeated violations), in addition to orders to repay consumers. For businesses, an AG investigation letter or subpoena should be taken very seriously – it can often be resolved via an Assurance of Voluntary Compliance (a settlement) but ignoring it could lead to a public lawsuit.

Local Consumer Protection Resources: Northern Virginia localities also have consumer protection offices or hotlines (for instance, Fairfax County Consumer Affairs). While these county agencies don’t prosecute cases, they mediate complaints and can refer patterns of abuse to the Attorney General. A flurry of complaints to a county consumer affairs office could trigger deeper scrutiny of a business. Businesses would do well to resolve issues before they escalate to that point. Additionally, Northern Virginia has an educated consumer base that is aware of their rights – websites, local news, and even word-of-mouth often remind residents that the VCPA is available to them. It’s not uncommon to see local newspapers or TV reporting on “scam alerts” or consumer lawsuits, which can spur more claims.

Jury Pools and Trends: Culturally, Northern Virginia is diverse and relatively pro-consumer when it comes to fraud and unfair practices. Juries here might include federal workers, tech industry employees, military families, etc., who tend to be savvy and may not look kindly on a business that took advantage of “the little guy.” On the flip side, they also appreciate legitimate businesses – a Northern Virginia jury can distinguish between a frivolous gripe and an actual scam. So if you have strong evidence that you acted fairly, that will play fine locally. But if evidence shows you knowingly cheated a customer, don’t expect much sympathy. Judges in these counties also have experience with VCPA cases and will often allow them to proceed to trial if the consumer’s allegations meet the statute’s criteria, given the remedial intent of the law.

Geographic Impact on Damages and Venue: One practical consideration: doing business in multiple counties means you could be sued wherever the consumer transaction took place or where the consumer resides. We’ve seen cases where, for example, a Leesburg-based company is sued in Arlington because the customer lives there and signed the contract. Defending a case in a different county can add complexity. Also, some counties (like Fairfax) have historically high verdicts in civil cases, while others might be more conservative – this can subtly influence a plaintiff’s choice of venue. Businesses can’t always control the venue, but it’s something to be mindful of.

5. Defensive Checklist for Virginia Businesses

Use this checklist as a proactive defense tool – by following these steps, a business can significantly reduce VCPA risk and be better prepared to defend against any consumer protection claims:

✅ Advertise Honestly and Clearly: Review all marketing materials (ads, websites, brochures) for accuracy. Remove or clarify any statement that could be misconstrued. If you mention prices, products, or discounts, ensure you honor them as advertised (bait-and-switch is illegal). Always include any required disclaimers (e.g., “limited supply,” “results may vary”). When in doubt, err on the side of transparency.

✅ Disclose Key Terms Up Front: Before a sale is final, make sure the customer has any crucial information that might affect their decision. This includes return/refund policies, warranty terms, delivery timelines, installation requirements, or anything not obvious about the product/service. Put these disclosures in writing (contracts, receipts, or signs in-store) so you have proof. Surprises later = angry customers (and potential lawsuits).

✅ Avoid Unfair Contract Clauses: Do not include provisions in consumer contracts that violate the law or public policy (for example, a clause waiving all consumer rights, or an exorbitant penalty for cancellation that isn’t allowed by law). Such clauses can not only be struck down but also expose you to VCPA claims. Use plain language contracts and, if applicable, include the Notice of Cancellation rights for certain sales (home solicitation, etc.). If you’re not sure about a contract term, get legal review – it’s cheaper than litigation later.

✅ Train Employees on Truthful Sales Practices: Often, a VCPA case stems from what a salesperson said (or didn’t say). Train your staff to never make false claims or promises just to close a deal. Establish a policy that all representations to customers must be truthful and authorized. If a customer asks a question and the employee isn’t sure, they should say they’ll find out – not guess or bluff. Consider providing scripts or FAQs to address common questions and ensure consistent, accurate answers.

✅ Monitor and Update Marketing Content: Ensure that outdated or incorrect claims aren’t lingering on your website, social media, or in-store signage. If a promotion ended or a product spec changed, update it everywhere. Designate someone to periodically audit your public content. Old misrepresentations can be just as damaging if customers rely on them (for instance, a two-year-old blog post that gives wrong info about your service is still “advertising” in the eyes of the law).

✅ Keep Documentation of All Consumer Transactions: Maintain copies of advertisements, signed contracts, receipts, warranties given, and all correspondence with customers. If a dispute arises, this documentation is your best defense to show what was communicated and agreed upon. For any verbal promises, it’s wise to confirm them in writing (email or text) so there’s a record. Good record-keeping can make or break your ability to defend a VCPA claim.

✅ Implement a Complaint Response Plan: Have a clear process for handling customer complaints or refund requests. Train your customer service reps to escalate serious issues to management. Respond in writing to significant complaints, summarizing any resolution offered. A timely cure offer or settlement with a dissatisfied customer can prevent a minor issue from exploding into a lawsuit. Plus, if you do end up in court, showing that you tried to resolve the matter reasonably can only help your case.

✅ Utilize Cure Offers When Appropriate: If you identify a potential VCPA violation or get a demand letter from a customer’s lawyer, consider using the cure offer mechanism proactively. Work with legal counsel to draft a compliant offer that provides the customer full relief plus the statutory additional amount. Send it via certified mail. Even if the customer rejects it, you’ve likely limited your worst-case exposure (no attorneys’ fees or punitive damages beyond actual loss) if litigation ensues.

✅ Check for Statutory Compliance (Specific Laws): If your business type has extra consumer protection statutes (for example, you run a gym, sell travel club memberships, offer credit services, etc.), double-check that you’re following those laws to the letter. Make a compliance calendar or checklist for any notices, cancellation rights, or disclosures that those laws require. Compliance with those will generally mean compliance with the VCPA as well, since violations of those acts trigger the VCPA.

✅ Good Faith Error? Document It: Despite best efforts, mistakes can happen – a typo in an ad, a misquoted price, an employee’s slip of the tongue. If you discover such an error, fix it immediately and document what happened. Show that it was inadvertent and note what corrective action you took (retraining staff, updating the ad, etc.). Under Va. Code § 59.1-207, demonstrating that a violation was an unintentional, bona fide error and that you had procedures to avoid it can shield you from liability (aside from restitution). Your documentation could be key evidence for this defense.

✅ Consult Legal Counsel Periodically: Laws and regulations evolve. For example, recent amendments to the VCPA expanded protections for certain data privacy issues and other modern concerns. It’s wise to have a periodic legal check-up for your consumer practices – especially if you roll out a new advertising campaign or product line. An attorney can help identify any red flags (maybe that new “money-back guarantee” needs specific qualifying language, or that marketing claim needs a study to back it up) before they become problems. Being proactive legally is a solid investment in preventing VCPA headaches.

By following the checklist above, businesses can greatly reduce the risk of violating the Virginia Consumer Protection Act. Not only does this protect you from lawsuits and fines, but it also builds trust and goodwill with your customers – a win-win scenario.

FAQs – Virginia Consumer Protection Act

Q: What is the Virginia Consumer Protection Act (VCPA) and who does it protect?

A: The VCPA is a Virginia law (Va. Code § 59.1-196 et seq.) that protects consumers from fraudulent or deceptive acts by businesses in consumer transactions. It covers sales, leases, and services for personal or household use. Essentially, it is meant to ensure fair dealing in the marketplace, so that consumers aren’t misled or cheated by suppliers. It gives consumers the right to sue and also authorizes government enforcement for a wide range of unfair business practices.

Q: What are some examples of VCPA violations?

A: Common examples include: misrepresenting a product’s qualities or origin (saying something is “all natural” or “Made in USA” when it’s not); false advertising (like bait-and-switch, or fake “sale” prices); selling used or defective goods as new without disclosure; hidden fees or charges that weren’t clearly disclosed; using contracts with illegal provisions (e.g., waiving rights that can’t be waived); or any kind of deception or false promise made to a consumer in a transaction. Even an omission can be a violation if it makes what was said misleading. The law casts a wide net over dishonest and unfair business tactics.

Q: My business didn’t intend to mislead anyone – can we still be liable under the VCPA?

A: Yes, intent is not required for many VCPA violations. The law prohibits conduct that has the effect of misleading consumers, even if you didn’t mean to. For instance, if an employee accidentally gives a customer incorrect information about a product and the customer relies on it, that can trigger liability, willful or not. Lack of intent might protect you from treble damages (which require willfulness) and might invoke the unintentional error defense if you had good procedures in place, but the consumer can still claim actual damages. In short, good faith is not a get-out-of-jail-free card – a misrepresentation is a misrepresentation. That said, if you truly had no intent and it was a snafu despite proper training, bring that up in your defense; it can help mitigate the outcome.

Q: What can a consumer get if they win a VCPA lawsuit?

A: A successful consumer can recover actual damages (their quantifiable loss) or $500, whichever is greater. They can also get reasonable attorneys’ fees and court costs paid by the defendant. If the business’s violation was found to be willful, the court may award up to 3 times the actual damages (commonly referred to as treble damages) as a punitive measure. For example, if a consumer’s actual loss was $2,000 and the conduct was willful, the court could award up to $6,000. Additionally, a court can order injunctive relief or other remedies to stop unlawful practices, and in government enforcement cases, civil penalties up to $2,500 per violation can be imposed.

Q: Is my industry or business type exempt from the VCPA?

A: Only a few are explicitly exempt. Va. Code § 59.1-199 lists entities such as banks, savings institutions, credit unions, public utilities, insurance companies, etc., that are generally exempt when acting in their regulated business. It also exempts aspects of transactions that are specifically authorized by other laws (so if another law says you can do X, VCPA won’t punish you for doing X). Landlords have some exemptions for ordinary evictions or rent issues (unless there’s an actual misrepresentation). In many cases, real estate home sales by owners are exempt. If you’re not on the exempt list, assume the VCPA applies. Even if you are on the list, note that the exemption might be narrow – e.g., an insurance company is exempt for insurance transactions, but if it sells some product outside of that (like a side business), that could be covered.

Q: How long does a consumer have to file a VCPA claim?

A: The statute of limitations for a VCPA lawsuit is two years from when the cause of action accrues. In practical terms, that usually means two years from the transaction date or the date the consumer discovered the misrepresentation. There is a tolling provision if a government enforcement action is filed; essentially, the clock might pause during an ongoing AG lawsuit about the same conduct. But generally, if more than two years have passed since the sale or the problem came to light, a private VCPA claim would be time-barred.

Q: Can a consumer sue for both fraud and under the VCPA for the same issue?

A: Yes, they can include both counts in their lawsuit (and often do), but they can’t recover twice for the same harm. The VCPA is considered a different cause of action from common-law fraud, so plaintiffs sometimes plead both – fraud (requiring intent and allowing possibly punitive damages beyond the VCPA’s trebling cap) and VCPA (easier to prove and includes attorney fees). If they win on both, they would typically choose the higher award to avoid double recovery. One notable difference: fraud in Virginia requires clear and convincing proof and showing of intent to deceive, whereas VCPA requires only a preponderance of evidence and no intent in most cases. Also, the VCPA provides attorney fees which fraud does not by itself. So even if a consumer loses the fraud count, they might still win under VCPA.

Q: How can I, as a business, avoid VCPA lawsuits in the first place?

A: Prevention is key. Use the kind of checklist we provided above. In summary: be truthful in all representations, keep your customers informed, honor your promises, and address complaints proactively. Make sure your employees understand that honesty is the policy – a single rogue misrepresentation can put your whole company on the hook. Keep documentation of what you sell and say. If a mistake happens, fix it fast (consider offering refunds or other remedies before the issue escalates). It’s also wise to have your standard contracts and marketing reviewed periodically by a legal professional. They might catch clauses or claims that could be problematic.

Principal Attorney | Shin Law Office

Call 571-445-6565 or book a consultation online today.

(This article is provided for general informational purposes and does not constitute legal advice. For advice on your specific situation, consult with a licensed Virginia attorney.)

References

-

Statutes and Codes

Virginia Consumer Protection Act, Va. Code Ann. §§ 59.1-196–59.1-207 (2025).

https://law.lis.virginia.gov/vacode/title59.1/chapter17/Virginia Code § 59.1-199. Exemptions. (2025).

https://law.lis.virginia.gov/vacode/59.1-199/Virginia Code § 59.1-200. Prohibited practices. (2025).

https://law.lis.virginia.gov/vacode/59.1-200/Virginia Code § 59.1-204. Private actions and damages. (2025).

https://law.lis.virginia.gov/vacode/59.1-204/Virginia Code § 59.1-207. Unintentional violations. (2025).

https://law.lis.virginia.gov/vacode/59.1-207/

Case Law

Ballagh v. Fauber, 290 Va. 120, 772 S.E.2d 315 (2015).

https://law.justia.com/cases/virginia/supreme-court/2015/140686.htmlOwens v. DRS Automotive FantomWorks, Inc., 288 Va. 489, 764 S.E.2d 256 (2014).

https://law.justia.com/cases/virginia/supreme-court/2014/130576.html

Government and Enforcement Resources

Office of the Attorney General of Virginia. (2024). Consumer protection laws and enforcement authority.

https://www.oag.state.va.us/consumer-protection/Office of the Attorney General of Virginia. (2024). Virginia Consumer Protection Act overview.

https://www.oag.state.va.us/consumer-protection/index.php/consumer-laws