BLUF (Bottom Line Up Front)

Under Virginia law, business fraud isn’t just a bad deal, a broken promise, or aggressive sales talk — it requires intentional deception at the time it was made that leads another party to act and suffer measurable financial harm. To succeed, a claim generally must show a false representation of a present, material fact, made knowingly and intentionally, that another person reasonably relied on, and that reliance caused real economic loss. Virginia courts strictly distinguish fraud from ordinary contract disputes and routinely dismiss cases that merely reflect poor judgment or unresolved negotiations rather than deliberate misrepresentation. Understanding the legal elements of business fraud and how courts evaluate them early — including the timing of statements, proof of intent, and reliance — is essential for any business owner or executive assessing whether they have a viable claim or defense.

If you are asking questions like these, this article is written for you:

• What legally counts as business fraud under Virginia law?

• How is business fraud different from breach of contract?

• What evidence do courts require to prove intentional misrepresentation?

• Why do many fraud claims fail before trial in Virginia courts?

• How should businesses prepare and document fraud disputes?

This guide explains how Virginia courts define and decide business fraud cases, the difference between fraud and other commercial disputes, and what evidence matters most when intentional deception is alleged.

Table of Contents

- What Is Considered Business Fraud Under Virginia Law

- Virginia Legal Authority

- Case Law Deep Dive on What Qualifies as Business Fraud

- What Are the Legal Elements of Business Fraud in Virginia

- Why These Elements Matter in Practice

- How Do Virginia Courts Evaluate Business Fraud Claims

- Case Law Deep Dive on Fraud Versus Contract Claims

- What Evidence Is Required to Prove Business Fraud

- Strategic Insight for Business Plaintiffs

- Can Business Fraud Be Claimed Alongside Breach of Contract

- Practical Warning for Plaintiffs

- What Damages Are Available in Virginia Business Fraud Cases

- How Long Do You Have to File a Business Fraud Lawsuit in Virginia

- What Happens After a Business Fraud Lawsuit Is Filed

- Final Takeaway

What Is Considered Business Fraud Under Virginia Law

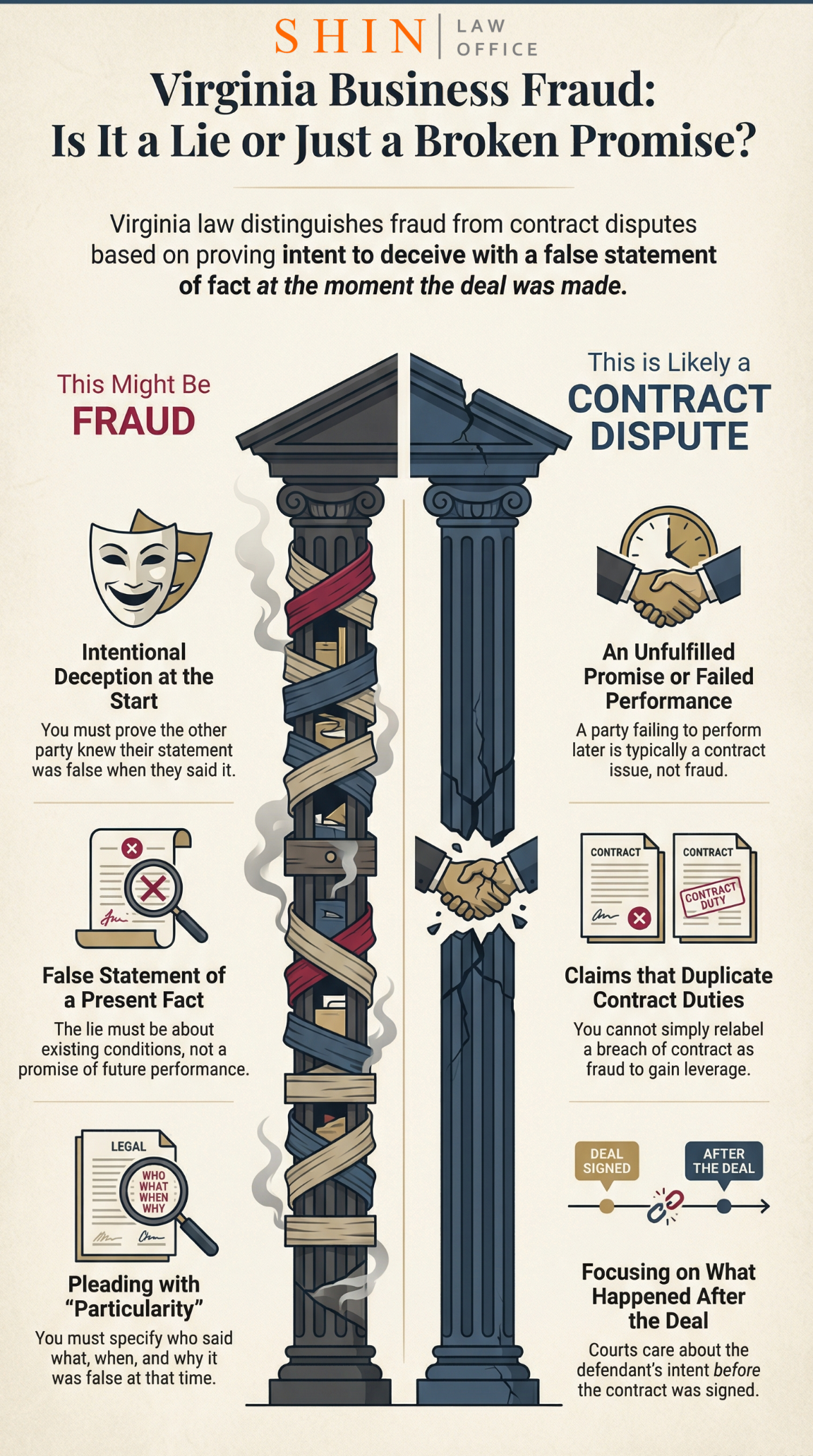

Under Virginia law, business fraud occurs when one party intentionally misrepresents a material fact to induce another party to act, and that deception causes measurable financial harm. The misrepresentation must be more than poor judgment, aggressive sales tactics, or a failed business deal. It must involve intentional deception existing at the time the statement was made.

Virginia courts repeatedly emphasize that fraud is not a substitute for breach of contract. A party who later fails to perform does not commit fraud unless the plaintiff can prove the defendant never intended to perform when the promise was made.

This distinction is foundational in Virginia commercial litigation and often determines whether a fraud claim survives a motion to dismiss or is dismissed with prejudice at the pleading stage.

Virginia Legal Authority

Virginia fraud claims are governed by common law principles rather than a single statute, but the pleading standard is reinforced by Rule 1:4 of the Rules of the Supreme Court of Virginia, which requires fraud to be pleaded with particularity.

Virginia courts strictly enforce this requirement.

Case Law Deep Dive on What Qualifies as Business Fraud

Virginia appellate courts consistently hold that fraud must involve a misrepresentation of a present or pre existing fact. Statements regarding future performance generally do not qualify unless the plaintiff proves the defendant had no intention of performing when the promise was made.

In Station 2, LLC v. Lynch, 280 Va. 166 (2010), the Supreme Court of Virginia reaffirmed that fraud cannot be based on unfulfilled promises or future events unless there is evidence the promisor had a present intent not to perform. The Court emphasized that converting every contract dispute into a fraud claim would undermine contract law entirely.

Similarly, in Abi Najm v. Concord Condominium, LLC, 280 Va. 350 (2010), the Court allowed a fraud claim to proceed only because the alleged misrepresentations occurred before contract formation and involved present facts, not future performance. The Court made clear that pre-contract deception aimed at inducing agreement may support a fraud claim when adequately pleaded.

These cases illustrate why many business fraud claims fail early. Without specific allegations showing present intent to deceive, Virginia courts will not allow fraud claims to proceed.

What Are the Legal Elements of Business Fraud in Virginia

To prove business fraud in Virginia, a plaintiff must establish six distinct elements.

First, a false representation must have been made.

Second, the representation must concern a material fact.

Third, the defendant must have known the representation was false.

Fourth, the defendant must have intended to mislead the plaintiff.

Fifth, the plaintiff must have reasonably relied on the misrepresentation.

Sixth, that reliance must have caused actual damages.

This six element framework has been repeatedly reaffirmed by the Supreme Court of Virginia, including in Evaluation Research Corp. v. Alequin, 247 Va. 143 (1994).

Failure to prove even one element defeats the entire claim.

Why These Elements Matter in Practice

Virginia courts do not relax fraud standards simply because a business dispute involves significant money or alleged misconduct. Fraud is treated as an extraordinary claim that requires extraordinary specificity.

Judges routinely dismiss fraud claims where plaintiffs fail to allege intent, reliance, or damages with concrete facts. Conclusory allegations and generalized accusations are insufficient under Virginia law.

How Do Virginia Courts Evaluate Business Fraud Claims

Virginia courts require fraud to be pleaded with particularity. This means the complaint must identify who made the misrepresentation, exactly what was said, when and where it was said, and why it was false when made.

This requirement is enforced rigorously.

In Harrison v. Westinghouse Savannah River Co., while not a Virginia Supreme Court case, Virginia courts frequently cite its articulation of particularity principles consistent with Rule 1:4.

Courts also examine whether the alleged fraud is independent of contractual duties. If the fraud claim simply restates a failure to perform under the contract, it will be dismissed.

Case Law Deep Dive on Fraud Versus Contract Claims

In Richmond Metropolitan Authority v. McDevitt Street Bovis, Inc., 256 Va. 553 (1998), the Supreme Court of Virginia held that fraud claims duplicating breach of contract allegations are barred unless the fraud arises from an independent duty.

The Court explained that allowing contract claims to be repackaged as fraud would distort Virginia commercial law and improperly expand tort liability.

This principle is frequently cited by trial courts when dismissing business fraud claims at the motion-to-dismiss stage.

What Evidence Is Required to Prove Business Fraud

Evidence in Virginia business fraud cases typically includes emails, written proposals, internal financial records, contemporaneous communications, and testimony demonstrating what the defendant knew at the time the alleged misrepresentation was made.

Courts focus on intent at the moment of the transaction. Later conduct alone is insufficient.

In Flippo v. CSC Associates III, LLC, 262 Va. 48 (2001), the Court emphasized that fraud must be proven by clear and convincing evidence, a higher evidentiary standard than ordinary civil claims.

Strategic Insight for Business Plaintiffs

Many businesses lose fraud claims because they rely on hindsight rather than contemporaneous proof. Successful fraud cases are built around documents and communications created before or during contract formation, not after the relationship collapses.

Can Business Fraud Be Claimed Alongside Breach of Contract

Yes, but only in narrow circumstances.

Virginia law allows fraud and breach of contract claims to proceed together when the fraud arises from a duty separate from the contract itself. Pre-contract misrepresentations are the most common example.

This principle was reinforced in Abi Najm, where the Court allowed fraud claims to coexist with contract claims because the deception occurred before the contract was executed.

Practical Warning for Plaintiffs

Virginia courts are skeptical of overlapping claims. Poorly pleaded fraud counts are often dismissed early and may undermine the credibility of the entire case.

Precision matters.

What Damages Are Available in Virginia Business Fraud Cases

A successful fraud claim may support recovery of compensatory damages, lost profits, and in rare cases punitive damages.

Punitive damages in Virginia are capped by statute under Virginia Code § 8.01 38.1 and are reserved for conduct that is willful, malicious, or demonstrates a conscious disregard for the rights of others.

Fraud claims may also support equitable remedies such as rescission or injunctions where appropriate.

How Long Do You Have to File a Business Fraud Lawsuit in Virginia

Under Virginia Code § 8.01 243, fraud claims are generally subject to a two-year statute of limitations. However, Virginia applies a discovery rule to fraud claims.

The limitations period begins when the fraud is discovered or reasonably should have been discovered through due diligence.

Courts analyze discovery closely, and unjustified delay can bar otherwise valid claims.

What Happens After a Business Fraud Lawsuit Is Filed

Once filed, business fraud cases in Virginia typically face aggressive motions to dismiss. Defendants often challenge the sufficiency of the pleading, reliance, causation, and the independence of the fraud claim from the contract.

Surviving dismissal significantly increases leverage. Many cases resolve after discovery reveals internal communications and evidence of intent that would not otherwise come to light.

Final Takeaway

Business fraud claims in Virginia are powerful but unforgiving. Courts require precise pleading, clear proof of intent at the time of the misrepresentation, and a strict separation from ordinary contract disputes.

When fraud is alleged correctly and supported by evidence, it can dramatically alter the trajectory of a business dispute. When it is not, dismissal is swift and often final.

Principal Attorney | Shin Law Office

Call 571-445-6565 or book a consultation online today.

Business Litigation Attorney for Northern Virginia

Frequently Asked Questions

1. What is considered business fraud under Virginia law

Business fraud in Virginia occurs when one party intentionally makes a false statement about a material fact to induce another party to act, causing financial harm.

2. What are the elements of business fraud in Virginia

Virginia requires proof of a false representation, material fact, knowledge of falsity, intent to mislead, reasonable reliance, and resulting damages.

3. How do I prove business fraud in a Virginia court

You must present detailed evidence showing the false statement, intent to deceive at the time it was made, reliance on the statement, and measurable financial harm.

4. What does a material misrepresentation mean in Virginia fraud cases

A material misrepresentation is a false statement that a reasonable person would consider necessary when deciding whether to enter a business transaction.

5. Is a broken promise automatically fraud in Virginia

No. A broken promise alone is usually a breach of contract unless you can prove the promise was never intended to be kept when it was made.

6. Can a future promise count as fraud in Virginia

Only if there is proof the speaker had no intention of performing at the time the promise was made.

7. What is the difference between business fraud and breach of contract in Virginia

Fraud involves intentional deception independent of the contract, while breach of contract requires failure to perform agreed terms without deception.

8. Can I sue for fraud and breach of contract at the same time in Virginia

Yes, but only if the fraud arises from a duty separate from the contract, such as a duty of good faith during negotiations.

9. What evidence is most persuasive to prove business fraud in Virginia

Emails, written proposals, financial records, internal communications, and witness testimony showing intent at the time of the statement are most persuasive.

10. Do emails and text messages help prove fraud in a Virginia business case

Yes. Contemporaneous emails and messages are often critical evidence of knowledge, intent, and misrepresentation.

11. How do Virginia courts decide whether reliance was reasonable

Courts look at the sophistication of the parties, access to information, and whether reliance made sense under the circumstances.

12. What does reliance mean in a Virginia business fraud claim

Reliance means the plaintiff actually believed the false statement and acted on it when making a business decision.

13. Do I have to show intent to deceive to win a fraud case in Virginia

Yes. Intent to deceive is a required element and must be proven with specific facts.

14. How can I prove someone never intended to perform in Virginia

Proof often comes from internal documents, contradictory statements, financial incapacity, or conduct inconsistent with the promise at the time it was made.

15. What does it mean to plead fraud with particularity in Virginia

It means the complaint must specify who made the statement, what was said, when it was said, and why it was false.

16. Why do Virginia judges dismiss fraud claims early

Fraud claims are dismissed when they lack detail, fail to show intent, or improperly duplicate breach of contract allegations.

17. Can silence or withholding information be fraud in Virginia business deals

Yes, but only when the party had a legal duty to disclose material information.

18. When does a party have a duty to disclose in Virginia business transactions

A duty arises in fiduciary relationships, partial disclosures that are misleading, or when one party has superior knowledge not reasonably available to the other.

19. What damages can I recover for business fraud in Virginia

Recoverable damages may include compensatory damages, lost profits, and in limited cases punitive damages.

20. Can I recover lost profits in a Virginia business fraud case

Yes, if the lost profits can be proven with reasonable certainty and are directly caused by the fraud.

21. Are punitive damages available for business fraud in Virginia

Yes, but only for egregious conduct and subject to Virginia’s statutory cap.

22. How long do I have to file a business fraud lawsuit in Virginia

Most business fraud claims must be filed within two years from when the fraud was discovered or should have been discovered.

23. When does the statute of limitations start for fraud in Virginia

The limitations period begins when the fraud is discovered or reasonably should have been discovered.

24. What happens after I file a business fraud lawsuit in Virginia

The defendant typically files motions to dismiss, followed by discovery if the case survives early challenges.

25. How long does a business fraud case usually take in Virginia circuit court

Depending on complexity, a business fraud case can take several months to multiple years to resolve.

Disclaimer:The information provided in this article is for educational purposes only and does not constitute legal advice. Every case is unique. If you believe you have a claim, contact a qualified attorney immediately to discuss the specifics of your situation and the applicable statutes of limitation.