BLUF (Bottom Line Up Front)

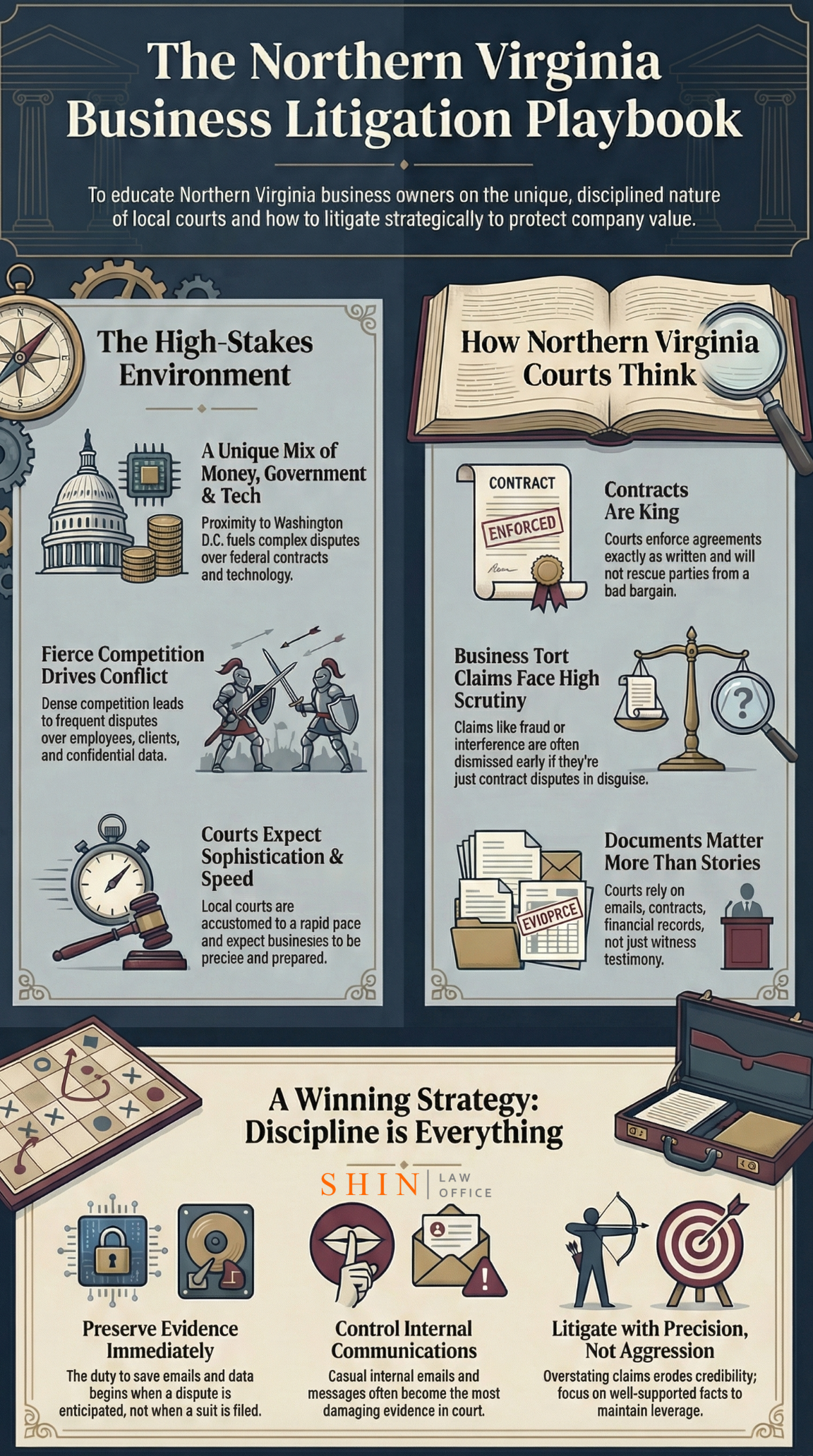

Business litigation in Northern Virginia is rarely about who feels wronged. It is about who understood the rules before the dispute began. Courts here move fast, enforce contracts exactly as written, and dismantle overreaching claims early. Fraud, tortious interference, business conspiracy, and breach of fiduciary duty claims succeed only when they are precise, evidence driven, and grounded in real legal duties, not frustration or hindsight.

Businesses that preserve evidence early, control internal and external communications, and litigate with discipline protect more than a lawsuit. They protect credibility, leverage, and long term enterprise value in one of the most competitive and unforgiving business litigation environments in Virginia.

If you are asking questions like these, this article is written for you:

• What types of injuries and accidents qualify for a claim in Fairfax County?

• What happens if I waited too long or missed a legal deadline?

• How long do I have to file a personal injury claim in Virginia?

• What if I was partly at fault for what happened?

• What should I ask a personal injury lawyer before taking action?

This guide explains the legal standards Northern Virginia courts actually apply, the mistakes that quietly kill claims, and how disciplined strategy separates recoverable cases from expensive losses.

Table of Contents

Ultimate Guide to Business Litigation in Northern Virginia

- Why Is Business Litigation So Common in Northern Virginia?

- What Actually Counts as a Business Dispute Under Virginia Law?

- Is This a Contract Dispute or a Business Tort? Why the Difference Matters

- What Are the Most Common Contract Disputes That Lead to Litigation in Northern Virginia?

- When Does a Broken Promise Become Business Fraud Under Virginia Law?

- What Is Constructive Fraud and Negligent Misrepresentation in Virginia Business Disputes?

- What Is Tortious Interference With Contract and Why Is It So Common in Northern Virginia?

- What Is Tortious Interference With Business Expectancy and Why Is It Harder to Prove?

- What Is a Virginia Business Conspiracy Claim and Why Do Courts Treat It Cautiously?

- When Do Fiduciary Duties Arise in Business Relationships Under Virginia Law?

- How Do Partner, Shareholder, and LLC Member Disputes Turn Into Litigation?

- Why Are Federal Contract and Government Contractor Disputes So Common in Northern Virginia?

- Why Are Technology, Data, and Confidential Information Disputes Increasing?

- What Damages and Remedies Can a Business Actually Recover in Northern Virginia Litigation?

- Why Are So Many Business Tort Claims Dismissed Early in Northern Virginia?

- What Does Discovery Really Look Like in Northern Virginia Business Litigation?

- How Does Summary Judgment Actually Work in Northern Virginia Business Cases?

- What Actually Happens at Trial in a Northern Virginia Business Case?

- Should a Business Dispute Go to Arbitration or Court in Northern Virginia?

- Can Civil Business Litigation Create Criminal Exposure in Northern Virginia?

- What Should a Business Do Immediately When a Serious Dispute Arises?

- How Does Business Litigation Affect Long Term Company Value?

- How Do You Choose the Right Business Litigation Lawyer in Northern Virginia?

- Key Takeaways for Northern Virginia Businesses Facing Litigation

- A Final Word on Business Litigation Strategy in Northern Virginia

Legal Citations & Case Law

Virginia Statutes Cited

- Virginia Code § 8.01-38.1 – Statutory cap on punitive damages

- Virginia Code § 18.2-178 – Obtaining money or property by false pretenses

- Virginia Code § 18.2-181 – Issuing bad checks

- Virginia Code § 18.2-111 – Embezzlement

- Virginia Code §§ 18.2-499 and 18.2-500 – Virginia Business Conspiracy Statute (civil conspiracy, treble damages, attorney’s fees)

- Virginia Code §§ 59.1-336 through 59.1-343 – Virginia Uniform Trade Secrets Act

Federal Statutes Cited

- 9 U.S.C. §§ 1–16 – Federal Arbitration Act

- 18 U.S.C. § 1836 – Defend Trade Secrets Act

- 41 U.S.C. §§ 7101–7109 – Contract Disputes Act

Virginia Supreme Court and Appellate Case Law

Contract Law and Interpretation

- Filak v. George, 267 Va. 612 (2004)

- Pocahontas Mining LLC v. CNX Gas Co., 276 Va. 346 (2008)

- Countryside Orthopaedics, P.C. v. Peyton, 261 Va. 142 (2001)

- Video Zone, Inc. v. KF & F Properties, L.C., 267 Va. 621 (2004)

Fraud and Misrepresentation

- Station #2, LLC v. Lynch, 280 Va. 166 (2010)

- Abi-Najm v. Concord Condominium, LLC, 280 Va. 350 (2010)

- Mortarino v. Consultant Engineering Services, Inc., 251 Va. 289 (1996)

Economic Loss Rule

Tortious Interference

- Chaves v. Johnson, 230 Va. 112 (1985)

- Duggin v. Adams, 234 Va. 221 (1987)

- Commercial Business Systems, Inc. v. Halifax Corp., 253 Va. 292 (1997)

- Lewis-Gale Medical Center, LLC v. Alldredge, 282 Va. 141 (2011)

- Dunn, McCormack & MacPherson v. Connolly, 281 Va. 553 (2011)

Business Conspiracy

- Almy v. Grisham, 273 Va. 68 (2007)

- Fox v. Deese, 234 Va. 412 (1987)

- Simmons v. Miller, 261 Va. 561 (2001)

Fiduciary Duty and Internal Business Disputes

- Augusta Mutual Insurance Co. v. Mason, 274 Va. 199 (2007)

- Flippo v. CSC Associates III, L.L.C., 262 Va. 48 (2001)

Evidence, Discovery, and Procedure

Federal Case Law

Pleading Standards

Summary Judgment

Arbitration

Expert Testimony

Federal Contracting

Chapter 1

Why Is Business Litigation So Common in Northern Virginia?

I am often asked some version of the same question by business owners in Alexandria, Fairfax, Arlington, and the surrounding Northern Virginia communities. Why does it feel like disputes here escalate faster, cost more, and become more complex than in other parts of Virginia?

The short answer is this. Northern Virginia sits at the intersection of money, government, technology, and competition. That combination produces opportunity, but it also produces friction. And when friction involves contracts, representations, and relationships, it often leads to litigation.

What Makes Northern Virginia Different From the Rest of Virginia?

Northern Virginia is not just another regional market. It operates under pressures that do not exist in most other parts of the Commonwealth.

This region is home to government contractors, defense firms, technology companies, consulting practices, professional services firms, real estate developers, and closely held businesses that often operate on tight timelines and high stakes. Deals move fast. Relationships overlap. Expectations are high.

When something goes wrong, the financial consequences are rarely small. That alone increases the likelihood that a dispute ends up in court.

Why Proximity to Washington DC Matters

Being close to Washington DC shapes how businesses operate here. Federal contracts, subcontracting chains, teaming agreements, compliance requirements, and regulatory representations are part of everyday business in places like Alexandria, Fairfax, Arlington, McLean, and Tysons.

That environment creates disputes distinct from a simple vendor disagreement. Many cases involve questions like:

- Who promised what to whom

- Whether certifications or disclosures were accurate

- Whether performance met contractual and regulatory standards

- Whether a termination was justified or strategic

When contracts involve government-related work or high-dollar compliance obligations, parties are far less willing to simply walk away from a dispute.

Why Contracts Are Litigated So Aggressively Here

Northern Virginia businesses tend to rely heavily on written agreements. Service contracts, professional engagement letters, software agreements, development contracts, consulting arrangements, and employment agreements form the backbone of daily operations.

When those contracts fail, the consequences ripple quickly. Cash flow is affected. Client relationships are strained. Investors and lenders pay attention.

As a result, parties are more likely to litigate rather than absorb losses quietly.

I see this play out repeatedly in Fairfax County and Arlington cases where the real issue is not just a missed deliverable, but the downstream impact on reputation, pipeline, or compliance exposure.

Why Competition Drives Litigation in This Region

Northern Virginia is dense. Competitors are often located minutes apart. Employees move between firms. Clients know multiple providers. Information travels quickly.

That environment fuels disputes involving:

- Former employees taking clients

- Allegations of misuse of confidential information

- Noncompete and nonsolicitation enforcement

- Claims of improper competition or interference

These cases are not about normal business rivalry. They arise when one party believes the rules were crossed, not just that competition was tough.

Why Businesses Here Litigate Early Instead of Waiting

In many parts of Virginia, businesses tolerate disputes longer before involving lawyers or courts. In Northern Virginia, waiting can be dangerous.

Delay can mean lost contracts, regulatory exposure, or irreversible client damage. That reality pushes businesses toward early legal action, including injunctions, emergency motions, and aggressive defense strategies.

The courts in Alexandria and Fairfax are accustomed to this pace. They expect parties to be sophisticated, prepared, and precise.

Why Northern Virginia Courts See Higher Complexity Cases

The disputes that reach court here are rarely simple. They often involve multiple parties, layered contracts, technical subject matter, and overlapping legal theories.

A single case may involve breach of contract, fraud allegations, tortious interference claims, fiduciary duty questions, and requests for injunctive relief all at once.

Courts in this region are experienced with that complexity, and they respond by enforcing strict pleading standards and narrowing cases early.

What This Means for Business Owners

If you operate a business in Northern Virginia, litigation risk is not an anomaly. It is part of the landscape.

That does not mean disputes are inevitable. But it does mean that contracts, communications, and strategic decisions here carry greater legal weight than many owners realize.

Understanding why litigation is so common in this region is the first step toward managing that risk rather than reacting to it.

In the next chapter, I explain what actually counts as a business dispute under Virginia law, and why many disagreements that feel unfair never become viable lawsuits in Northern Virginia courts.

Chapter 2

What Actually Counts as a Business Dispute Under Virginia Law?

One of the most important conversations I have with Northern Virginia business owners happens early, often before any lawsuit is filed. It usually starts with frustration. Something went wrong. A deal failed. A partner acted unfairly. A vendor did not deliver. And the question comes quickly. Do I have a case?

The answer depends on whether the issue is a legal dispute or simply a business problem. Virginia law draws a firm line between the two, and Northern Virginia courts enforce that line strictly.

Not Every Business Problem Is a Legal Dispute

This is the first reality many owners struggle with. A bad outcome does not automatically create a legal claim.

Virginia courts do not exist to fix poor business judgment, bad luck, or deals that did not work out as hoped. They resolve disputes where a recognized legal duty was violated and where the law provides a remedy.

In Northern Virginia, judges assume businesses are sophisticated. They expect companies in Alexandria, Fairfax, and Arlington to protect themselves through contracts, diligence, and risk allocation.

That expectation shapes how disputes are evaluated from the start.

The Core Question Courts Ask First

When a case is filed, courts quickly focus on one foundational question.

What legal duty was violated?

Everything flows from that. If no duty recognized by law was breached, the dispute ends there, no matter how unfair the situation feels.

This is why many cases are dismissed early. The facts may be messy. The conduct may feel wrong. But if the duty arises only from disappointed expectations, the court will not intervene.

Contractual Duties Versus Legal Duties

Most business disputes in Northern Virginia arise out of contracts. That is not a problem. Contract law exists to enforce agreements.

But Virginia courts are careful to keep contract claims in their lane. If the obligation exists because the parties agreed to it, the dispute usually stays in contract.

A business dispute becomes something more only when the law imposes a duty independent of the contract. Examples include duties not to commit fraud, not to misuse confidential information, or not to interfere improperly with another party’s contractual relationships.

Confusing these categories is one of the fastest ways to lose credibility in court.

Why Courts Are Skeptical of Reframed Claims

I often see complaints where a breach of contract is repackaged as fraud, interference, or conspiracy. This rarely succeeds in Northern Virginia courts.

Judges are trained to look past labels and focus on substance. If the alleged wrongdoing is simply a failure to perform as promised, calling it fraud does not change the analysis.

This is especially true in Fairfax and Alexandria courts, where judges routinely narrow cases early to eliminate claims that do not belong.

What Courts Recognize as True Business Disputes

Legitimate business disputes under Virginia law typically fall into recognizable categories.

- Breach of contract where terms were violated

- Fraud involving false statements of present fact

- Tortious interference with contracts or business expectancies

- Breach of fiduciary duty by someone in a position of trust

- Misuse of confidential or proprietary information

- Enforceable noncompete or nonsolicitation violations

These disputes are not about disappointment. They are about violations of defined legal standards.

Why Northern Virginia Businesses Face Higher Scrutiny

Northern Virginia courts assume that businesses here understand risk. Deals are negotiated by professionals. Contracts are drafted deliberately. Parties are expected to read what they sign.

Because of that, courts are less sympathetic to claims that rely on hindsight or regret. They expect clarity, specificity, and evidence.

This does not mean businesses cannot win. It means they must win on law and facts, not emotion.

The Practical Takeaway for Business Owners

Before assuming a dispute belongs in court, the right question is not who acted unfairly. It is whether a recognized legal duty was violated and whether the law provides a remedy worth pursuing.

Understanding this distinction early saves time, money, and strategic leverage.

In the next chapter, I explain how courts decide whether a dispute sounds in contract or business tort, and why that classification often determines whether a case survives its first challenge in Northern Virginia.

Chapter 3

Is This a Contract Dispute or a Business Tort? Why the Difference Matters So Much in Northern Virginia

This is where many business cases in Northern Virginia are won or lost before they ever reach discovery. I see it constantly. A business owner comes in convinced they were lied to, sabotaged, or treated unfairly. They want to pursue every possible claim. Breach of contract. Fraud. Interference. Conspiracy.

The problem is that Virginia law does not let you throw everything at the wall and see what sticks. Courts here force you to choose the correct legal lane early, and they enforce that choice aggressively.

Why Courts Care About This Distinction

From a judge’s perspective, the difference between a contract dispute and a business tort is not academic. It controls what evidence matters, what damages are available, how discovery proceeds, and whether the case survives at all.

Northern Virginia courts are exceptionally disciplined about this because so many cases involve sophisticated parties and carefully drafted agreements. Judges assume that contracts are how businesses allocate risk. Tort law is not meant to rewrite those bargains after the fact.

The Question Courts Ask First

When a complaint is filed, the court is usually asking a simple question beneath the surface.

Did the alleged duty exist because the parties signed a contract, or did it exist regardless of the contract?

If the answer is that the duty came from the agreement itself, the claim almost always belongs in contract law. If the answer is that the law imposed the duty independently, then a tort claim may be viable.

This is often referred to as the source of duty analysis, but you do not need legal jargon to understand it. The court wants to know whether the defendant violated the deal or the law.

Why Many Tort Claims Fail Early

In Northern Virginia, many business tort claims fail because they are really contract disputes in disguise.

- A vendor failed to deliver on time.

- A consultant did not meet expectations.

- A subcontractor underperformed.

- A partner made a bad business decision.

Those facts may support a breach-of-contract claim. They do not automatically support fraud, interference, or conspiracy.

Courts will not allow tort claims to proceed simply because a party acted poorly or the outcome was damaging.

What Makes a Dispute a True Business Tort

A business tort exists when the conduct violates a duty imposed by law, not just by agreement.

Examples include knowingly lying about a present fact to induce a deal, intentionally interfering with another party’s contract through improper means, or breaching a fiduciary duty owed because of a position of trust.

These duties exist whether or not a contract was signed. That is the difference.

If you remove the contract from the picture, and the conduct would still be wrongful, you are likely dealing with a tort.

Why This Matters So Much in Practice

Misclassifying a claim has real consequences.

Tort claims are subject to stricter pleading standards. Fraud must be alleged with particularity. Interference claims require proof of improper methods. Conspiracy claims demand evidence of coordination and malice.

If those elements are missing, the court will not allow discovery to fill in the gaps. The claim is dismissed.

In contrast, contract claims often turn on documents, timelines, and performance evidence. They are narrower, but often stronger.

The Strategic Mistake Businesses Make

Many business owners assume that adding tort claims increases leverage. In Northern Virginia, it often does the opposite.

Weak tort claims distract from strong contract claims. They invite early motions. They erode credibility. Judges notice when claims are overstated.

I have seen cases where a solid breach-of-contract claim was overshadowed by poorly supported fraud allegations, causing the entire complaint to be viewed skeptically.

How Courts in This Region Actually Think

Judges in Alexandria, Fairfax, and Arlington see these issues constantly. They are not hostile to business plaintiffs. They are hostile to imprecision.

They want to know precisely what duty was owed, how it was violated, and what remedy the law allows. Claims that blur those lines do not last long.

The Takeaway for Northern Virginia Businesses

Before filing suit or responding to one, it is critical to classify the dispute correctly. Ask whether the complaint is really about performance under a deal or about conduct the law independently forbids.

Getting that answer right shapes everything that follows.

In the next chapter, I explain the most common contract disputes that actually lead to litigation in Northern Virginia, and why some disagreements escalate while others quietly resolve without court involvement.

Chapter 4

What Are the Most Common Contract Disputes That Lead to Litigation in Northern Virginia?

When business owners in Northern Virginia ask me what types of disputes actually end up in court, my answer is almost always the same. Exotic legal theories do not drive most litigation here. It is driven by contracts that did not play out the way one side expected.

Alexandria, Fairfax, and Arlington courts see a steady flow of contract cases because contracts are how businesses here operate. They govern relationships with vendors, clients, consultants, employees, subcontractors, and government entities. When those relationships break down, the contract is the first and often only place the court looks.

Nonpayment and Fee Disputes Are the Most Common Triggers

By volume, nonpayment disputes are the most common contract cases I see in Northern Virginia. A business performs work, delivers services, or supplies goods, and payment does not arrive as expected.

Under Virginia law, breach of contract requires proof of a legally enforceable agreement, the plaintiff’s performance, the defendant’s breach, and resulting damages. This basic framework is consistently applied by Virginia courts, including in Filak v. George, 267 Va. 612 (2004), which reinforces that courts enforce contracts as written and do not add obligations that are not there.

What surprises many businesses is how often these cases turn on contract mechanics rather than fairness. Courts look closely at invoicing requirements, payment schedules, dispute resolution clauses, and notice provisions. If the contract requires a specific form of notice before payment is due, and it was not followed, that can defeat an otherwise legitimate claim.

Scope of Work Disputes Escalate Quickly

Another common category involves disputes over scope. One side believes the contract covered specific work. The other insists it did not.

Virginia courts resolve these disputes by applying the plain meaning rule. If contract language is clear and unambiguous, courts enforce it as written without resorting to outside evidence. This principle is firmly established in Pocahontas Mining LLC v. CNX Gas Co., 276 Va. 346 (2008).

In Northern Virginia, these disputes are especially common in consulting agreements, technology development contracts, and professional services arrangements. When scope language is vague, litigation risk increases dramatically.

Termination and Default Disputes Are High-Stakes

Termination-for-cause disputes frequently lead to litigation because they often entail immediate financial and reputational consequences.

Virginia courts strictly enforce termination provisions. If a contract requires notice and an opportunity to cure before termination, failing to follow that process can invalidate the termination, even if the other party underperformed. This approach is reflected in Countryside Orthopaedics, P.C. v. Peyton, 261 Va. 142 (2001), where the court emphasized adherence to contractual termination procedures.

In Fairfax and Arlington cases, I often see disputes where a party terminates first and worries about justification later. That is a dangerous approach under Virginia law.

Performance Standards and Expectations Create Conflict

Many contracts include performance standards that are not well defined. Phrases like “commercially reasonable efforts” or “industry-standard performance” sound clear until a dispute arises.

Virginia courts interpret these provisions based on contract language and, when necessary, limited extrinsic evidence. However, courts do not rewrite vague standards to save one side from a bad bargain.

The takeaway is simple. If performance expectations are critical, they must be defined with precision at the drafting stage.

Why Contract Disputes Escalate Faster in Northern Virginia

Northern Virginia businesses often cannot afford prolonged uncertainty. Contract disputes here affect government compliance, client confidence, investor relationships, and ongoing operations.

Because of that, parties are more likely to litigate early rather than absorb losses quietly. Courts in Alexandria and Fairfax are accustomed to this dynamic and expect parties to come prepared with clean contracts and clear theories.

Federal Law Considerations in Contract Disputes

In contracts involving interstate commerce, arbitration clauses are often governed by the Federal Arbitration Act, 9 U.S.C. §§ 1–16. Federal courts, including those in the Eastern District of Virginia, regularly enforce arbitration agreements under this statute when applicable.

This is particularly relevant in Northern Virginia, where many contracts cross state lines or involve federal contractors.

The Practical Lesson for Businesses

Most contract disputes that reach court could have been narrowed or avoided with more precise drafting and disciplined performance documentation.

Virginia courts do not rescue parties from poorly written contracts. They enforce what was signed.

Understanding which contract disputes commonly escalate in Northern Virginia allows businesses to spot risk early and respond strategically.

In the next chapter, I explain when a broken promise crosses the line into fraud under Virginia law, and why fraud claims face a much higher bar than most business owners expect.

Chapter 5

When Does a Broken Promise Become Business Fraud Under Virginia Law?

This is one of the most misunderstood issues I see in Northern Virginia business litigation. A deal falls apart. A counterparty does not do what they promised. The damage is real. And the first instinct is to call it fraud.

Virginia law does not work that way.

In Alexandria, Fairfax, and Arlington courts, fraud is not a catchall for bad behavior or broken commitments. It is a narrowly defined claim with a high burden of proof, and courts enforce that burden rigorously.

Why Fraud Is Treated Differently Than Breach of Contract

Fraud is treated differently because it carries different consequences. It can open the door to punitive damages, reputational harm, and in some cases criminal exposure.

Because of that, Virginia courts require more than disappointment or hindsight. They require proof that the defendant lied about an existing fact at the time the statement was made, with the intent to mislead.

This principle is consistently enforced by the Virginia Supreme Court, including in Station #2, LLC v. Lynch, 280 Va. 166 (2010), which makes clear that fraud must involve a misrepresentation of present fact, not a future promise that later goes unfulfilled.

The Elements of Actual Fraud in Virginia

To prove actual fraud under Virginia law, a plaintiff must establish six elements by clear and convincing evidence.

- A false representation

- Of a present and material fact

- Made intentionally and knowingly

- With the intent to mislead

- Reasonable reliance by the plaintiff

- Resulting damage

These elements are not flexible. Courts apply them strictly, particularly in sophisticated business disputes.

Why Future Promises Usually Do Not Count

Most business disputes involve promises about future performance. We will deliver by this date. We will secure this approval. We will allocate these resources.

Virginia law draws a sharp distinction between a broken promise and fraud. A promise about the future is not fraud unless the plaintiff can prove that, at the moment the promise was made, the speaker had no intention of performing.

That is a difficult standard to meet, and courts do not infer fraudulent intent from later nonperformance alone. This rule is reinforced in Abi-Najm v. Concord Condominium, LLC, 280 Va. 350 (2010), where the court emphasized that fraudulent intent must exist at the time of the representation.

Why Courts Are Skeptical of Business Fraud Claims

Northern Virginia courts see many fraud claims attached to ordinary contract disputes. Judges are alert to this and scrutinize allegations of fraud carefully.

Fraud must be pled with particularity under Virginia procedural rules, and conclusory allegations do not survive early challenges. Courts expect detailed allegations of who said what, when it was said, how it was false at the time, and why reliance was reasonable.

This approach is consistent with Mortarino v. Consultant Engineering Services, Inc., 251 Va. 289 (1996), where the court rejected fraud claims lacking specific factual support.

Constructive Fraud and Negligent Misrepresentation

Virginia also recognizes constructive fraud, which does not require proof of intent to deceive. Instead, it involves negligent or reckless misrepresentation that causes harm.

Even here, courts require proof of a false representation of present fact and reasonable reliance. Constructive fraud is not a fallback for weak fraud claims. It remains a demanding cause of action.

Federal Law and Fraud in Business Disputes

In cases involving interstate commerce or federal contracting, fraud allegations can implicate federal statutes and regulations. While civil fraud claims are governed by state law, misrepresentations tied to federal contracts can trigger parallel federal scrutiny.

This is especially relevant in Northern Virginia, where federal contractors operate under extensive disclosure and certification requirements.

The Practical Reality for Businesses

Calling a broken promise fraud does not make it fraud. In Northern Virginia, overstating a fraud claim often damages credibility and weakens the overall case.

Strong fraud claims exist, but they are built on evidence of intentional deception at the outset, not frustration after the fact.

Understanding when fraud applies and when it does not is critical to protecting leverage and avoiding early dismissal.

In the next chapter, I explain constructive fraud and negligent misrepresentation, and when Virginia law allows recovery even without proof of intent to deceive.

Chapter 6

What Is Constructive Fraud and Negligent Misrepresentation in Virginia Business Disputes?

After business owners learn how hard it is to prove actual fraud in Northern Virginia, the next question almost always follows. What if the other side did not intend to lie, but still gave us bad information that caused real harm?

That is where constructive fraud and negligent misrepresentation enter the discussion. These claims exist under Virginia law, but they are often misunderstood and frequently misused.

Constructive Fraud Is Not a Weaker Version of Fraud

Constructive fraud is sometimes described as fraud without intent, but that description can be misleading. While intent to deceive is not required, the claim still demands discipline and proof.

Under Virginia law, constructive fraud involves a false representation of a present, material fact that is made negligently or recklessly, relied upon reasonably, and results in damage. The absence of intent does not excuse the need for specificity.

The Virginia Supreme Court addressed this clearly in Mortarino v. Consultant Engineering Services, Inc., 251 Va. 289 (1996), holding that constructive fraud still requires a misrepresentation of fact and reasonable reliance. Courts will not allow constructive fraud claims to proceed where the alleged misstatement is vague, opinion-based, or future-oriented.

Why Negligent Misrepresentation Is Narrow in Virginia

Unlike some states, Virginia does not recognize a broad standalone tort of negligent misrepresentation in ordinary business transactions. Instead, negligent misrepresentation claims are tightly confined and often analyzed through the lens of constructive fraud.

Virginia courts are cautious here because expanding negligent misrepresentation too far would blur the line between tort and contract. That concern is central to the economic loss rule articulated in Sensenbrenner v. Rust, Orling & Neale, Architects, Inc., 236 Va. 419 (1988), where the court emphasized that purely economic losses arising from contractual relationships generally belong in contract law, not tort.

As a result, negligent misrepresentation claims often fail when the alleged duty arises solely from a contract rather than an independent legal obligation.

What Makes a Constructive Fraud Claim Viable

For a constructive fraud claim to survive in Northern Virginia courts, several elements must align.

- The representation must concern a present fact, not a future promise.

- The statement must be material, meaning it influenced the decision.

- The reliance must be reasonable under the circumstances.

- The defendant must have had a duty to speak accurately.

Courts examine these elements carefully, especially when both parties are sophisticated businesses.

In Abi-Najm v. Concord Condominium, LLC, 280 Va. 350 (2010), the court reinforced that even constructive fraud cannot be based on statements that are merely hopeful predictions or contractual expectations.

Why Reasonable Reliance Is the Battleground

In Northern Virginia business cases, reasonable reliance is often the linchpin of constructive fraud claims.

Courts expect businesses to exercise due diligence, read contracts, and verify critical facts when they can. Blind reliance is not protected.

If the information was available through ordinary inquiry, courts are reluctant to allow a claim of constructive fraud to proceed. This principle is consistently applied in Fairfax and Alexandria courts, particularly when contracts contain disclaimers or integration clauses.

Federal Context and Disclosure Obligations

In cases involving federal contractors or interstate transactions, disclosure obligations may arise from federal regulations or certifications. While civil fraud claims remain governed by Virginia law, negligent or reckless misstatements in regulated environments can carry broader consequences.

Northern Virginia businesses operating in government contracting environments must be especially careful. Statements made during procurement, certification, or performance can later become the foundation of civil disputes or regulatory scrutiny.

The Practical Reality for Business Owners

Constructive fraud is not a safety net for weak fraud claims. It is a distinct cause of action with its own limitations.

When used correctly, it addresses situations where false information caused harm even without intent to deceive. When used improperly, it collapses under early scrutiny.

The lesson is the same as with actual fraud. Precision matters. Evidence matters. And courts in Northern Virginia will not stretch the law to rescue poorly framed claims.

In the next chapter, I explain tortious interference with contract, one of the most commonly alleged business torts in Northern Virginia, and why lawful competition is often mistaken for unlawful interference.

Chapter 7

What Is Tortious Interference With Contract and Why Is It So Common in Northern Virginia?

Tortious interference with contract is one of the most frequently alleged business torts I see in Alexandria, Fairfax, and Arlington. It often arises when a business relationship ends abruptly and one party believes a third party caused that result.

What many business owners do not realize is that Virginia law protects competition. It does not protect expectations. The difference between the two is where most interference claims fail.

What Tortious Interference With Contract Actually Means Under Virginia Law

Under Virginia law, tortious interference with contract occurs when a third party intentionally disrupts an existing contractual relationship through improper methods.

The Virginia Supreme Court set out the core elements in Chaves v. Johnson, 230 Va. 112 (1985). To succeed, a plaintiff must prove:

- The existence of a valid contractual relationship

- Knowledge of that contract by the interferer

- Intentional interference inducing or causing a breach

- Use of improper methods

- Resulting damage

Every element matters. If even one is missing, the claim fails.

Why Knowledge and Intent Are Not Enough

In Northern Virginia, many interference claims focus on intent. A competitor knew about the contract. A former employee knew clients were under agreement. A vendor knew exclusivity existed.

Knowledge alone is not enough.

Virginia law requires improper methods. This is where most cases collapse.

In Duggin v. Adams, 234 Va. 221 (1987), the court made clear that competition, even aggressive competition, is not improper. Improper methods involve illegal conduct, independently tortious, or violates established standards of fair dealing.

Examples may include fraud, misuse of confidential information, or violation of enforceable restrictive covenants. Simply offering a better deal is not interference.

Why Employee Departure Cases Trigger These Claims

Northern Virginia sees a high volume of interference claims tied to employee departures. Consultants, sales professionals, and executives often move between competing firms in close proximity.

Businesses frequently assume that lost clients mean unlawful interference. Courts do not.

Unless the departing employee or new employer used improper methods, such as soliciting clients in violation of enforceable agreements or misusing protected information, the law permits competition.

This principle is reinforced in Lewis-Gale Medical Center, LLC v. Alldredge, 282 Va. 141 (2011), where the court emphasized the importance of protecting lawful competition while policing improper conduct.

Why Courts Scrutinize These Claims Early

Northern Virginia courts are particularly attentive to interference claims because they are often used strategically rather than substantively.

Judges are alert to attempts to weaponize tortious interference to block competition or punish employee mobility. As a result, courts frequently address these claims at the pleading or summary judgment stage.

Interference claims that rely on speculation, conclusory allegations, or business frustration do not survive.

Federal Context in Interference Claims

In cases involving federal contractors or interstate commerce, interference claims may intersect with federal contracting obligations or regulatory frameworks. While the tort itself is governed by state law, underlying conduct may implicate federal compliance duties.

This is especially relevant in Alexandria and Fairfax, where subcontracting relationships and teaming agreements are common and competitive pressures are intense.

Practical Guidance for Northern Virginia Businesses

Before alleging tortious interference, it is critical to identify the improper method. Without it, the claim will not last.

Before defending against such a claim, businesses should focus on demonstrating lawful competition and the absence of prohibited conduct.

In Northern Virginia, tortious interference claims succeed only when they are precise, evidence-based, and grounded in conduct the law actually prohibits.

In the next chapter, I explain tortious interference with business expectancy, how it differs from interference with contract, and why these claims face an even higher burden in Virginia courts.

Chapter 8

What Is Tortious Interference With Business Expectancy and Why Is It Even Harder to Prove in Virginia?

After learning about tortious interference with contract, business owners often assume there is a fallback option when no formal contract exists. If there was a likely deal, an ongoing relationship, or a strong pipeline opportunity, surely the law protects that too. Virginia law does, but only in very narrow circumstances.

Tortious interference with business expectancy is one of the most difficult business torts to prove in Northern Virginia. Courts recognize it cautiously because it sits at the edge of lawful competition.

How Business Expectancy Is Different From a Contract

A contract is concrete. It exists or it does not. A business expectancy is different. It refers to a probable future economic benefit, not a guaranteed one.

Virginia courts require more than hope or optimism. The expectancy must be reasonable, definite, and based on objective facts, not speculation.

The Virginia Supreme Court addressed this directly in Commercial Business Systems, Inc. v. Halifax Corp., 253 Va. 292 (1997), explaining that a plaintiff must show a probability of future economic benefit, not a mere possibility.

This distinction matters deeply in Northern Virginia, where businesses often operate on proposals, renewals, and rolling engagements rather than long term fixed contracts.

The Elements Virginia Courts Require

To prove tortious interference with business expectancy, a plaintiff must establish:

- The existence of a business relationship or expectancy with a probability of future economic benefit

- Knowledge of that expectancy by the defendant

- Intentional interference

- Use of improper methods

- Resulting damage

These elements are similar to interference with contract, but the expectancy element significantly raises the bar.

Why Improper Methods Still Control the Outcome

Just as with interference with contract, improper methods are the linchpin.

Virginia courts will not punish a competitor for pursuing the same opportunity unless the conduct crosses a legal line. The Supreme Court emphasized this in Duggin v. Adams, 234 Va. 221 (1987), which applies equally to expectancy claims.

Improper methods may include fraud, misrepresentation, intimidation, misuse of confidential information, or violation of enforceable restrictive covenants. Lawful competition is not enough.

Why These Claims Fail So Often in Northern Virginia

In Alexandria, Fairfax, and Arlington courts, interference with expectancy claims frequently fail for one of three reasons.

First, the alleged expectancy is too speculative. A hoped for renewal, a verbal assurance, or a strong relationship is not enough.

Second, the plaintiff cannot prove the defendant knew of the specific expectancy. General market awareness does not satisfy this requirement.

Third, there is no evidence of improper methods. Offering a better price, better service, or faster delivery is lawful competition.

The Virginia Supreme Court underscored the speculative nature problem in Dunn, McCormack & MacPherson v. Connolly, 281 Va. 553 (2011), where it rejected expectancy claims based on uncertain future opportunities.

Employee Movement and Expectancy Claims

Many expectancy claims arise after employees leave and clients follow. Businesses often assume this proves interference.

Virginia law disagrees.

Unless there is evidence that the departing employee or new employer used improper methods, courts treat client movement as a product of choice, not interference. This principle is applied consistently in Northern Virginia, where employee mobility is high.

Federal Contracting Context

In federal contracting environments, expectancy claims are especially risky. Government work is competitive by design, and future awards are inherently uncertain.

Courts are reluctant to recognize expectancy claims based on anticipated government contracts, teaming opportunities, or renewals absent extraordinary proof of certainty and improper conduct.

Practical Guidance for Businesses

Interference with business expectancy is not a catchall claim for lost opportunities. It is a narrow remedy reserved for clear cases of improper conduct that disrupt a probable economic relationship.

Before pursuing such a claim, businesses must honestly assess whether the opportunity was real, whether the defendant knew of it, and whether the conduct crossed a legal line.

In the next chapter, I explain Virginia business conspiracy claims, why they are attractive on paper, and why courts scrutinize them more harshly than almost any other business tort.

Chapter 9

What Is a Virginia Business Conspiracy Claim and Why Do Courts Treat It So Cautiously?

Business conspiracy claims get a lot of attention in Northern Virginia because they sound powerful. Treble damages. Attorney’s fees. Multiple defendants acting together. On paper, they look like leverage.

In practice, Virginia courts treat business conspiracy claims with extreme caution, especially in Alexandria, Fairfax, and Arlington. I often tell clients that this is one of the most misunderstood and most frequently dismissed claims in business litigation.

What the Virginia Business Conspiracy Statute Actually Covers

Virginia’s business conspiracy statute is codified at Virginia Code §§ 18.2-499 and 18.2-500. It allows a civil cause of action when two or more persons combine to willfully and maliciously injure another in their business.

Section 18.2-500 is what makes the statute attractive. It authorizes treble damages and recovery of attorney’s fees for a successful plaintiff.

Because of those enhanced remedies, courts require strict compliance with every element.

The Core Elements That Must Be Proven

To prevail on a business conspiracy claim, a plaintiff must prove:

- A combination of two or more persons

- Legal malice means intentional, purposeful conduct to harm

- An underlying unlawful act or tort

- Resulting damage to business or property

Concrete facts, not conclusions, must support each element.

The Virginia Supreme Court made this clear in Almy v. Grisham, 273 Va. 68 (2007), holding that a conspiracy claim fails unless there is an actionable underlying tort. The conspiracy itself is not enough.

Why Intracorporate Immunity Defeats Many Claims

One of the biggest obstacles to business conspiracy claims in Northern Virginia is the doctrine of intracorporate immunity.

Under this doctrine, a corporation and its agents acting within the scope of their employment are treated as a single entity. They cannot legally conspire with themselves.

The Virginia Supreme Court applied this principle in Fox v. Deese, 234 Va. 412 (1987), rejecting conspiracy claims where the alleged conspirators were employees of the same company acting in their official capacities.

This comes up constantly in cases involving executives, managers, or employees accused of coordinating misconduct. If they were acting for the same entity, the conspiracy claim often fails immediately.

Why Malice Is Harder to Prove Than It Sounds

Virginia law requires proof of legal malice, not personal dislike or business hostility.

In Simmons v. Miller, 261 Va. 561 (2001), the court explained that malice requires proof that the defendants acted intentionally and without lawful justification, for the purpose of causing harm.

Competing aggressively, enforcing contracts, or protecting one’s own business interests is not malicious. Courts in Northern Virginia are quick to dismiss claims that confuse competitive behavior with malicious intent.

Why These Claims Are Scrutinized Early

Because of the statute’s punitive nature, courts examine business conspiracy claims at the pleading stage and again at summary judgment.

Judges expect detailed allegations showing who agreed with whom, when the agreement was formed, what unlawful act was committed, and how damages flowed from that act.

General allegations that defendants worked together or coordinated actions are not enough. This is particularly true in Fairfax and Alexandria courts, which routinely narrow cases early.

Federal Context and Multi-Party Disputes

In Northern Virginia, cases involving federal contractors sometimes include conspiracy claims alongside allegations of procurement misconduct or competitive exclusion.

While the business conspiracy statute is a state law, courts are careful not to allow it to interfere with federally regulated competitive processes. Claims based on lawful competition for government work face steep odds.

Practical Guidance for Businesses

Business conspiracy claims should be used sparingly and precisely. When supported by evidence of coordination, malice, and an underlying tort, they can be powerful. When used as a pressure tactic, they often backfire.

In Northern Virginia, overstating a conspiracy claim can undermine the credibility of an otherwise strong case.

In the next chapter, I explain when fiduciary duties arise in business relationships, how they are breached, and why fiduciary duty claims are common in closely held businesses across Fairfax and Arlington.

Chapter 10

When Do Fiduciary Duties Arise in Business Relationships Under Virginia Law?

Fiduciary duty claims come up frequently in Northern Virginia business litigation, especially in closely held companies, professional practices, and family owned businesses in Fairfax, Arlington, and Alexandria. These disputes are often emotional because they involve trust. But Virginia law treats fiduciary duties with precision, not sentiment.

Understanding when a fiduciary duty exists is critical. Many business owners assume loyalty is implied. Under Virginia law, it is not.

What a Fiduciary Duty Actually Is

A fiduciary duty is a legal obligation to act in the best interests of another party. It is not a general obligation to be fair or cooperative. It is a heightened duty imposed by law because of the nature of the relationship.

The Virginia Supreme Court has made clear that fiduciary duties arise only in specific circumstances. In Augusta Mutual Insurance Co. v. Mason, 274 Va. 199 (2007), the court emphasized that a fiduciary relationship exists only when one party places special trust in another and that trust is accepted.

Courts do not lightly impose fiduciary duties between sophisticated business actors.

Common Business Relationships That Carry Fiduciary Duties

In Northern Virginia litigation, fiduciary duties most often arise in these contexts:

- Corporate officers and directors

- Partners in a partnership

- Managing members of an LLC

- Agents entrusted with decision making authority

These duties typically include loyalty, care, and good faith. But their scope depends heavily on governing documents.

Why Contracts and Operating Agreements Matter So Much

Virginia law allows businesses to define and, in some cases, limit fiduciary duties through contracts and operating agreements.

In Flippo v. CSC Associates III, L.L.C., 262 Va. 48 (2001), the Virginia Supreme Court recognized that LLC operating agreements can modify or restrict fiduciary obligations. Courts will enforce those agreements as written.

This is a critical point in Northern Virginia disputes. Many fiduciary duty claims fail because the operating agreement or bylaws expressly permitted the challenged conduct.

What Does Not Create a Fiduciary Duty

This is where many claims break down.

Ordinary contractual relationships do not create fiduciary duties. Vendors, customers, subcontractors, and even long term business partners do not owe fiduciary duties to one another simply because they work together.

Virginia courts repeatedly reject attempts to transform arms length business relationships into fiduciary ones. Trust alone is not enough. The law looks for authority, control, and accepted responsibility.

Common Allegations in Fiduciary Duty Claims

When fiduciary duties do exist, common allegations include:

- Self dealing or diversion of opportunities

- Misuse of company funds

- Failure to disclose conflicts of interest

- Acting for personal benefit at the company’s expense

Courts examine whether the defendant acted within their authority and whether the conduct was permitted by governing documents.

Why These Claims Are Closely Scrutinized in Northern Virginia

Courts in Alexandria and Fairfax see many internal business disputes framed as fiduciary duty claims. Judges are careful not to let these claims become tools for resolving ordinary business disagreements.

Claims lacking clear duty, defined authority, and measurable harm are often dismissed early.

Federal Overlay in Certain Cases

In companies involved in federal contracting, fiduciary duty disputes sometimes intersect with compliance obligations, disclosure rules, and internal controls. While fiduciary claims remain governed by state law, the business context can affect how conduct is evaluated.

The Practical Takeaway

Fiduciary duty claims are powerful when grounded in real authority and absolute obligations. They are weak when based on expectations rather than law.

In Northern Virginia, courts enforce fiduciary duties as defined, not as imagined.

In the next chapter, I explain how internal disputes among partners, shareholders, and LLC members escalate into litigation, and why these cases are among the most personal and challenging business disputes courts handle.

Chapter 11

How Do Partner, Shareholder, and LLC Member Disputes Turn Into Litigation in Northern Virginia?

Some of the most challenging business litigation I handle in Northern Virginia does not start with competitors or outside actors. It starts inside the company. Partners stop trusting one another. Shareholders feel shut out. LLC members disagree on control, money, or direction. These disputes are personal, but Virginia courts treat them with structure and discipline.

Understanding how internal disputes escalate into litigation helps business owners recognize warning signs before positions harden and options narrow.

Why Internal Business Disputes Escalate So Quickly

Closely held businesses are common across Fairfax, Arlington, and Alexandria. Many are built on relationships rather than formal governance. Decisions are made informally. Expectations are assumed rather than documented.

That works until it does not.

When money tightens, growth slows, or strategic direction changes, informal arrangements break down. Without clear rules, conflict escalates fast.

The Legal Framework Courts Use

Virginia courts begin these cases by examining governing documents. Shareholder agreements, operating agreements, bylaws, and partnership agreements control almost everything.

Courts enforce these documents as written. This principle is consistent with Pocahontas Mining LLC v. CNX Gas Co., 276 Va. 346 (2008), which reinforces that unambiguous contract terms govern the parties’ rights and obligations.

If the documents address voting rights, distributions, management authority, or exit provisions, courts apply those rules strictly.

Common Triggers for Internal Litigation

In Northern Virginia, internal disputes often arise from a small number of recurring issues:

- Disputes over control or voting power

- Allegations of exclusion or oppression

- Conflicts over distributions or compensation

- Self dealing or diversion of company opportunities

- Disagreements over sale or dissolution

These issues are rarely isolated. They tend to compound over time.

Minority Owner Claims and Expectations

Minority owners often feel vulnerable, particularly in closely held companies where exit options are limited.

Virginia law does not automatically protect minority owners from business decisions they disagree with. Courts look for violations of legal duties, not unfair outcomes.

Absent a breach of fiduciary duty, violation of governing documents, or statutory protections, courts are reluctant to intervene.

The Role of Fiduciary Duty in Internal Disputes

As discussed in the prior chapter, fiduciary duties may apply to those in control. But courts will not infer misconduct simply because a decision favored one group over another.

In Augusta Mutual Insurance Co. v. Mason, 274 Va. 199 (2007), the court reiterated that fiduciary duties are defined by authority and responsibility, not by hurt feelings or expectations.

Why Documentation and Process Matter

In internal disputes, documentation often determines outcomes. Emails, meeting minutes, financial records, and formal approvals carry significant weight.

Courts are less concerned with what was discussed informally and more focused on what was authorized and recorded.

Federal Contracting Considerations

In companies involved in federal contracting, internal disputes can trigger compliance concerns. Control changes, ownership shifts, and governance failures may have regulatory consequences beyond the lawsuit itself.

This adds pressure and complexity to already strained relationships.

The Practical Reality for Business Owners

Internal disputes are emotionally draining and legally complex. They are also among the hardest to unwind once litigation begins.

Early legal advice, clear documentation, and disciplined decision-making often prevent these disputes from becoming lawsuits.

In the next chapter, I explain why federal contract disputes are especially common in Northern Virginia, and how government-related business relationships introduce unique litigation risks.

Chapter 12

Why Are Federal Contract and Government Contractor Disputes So Common in Northern Virginia?

If there is one category of business litigation that is truly unique to Northern Virginia, it is disputes involving federal contracts and government contractors. Alexandria, Fairfax, Arlington, McLean, Tysons, and Reston sit at the center of the federal procurement ecosystem. That reality shapes the types of disputes courts see and how those disputes unfold.

I regularly remind clients that government contracting is not just commercial contracting with a different customer. It is a regulated environment where mistakes escalate quickly and legal exposure multiplies.

Why Federal Contracting Changes the Litigation Landscape

Federal contracts are governed by layers of law that do not exist in ordinary commercial relationships. In addition to the contract itself, parties must navigate federal statutes, regulations, agency rules, and flow-down clauses that bind subcontractors as tightly as prime contractors.

Most disputes arise not because parties disagree about what they wanted to do, but because the contract and regulations dictate what they were required to do.

Courts in Northern Virginia are accustomed to this complexity. They expect contractors to understand the framework they chose to operate within.

Common Triggers for Federal Contract Disputes

Federal contract disputes in this region most often involve:

- Termination for default or convenience

- Disputes over performance standards

- Payment and invoicing issues

- Teaming agreement breakdowns

- Subcontractor scope and flow-down conflicts

- Alleged misrepresentations during procurement

These disputes often involve significant financial exposure and reputational risk, which drives litigation rather than quiet resolution.

Termination Disputes Are Especially High-Stakes

One of the most common and damaging disputes involves termination. A termination for default can end a contract and damage a contractor’s future eligibility for government work.

While the Contract Disputes Act, 41 U.S.C. §§ 7101–7109, governs many federal contract disputes, related litigation frequently spills into state courts when subcontractor relationships or side agreements are involved.

Northern Virginia businesses often underestimate how termination language and regulatory obligations interact. Courts do not excuse noncompliance simply because performance was difficult.

Teaming Agreements and Subcontractor Conflicts

Teaming agreements are standard in Northern Virginia. They allow companies to pursue government work together while dividing responsibilities.

Litigation arises when expectations diverge. One party believes the agreement guaranteed future work. The other views it as an agreement to cooperate, not a binding promise.

Virginia courts scrutinize these agreements. In Cyberlock Consulting, Inc. v. Information Experts, Inc., 939 F. Supp. 2d 572 (E.D. Va. 2013), the court rejected claims that a teaming agreement created enforceable obligations where essential terms were left open.

This case is frequently cited in Northern Virginia disputes and serves as a warning that vague teaming language invites litigation but rarely produces wins.

Misrepresentation and Disclosure Risks

Federal contracting environments impose disclosure obligations that can later become the basis for civil disputes. Statements made during procurement, certifications, or performance reporting can be scrutinized long after the deal closes.

While civil fraud claims are governed by Virginia law, misrepresentations tied to federal contracts can implicate federal statutes and regulatory enforcement. That dual exposure makes these disputes particularly sensitive.

Why Northern Virginia Courts Take These Cases Seriously

Courts in Alexandria and Fairfax understand that federal contracting disputes affect more than the parties involved. They can impact government operations, compliance regimes, and market integrity.

As a result, judges demand precision. Allegations must be specific. Contracts must be read carefully. Regulatory context matters.

The Practical Reality for Government Contractors

Federal contract disputes are rarely isolated events. They affect future bidding, compliance reviews, and business reputation.

Businesses operating in this space must approach disputes strategically, understanding both the legal and regulatory consequences.

In the next chapter, I explain technology, data, and confidential information disputes, which frequently overlap with government contracting and are increasingly common across Northern Virginia’s technology-driven economy.

Chapter 13

Why Technology, Data, and Confidential Information Disputes Are Increasing Across Northern Virginia

As Northern Virginia has become more technology-driven, business litigation here has followed suit. Alexandria, Fairfax, Arlington, Reston, and Tysons are home to software developers, cybersecurity firms, SaaS providers, defense technology companies, and data-driven service businesses. With that growth has come a sharp rise in disputes involving data access, confidential information, and technology contracts.

These cases often feel technical, but Virginia courts approach them with familiar legal tools. The challenge for businesses is understanding where technology ends and legal responsibility begins.

Why Technology Disputes Escalate Quickly

Technology-related disputes escalate faster than many traditional contract disputes because damage can occur immediately. Access can be revoked. Data can be copied. Systems can be locked. Clients can be lost overnight.

When a dispute involves proprietary systems or sensitive information, businesses often seek emergency relief rather than waiting for damages later.

Courts in Northern Virginia are accustomed to this urgency, but they still require disciplined proof.

What Counts as Confidential Information Under Virginia Law

Not all information a business values is legally protected.

Virginia courts distinguish between general knowledge and protected confidential information or trade secrets. Protection depends on whether the information derives independent economic value from not being generally known and whether reasonable efforts were taken to keep it secret.

Virginia has adopted the Uniform Trade Secrets Act, codified at Virginia Code §§ 59.1-336 through 59.1-343. These statutes govern many disputes involving alleged misuse of proprietary information.

Courts place heavy emphasis on the steps the business took to protect the information. Labels alone are not enough.

Common Technology-Related Litigation Scenarios

In Northern Virginia, technology disputes often arise from:

- Former employees accessing or copying data after departure

- Disputes over ownership of software or code

- Termination of SaaS or cloud service agreements

- Misuse of credentials or system access

- Conflicts over data migration and handoff obligations

These disputes often combine contract claims with allegations of trade secret misappropriation or breach of fiduciary duty.

Employee Movement and Data Access

Employee departures are a frequent trigger for technology disputes. Businesses often discover access issues only after a key employee leaves.

Virginia courts examine whether access restrictions were clear, whether policies were enforced, and whether the employee had authorization at the time of access.

Claims based on vague policies or inconsistent enforcement face significant hurdles.

Contractual Control of Technology Rights

Most technology disputes turn on contracts. Licensing agreements, development contracts, employment agreements, and confidentiality provisions define rights and obligations.

Virginia courts enforce these agreements as written. If ownership, access, or post-termination obligations are unclear, courts will not fill in the gaps.

This reinforces the importance of precise drafting in technology-related contracts.

Federal Law Overlap in Technology Disputes

Many Northern Virginia technology businesses operate across state lines or serve federal clients. That can introduce federal statutes and regulations into otherwise state law disputes.

While trade secret claims are often brought under Virginia law, some cases also implicate the federal Defend Trade Secrets Act, 18 U.S.C. § 1836, particularly when interstate commerce is involved.

Courts analyze these claims carefully and require specific evidence of misappropriation and damage.

Why Courts Demand Precision in These Cases

Technology disputes are fact intensive. Courts do not assume harm simply because access occurred or information was shared.

Plaintiffs must identify what information was taken, why it was protected, how it was misused, and how damage resulted. Vague allegations do not survive early motions.

The Practical Takeaway for Businesses

Technology driven businesses in Northern Virginia must treat data protection and access control as legal issues, not just IT concerns.

Clear contracts, enforced policies, and disciplined offboarding procedures dramatically reduce litigation risk.

In the next chapter, I explain what damages and remedies Virginia courts actually award in business litigation, including lost profits, injunctions, and why expectations often exceed reality.

Chapter 14

What Damages and Remedies Can a Business Actually Recover in Northern Virginia Litigation?

One of the most critical and least understood parts of business litigation is remedies. Business owners often focus on proving wrongdoing, but courts focus just as much on what relief the law actually allows.

In Northern Virginia, unrealistic expectations about damages derail cases as often as weak liability theories. Understanding what courts will and will not award is critical to making smart litigation decisions.

Compensatory Damages Are the Baseline

The primary remedy in Virginia business litigation is compensatory damages. These are intended to place the injured party in the position they would have occupied had the breach or tort not occurred.

In contract cases, damages are typically limited to what the parties reasonably contemplated at the time of contracting. Virginia courts apply this rule consistently, including in Filak v. George, 267 Va. 612 (2004), which reinforces that damages must flow naturally from the breach.

Speculative damages are not recoverable. Courts require evidence, not assumptions.

Lost Profits Are Recoverable but Closely Scrutinized

Lost profits are often sought and rarely proven. Virginia law allows recovery of lost profits when they can be proven with reasonable certainty.

The Virginia Supreme Court addressed this standard in Murray v. Hadid, 238 Va. 722 (1989), emphasizing that lost profits must be supported by objective evidence, not conjecture.

In Northern Virginia, courts expect detailed financial records, historical performance data, and expert testimony. New businesses and untested ventures face an especially high burden.

Punitive Damages Are Rare

Punitive damages are not available for breach of contract and are rarely awarded in business tort cases.

Under Virginia law, punitive damages require proof of willful, wanton, or malicious conduct. Even when available, punitive damages are capped by statute at $350,000 under Virginia Code § 8.01-38.1.

Courts apply this cap strictly.

Injunctive Relief Can Be More Powerful Than Money

In many Northern Virginia cases, injunctions matter more than damages. Courts can issue injunctions to stop ongoing harm, such as enforcing noncompete agreements, preventing misuse of confidential information, or halting interference with contracts.

Injunctions require proof of irreparable harm and lack of an adequate remedy at law. Courts do not grant them lightly.

Businesses seeking emergency relief must come prepared with evidence, not just urgency.

Attorney’s Fees Are the Exception, Not the Rule

Virginia follows the American Rule, meaning each party pays its own attorney’s fees unless a statute or contract provides otherwise.

Business conspiracy claims under Virginia Code § 18.2-500 and certain contract provisions allow fee recovery. Absent such authority, courts will not award fees simply because a party prevailed.

Equitable Remedies in Internal Disputes

In internal business disputes, courts may order equitable relief, such as accounting, dissolution, or the appointment of a receiver, in extreme cases. These remedies are used sparingly and only when statutory or contractual standards are met.

Federal Overlay on Remedies

In cases involving federal law, such as trade secret claims under the Defend Trade Secrets Act or enforcement of arbitration under the Federal Arbitration Act, federal remedies may supplement state law relief.

Courts coordinate these remedies carefully to avoid duplication.

The Practical Reality for Business Owners

Winning a business case is not just about proving fault. It is about proving damages and selecting remedies that make sense for the business.

Overreaching on damages can undermine credibility. Underestimating the value of injunctive relief can leave lasting harm unaddressed.

In the next chapter, I explain why many business tort claims are dismissed early in Northern Virginia, and what courts look for when deciding whether a case moves forward or ends quickly.

Chapter 15

Why Are So Many Business Tort Claims Dismissed Early in Northern Virginia?

One of the most challenging conversations I have with business owners occurs after a complaint is filed and the opposing side files an early motion to dismiss. Clients are often surprised by how quickly courts in Alexandria, Fairfax, and Arlington scrutinize business tort claims and how frequently those claims are narrowed or eliminated before discovery ever begins.

This is not hostility toward plaintiffs. It is discipline.

Northern Virginia Courts Expect Precision From the Start

Business litigation in Northern Virginia involves sophisticated parties and experienced judges. Courts assume that if a business chooses to allege fraud, interference, conspiracy, or fiduciary breach, it has already done the work to support those claims.

Virginia pleading standards require more than notice-level allegations for many business torts. Fraud, in particular, must be pled with specificity. Courts routinely apply the standard articulated in Mortarino v. Consultant Engineering Services, Inc., 251 Va. 289 (1996), dismissing claims that rely on general accusations rather than concrete facts.

Judges want to see who said what, when it was said, why it was false at the time, and how reliance caused damage.

The Economic Loss Rule Eliminates Many Tort Claims

A significant reason tort claims fail early is the economic loss rule. Virginia courts do not allow parties to recover purely economic losses in tort when the duty breached arises solely from a contract.

The Virginia Supreme Court’s decision in Sensenbrenner v. Rust, Orling & Neale, Architects, Inc., 236 Va. 419 (1988), remains central to this analysis. If the dispute is really about disappointed contractual expectations, tort claims are not allowed to proceed.

In Northern Virginia, where contracts are standard and detailed, this rule eliminates many tort claims at the outset.

Improper Methods Are Often Missing

Claims for tortious interference frequently fail because plaintiffs cannot identify improper methods.

As explained in Duggin v. Adams, 234 Va. 221 (1987), lawful competition is not actionable. Offering better pricing, recruiting talent, or pursuing the same clients does not constitute interference without independent wrongful conduct.

Courts in Fairfax and Alexandria dismiss interference claims early when improper methods are alleged in name only, without factual support.

Business Conspiracy Claims Face Immediate Scrutiny

Because Virginia’s business conspiracy statute carries treble damages and attorneys’ fees, courts scrutinize these claims aggressively.

In Almy v. Grisham, 273 Va. 68 (2007), the Supreme Court made clear that a conspiracy claim fails without a viable underlying tort. Conclusory allegations of coordination or motive are not enough.

Many conspiracy claims also fail under the intracorporate immunity doctrine articulated in Fox v. Deese, 234 Va. 412 (1987), under which employees acting for the same entity cannot conspire with one another.

Courts Do Not Allow Discovery Fishing Expeditions

A critical point business owners often overlook is that courts do not allow discovery to cure deficient pleadings.

If a claim is not plausibly alleged at the outset, courts will not permit discovery in the hope that evidence might emerge later. This principle is applied consistently in Northern Virginia.

Judges expect parties to bring claims they can support, not claims designed to search for leverage.

Federal Courts Apply the Same Discipline

In cases removed to or filed in the Eastern District of Virginia, federal pleading standards apply. Under Bell Atlantic Corp. v. Twombly, 550 U.S. 544 (2007), and Ashcroft v. Iqbal, 556 U.S. 662 (2009), claims must be plausible, not speculative.

For Northern Virginia businesses involved in interstate commerce or federal contracts, this federal overlay reinforces the importance of precise pleadings.

The Practical Lesson for Businesses

Early dismissal is not a failure of the system. It is how the system enforces discipline.

Businesses that focus on well-supported claims, grounded in real duties and objective evidence, survive early motions and gain leverage. Businesses that overreach often see their cases shrink quickly.

In the next chapter, I explain what discovery actually looks like in Northern Virginia business litigation, why documents matter more than testimony, and how early preparation shapes outcomes.

Chapter 16

What Does Discovery Really Look Like in Northern Virginia Business Litigation?

Once a business case survives early motions, discovery becomes the center of gravity. Many business owners expect discovery to be about dramatic depositions or surprise witnesses. In reality, Northern Virginia business litigation is document driven, disciplined, and unforgiving of poor preparation.

Understanding how discovery actually works here can make the difference between gaining leverage and losing control of the case.

Documents Drive Business Cases

In Alexandria, Fairfax, and Arlington, judges expect business disputes to be proven primarily through documents. Contracts, emails, invoices, financial records, system logs, and internal communications usually matter more than witness recollections.

Courts assume that sophisticated businesses create and retain records. When those records are missing, incomplete, or inconsistent, courts notice.

The duty to preserve evidence arises when litigation is reasonably anticipated. Failure to preserve relevant documents can result in sanctions, adverse inferences, or worse.

The Virginia Supreme Court addressed spoliation principles in Wal-Mart Stores, Inc. v. Coleman, 273 Va. 443 (2007), emphasizing the consequences of destroying or failing to preserve evidence once litigation is foreseeable.

Litigation Holds Are Not Optional

One of the first steps I advise businesses to take is issuing a litigation hold. This is not just a formality. It is a legal obligation.

Emails, texts, messaging platforms, cloud storage, and personal devices may all contain discoverable information. Courts expect businesses to take reasonable steps to suspend routine deletion policies.

In Northern Virginia, judges are not sympathetic to explanations that data was lost because of ordinary business practices once a dispute has surfaced.

Depositions Are Strategic, Not Performative

Depositions matter, but they are not the centerpiece many people expect. In business cases, depositions are used to authenticate documents, lock in positions, and test credibility.

Judges in this region are alert to deposition tactics designed to harass or posture. Efficient, targeted depositions are far more effective than sprawling examinations.

Privilege Is Narrowly Applied

Attorney client privilege and work product protection are critical, but they are not limitless.