BOTTOM LINE UP FRONT (BLUF)

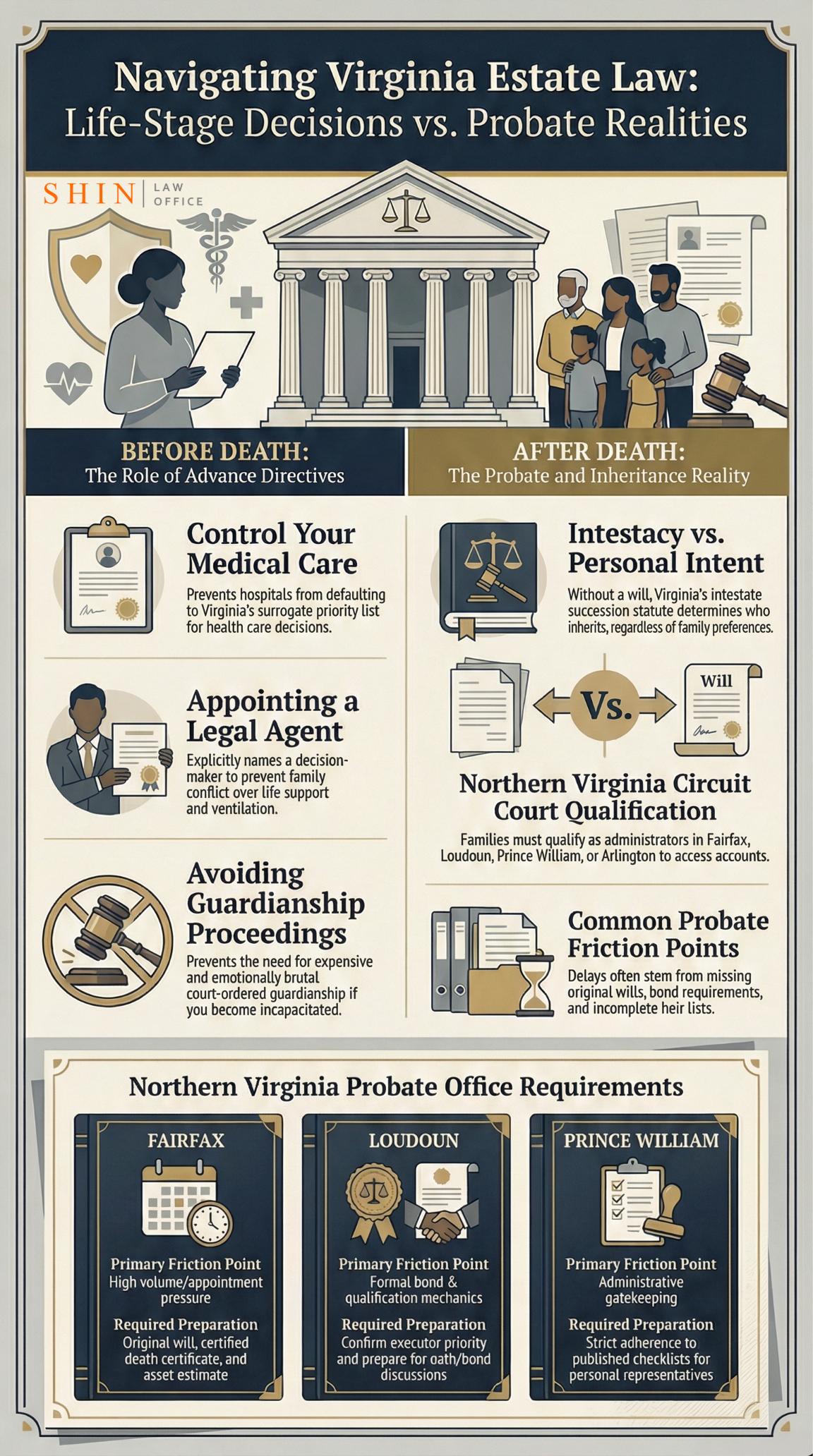

In Virginia, many people call an advance directive a living will. Without it, families often lose control at the exact moment decisions must be made. Medical teams may have to follow a default legal priority list for who can decide care, family members can clash over life support and comfort care, and time is lost while doctors document incapacity and identify the right surrogate. After death, families often discover a second problem. A living will does not control inheritance. If there is no last will, intestacy rules control who inherits and who can serve as administrator, which often triggers delays, costs, and conflicts in the Northern Virginia Circuit Court probate.

Table of Contents

- Introduction

- First, what a living will does in Virginia

- Problems families face before death when there is no living will

- Problems families face after death that families often confuse with a living will

- County-specific friction points in Fairfax, Loudoun, Prince William, and Arlington

- Practical prevention checklist

First, what a living will does in Virginia

In Virginia, a living will is typically part of an advance directive. It states your care wishes if you cannot communicate and may appoint an agent to make health care decisions for you.

If there is no advance directive, Virginia law provides a default process and a priority list of who may authorize health care for an incapacitated patient.

Problems families face before death when there is no living will

These are the issues that hit families in Fairfax, Loudoun, Prince William, and Arlington when a loved one is alive but cannot speak for themselves.

1. No clear decision maker, so conflict grows fast

If multiple relatives believe they are the decision maker, hospitals can slow down until the right surrogate is confirmed under Virginia’s default rules.

2. Decisions default to Virginia’s surrogate priority list, not family preference

Virginia law sets an order of who can decide care when there is no advance directive. This can elevate one person’s authority over others, even if the family informally relied on a different relative.

3. Life support decisions become a fight about values, not instructions

Without written instructions, families argue about what the person would have wanted. That can delay decisions about resuscitation, ventilation, feeding tubes, and comfort care.

4. Delay while incapacity is documented

Virginia’s process is triggered when the patient is determined to be incapable of making an informed decision. The documentation step matters, and it can slow down time-sensitive decisions.

5. Increased risk of guardianship or conservatorship proceedings

When families cannot agree or when there is no suitable surrogate, disputes can escalate into court involvement, which is expensive and emotionally brutal.

6. Organ donation and end-of-life choices are unclear

Advance directives can include specific preferences. Without one, families often face uncertainty and guilt afterward.

Problems families face after death that families often confuse with a living will

This is the second shock. A living will governs health care decisions. It does not distribute property after death. Probate and inheritance are controlled by a last will, trusts, beneficiary designations, and Virginia intestacy law if there is no will.

1. Virginia intestacy controls who inherits

If there is no will, Virginia’s intestate succession statute determines who receives property. This may not match the decedent’s wishes, especially in blended families.

2. No executor is named, so someone must qualify as administrator

A personal representative must qualify through the Circuit Court process. When no executor is named, families often fight over who should serve, and the court process can require additional steps like bond and formal qualification.

3. Probate delays block access to money and accounts

Banks and other institutions often require proof of qualification before releasing assets. That delay hits families trying to pay mortgages, rent, funeral costs, and bills.

4. Real estate becomes complicated quickly

Virginia real property can vest at death under intestacy or a will, but families still need to establish ownership in land records to sell or refinance.

5. Family conflict rises over personal property and sentimental items

Without clear authority and written directions, people grab items, accuse each other, and the dispute becomes permanent.

6. Wrongful death and lawsuit authority issues

Certain claims require a qualified personal representative. Even when families agree, they may lose time before someone has the authority to act.

7. Small estate shortcuts may not be available or may require full agreement

Virginia has a small estate affidavit process for qualifying small assets under defined conditions, including a dollar cap and time since death. If heirs do not cooperate, this becomes difficult.

County specific friction points in Northern Virginia

Fairfax County

Fairfax is high volume. That means process discipline matters.

What families typically run into

- Appointment and scheduling pressure

You often need to plan ahead to get time with the Probate Division. Walking in expectations can lead to wasted trips. - Document readiness gets tested

Fairfax clerks see everything. If a will is missing signatures, a notary page, or a self-proving affidavit, you may get paused until issues are addressed. - Bond questions come up quickly

If the will waives the bond, that helps. If there is no will, or the will does not waive bond, a bond is often required unless all beneficiaries waive or the court accepts an alternative. - Heir identification is scrutinized

When there is no will, families must present a clean family tree. Missing heirs, unknown addresses, or unclear relationships slow the process.

What to do before you show up

- Bring the original will and a certified death certificate if available

- Bring a working list of heirs and their addresses

- Bring an estimate of estate assets and where they are held

- Have your preferred administrator ready to serve, plus a backup if conflict is likely

- Assume you will be asked about the bond, and plan for it

Loudoun County

Loudoun tends to run more formal, especially for qualification mechanics.

What families typically run into

- Formal qualification steps are front and center

You should expect an oath, paperwork, and bond discussion to be part of the standard flow for both testate estates with a will and intestate estates without a will. - Bond is a common friction point

If the will does not waive bond, or there is no will, bond frequently becomes a required step. That adds cost and can add days if you have to coordinate a bond company. - Clear role separation matters

Executor and administrator roles are treated as serious appointments. If a family arrives with unclear authority, conflicting stories, or incomplete documentation, you may get sent back to fix the record.

What to do before you show up

- Confirm whether you are dealing with a will or intestate estate

- Know who has priority to qualify if there is no will

- Bring a clean heir list

- Prepare to discuss bond and what assets exist

- Bring government identification and proof of address

Prince William County

Prince William is very process oriented and tends to publish guidance and checklists that the probate staff expects families to follow.

What families typically run into

- Qualifying the personal representative is the first gate

Until someone is qualified, banks, landlords, insurers, and title companies may not cooperate. Prince William families often discover they cannot access accounts or manage property until qualification is complete. - Estate administration duties get emphasized early

Prince William families are often directed toward personal representative responsibilities, including notices, inventory and accounting, and basic estate housekeeping tasks. - Common bottlenecks

- Disagreements about who should serve

- Incomplete heir information in intestate estates

- Missing original documents

- Bond requirements when there is no waiver

What to do before you show up

- Bring original documents and a prepared asset snapshot

- Bring a list of beneficiaries or heirs and addresses

- Be ready to identify and value major assets at a high level

- If conflict is brewing, decide in advance who will petition to qualify and why

Arlington County

Arlington is smaller but can be appointment driven, and it tends to rely on structured checklists.

What families typically run into

- Appointment format affects timing

If qualification is by appointment, the key is preparation. A missed document can cost you days rather than minutes. - Checklist compliance is enforced

Arlington commonly expects you to bring a complete packet. If you arrive missing identification, death certificate, original will, or key heir information, the clerk may not proceed. - Bond and waiver details matter

Like other counties, bond can be required unless waived. Families are often surprised that bond is not optional just because everyone agrees informally.

What to do before you show up

- Use the checklist approach

- Make a folder with originals and copies

- Bring identification and contact information for all interested parties

- Bring addresses for heirs or beneficiaries

- Have a basic description of assets and debts so you can answer questions without guessing

The pattern across all four counties

Here is the practical truth: you can have a simple estate and still lose weeks if you are not ready for qualification.

- The biggest delays come from

- No original will

- Unclear heir list in intestate estates

- Bond surprise

- Family disagreements about who should serve

- Incomplete addresses and contact info

- No asset summary, which triggers uncertainty about the administration steps

Practical prevention checklist

- Sign a Virginia advance directive that includes both care instructions and a named agent.

- Make sure your agent and backup agent are willing and understand your wishes.

- Separately, execute a last will and review beneficiary designations on accounts and insurance so inheritance is not left to intestacy.

- Tell your family where documents are stored and who to call first.

Call Shin Law Office at 571-445-6565 or use our online contact form to schedule a consultation.