BLUF (Bottom Line Up Front)

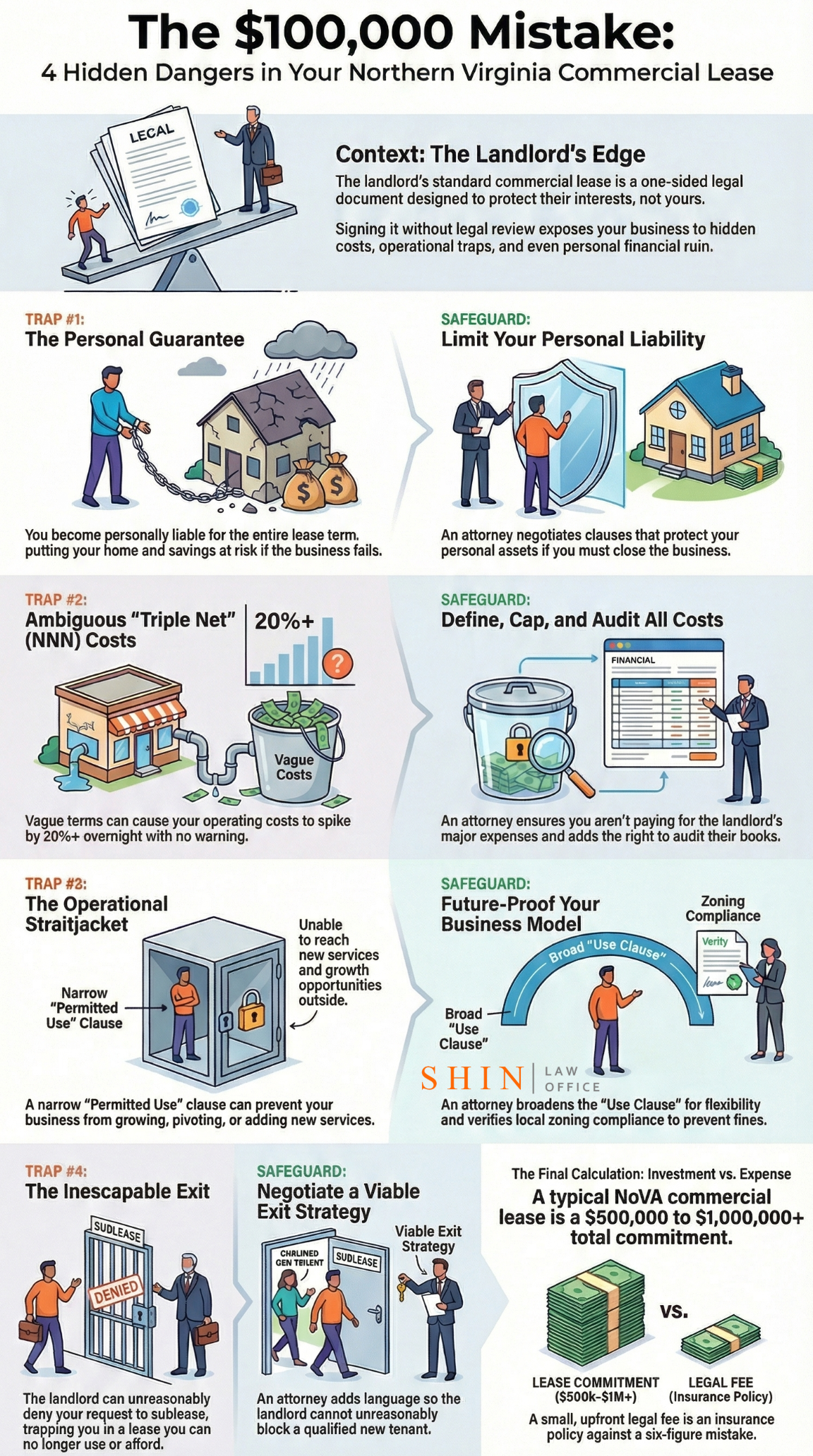

Commercial leases in Northern Virginia are powerful legal contracts that can quietly cost a business hundreds of thousands of dollars if you don’t understand what you’re signing. Leases commonly include personal guarantees, hidden financial traps like unbounded standard area maintenance (CAM) fees, unclear repair responsibilities, and strict use or zoning clauses that bind tenants far beyond base rent. These provisions can expose your personal assets, balloon operating costs, and trap you in unwanted space without a workable exit strategy unless they are negotiated and clarified up front. A seemingly simple rental agreement can become one of the most consequential legal documents your business will ever sign, not because of the rent amount alone, but because vague language and standardized clauses favor landlords and magnify risk for tenants. Reviewing and negotiating commercial lease terms with experienced legal counsel isn’t optional; it’s essential insurance against long-term financial and operational damage.

If you are asking questions like these, this article is written for you:

• What are the hidden dangers in a commercial lease in Northern Virginia?

• Why can a personal guarantee put my personal assets at risk?

• What costs beyond rent should I expect in a commercial lease (like CAM fees)?

• Who is responsible for repairs, maintenance, and capital expenses?

• How can I protect my business with the right lease terms and an exit strategy?

In this guide, you’ll learn how to spot costly provisions, negotiate stronger terms, and avoid traps that can derail your business plan before you sign.

Why Northern Virginia Business Owners Cannot Afford to Skip Legal Review of Their Commercial Lease

I’ve been practicing law in Northern Virginia long enough to know the exact moment a business owner realizes they’ve made a terrible, irreversible mistake.

It’s usually a Monday morning, and they’ve just received a demand letter, a threat of litigation based on a single clause in the commercial lease they signed years ago.

The irony is always the same: they tried to save a modest legal fee up front, only to face an expensive, disruptive, five-figure litigation cost on the back end.

As an attorney focused on Business Litigation and Transactions here in the D.C. Metro area, I want to shatter one of the most dangerous myths I hear from otherwise savvy NoVA entrepreneurs: that the landlord’s lease agreement is a standard, fair, non-negotiable document.

It is not. It is a carefully crafted, one-sided legal weapon designed by the landlord’s attorney to protect their client’s interests at your expense. When you sign it without your own legal counsel, you are essentially agreeing to a pre-packaged series of traps.

Here are the four most significant, wallet-crushing dangers I routinely see business owners face when they skip the legal review in this competitive Northern Virginia market.

1. The Personal Guarantee: Trading Your Business Risk for Your House

In high-value commercial markets like Fairfax, Arlington, and Loudoun County, the single most critical danger is the Personal Guarantee.

The Mistake: You sign the guarantee, believing it’s just a formality.

The Reality: The lease often makes you, the individual business owner, personally responsible for the corporation’s entire obligation for the whole of the term (often 5 to 10 years).

If your business fails, a common occurrence, the landlord doesn’t just sue the defunct company; they sue you.

I’ve seen good people lose their homes, college savings, and personal assets because they failed to negotiate a few simple words.

My Value: We negotiate “Good Guy” Guarantees or “Burn-Off” clauses. These limit your personal liability exposure, ensuring that if you have to close the doors, you can walk away without destroying your personal finances. This single negotiation can be worth hundreds of thousands of dollars in future liability protection.

2. The Hidden Financial Traps: CAM and the Triple Net Lie

The base rent you negotiated is a fraction of the story. Most commercial leases in NoVA, especially in high-end office parks and retail centers, are Triple Net (NNN). This means, on top of the base rent, you pay for the Landlord’s property taxes, insurance, and Common Area Maintenance (CAM).

The Mistake: You assume these Pass-Through costs will be reasonable and stable.

The Reality: Landlords often attempt to pass on costs that are their responsibility, not yours, such as major roof replacements, parking lot paving, or disproportionately high management fees. I’ve seen clients’ operating costs spike by 20% overnight because of ambiguous language in the CAM section.

My Value: We define, cap, and audit these costs. We ensure you are not responsible for capital expenditures that the landlord should bear. We insert language giving you the right to audit the landlord’s books—a critical, protective measure that most business owners never even know to ask for.

3. The Operational Straitjacket: Zoning and the Use Clause

Your business model is your competitive edge. Your lease should facilitate it, not strangle it.

The Mistake: You agree to a narrow “Permitted Use” clause that precisely describes your current operation, but ignores future growth or needed pivots.

The Reality: Northern Virginia counties have complex and distinct zoning laws. If you want to change your business hours, add a new service (e.g., a coffee bar to your bookstore), or even sell a different product, a poorly drafted “Use” clause can give the landlord the absolute right to say no. Worse, if your current use technically violates a nuanced local zoning ordinance, you become liable for the penalty, not the landlord.

My Value: We ensure the “Permitted Use” is broad enough to future-proof your business. We also confirm the premises are legally zoned and compliant for your intended use, preventing a disastrous fine or forced closure down the road.

4. The Exit Trap: Being Stuck in a Lease You Can’t Afford

Businesses change. They need to expand, contract, or move to a better location. What happens when your 7-year lease has 4 years left, and you need to leave?

The Mistake: You rely on the landlord being “reasonable” when you ask to sublease the space.

The Reality: Most leases state the landlord must approve any sublease or assignment, and they often refuse, allowing them to collect rent from you while simultaneously finding a higher-paying tenant. You are effectively locked in, paying rent on a property you can’t use.

My Value: We force the inclusion of language stating the landlord cannot unreasonably withhold consent to a qualified new tenant. This small addition grants you a viable exit strategy, giving you the flexibility every successful, dynamic Northern Virginia business needs.

My Final Takeaway: The Fee is an Investment, Not an Expense

Look at the total value of your lease, the base rent, taxes, insurance, and CAM fees over the entire term.

For a typical commercial space in Northern Virginia, this often exceeds $500,000 to $1,000,000.

Would you sign a contract of that magnitude without consulting a professional?

The landlord views their attorney’s fee as a mandatory cost of business protection.

You should view your attorney’s fee as a fraction of the overall contract value as an insurance policy against the $100,000 mistake.

My goal in handling your Commercial Lease Negotiation is simple: to make sure that if things go wrong, we have already insulated you and your business from the worst-case scenario.

When you hire an attorney with expertise in both Business Litigation and Transactions, you’re not just getting a lease reviewer; you’re hiring the same lawyer who will have to defend you in court, and we make sure the contract we negotiate is one we can win on.

Principal Attorney | Shin Law Office

Call 571-445-6565 or book a consultation online today.

Commercial Lease Attorney Northern Virginia

Business Litigation & Transactions

Disclaimer: The information provided in this article is for educational purposes only and does not constitute legal advice. Every case is unique. If you believe you have a claim, contact a qualified attorney immediately to discuss the specifics of your situation and the applicable statutes of limitation.