Bottom Line Up Front (BLUF)

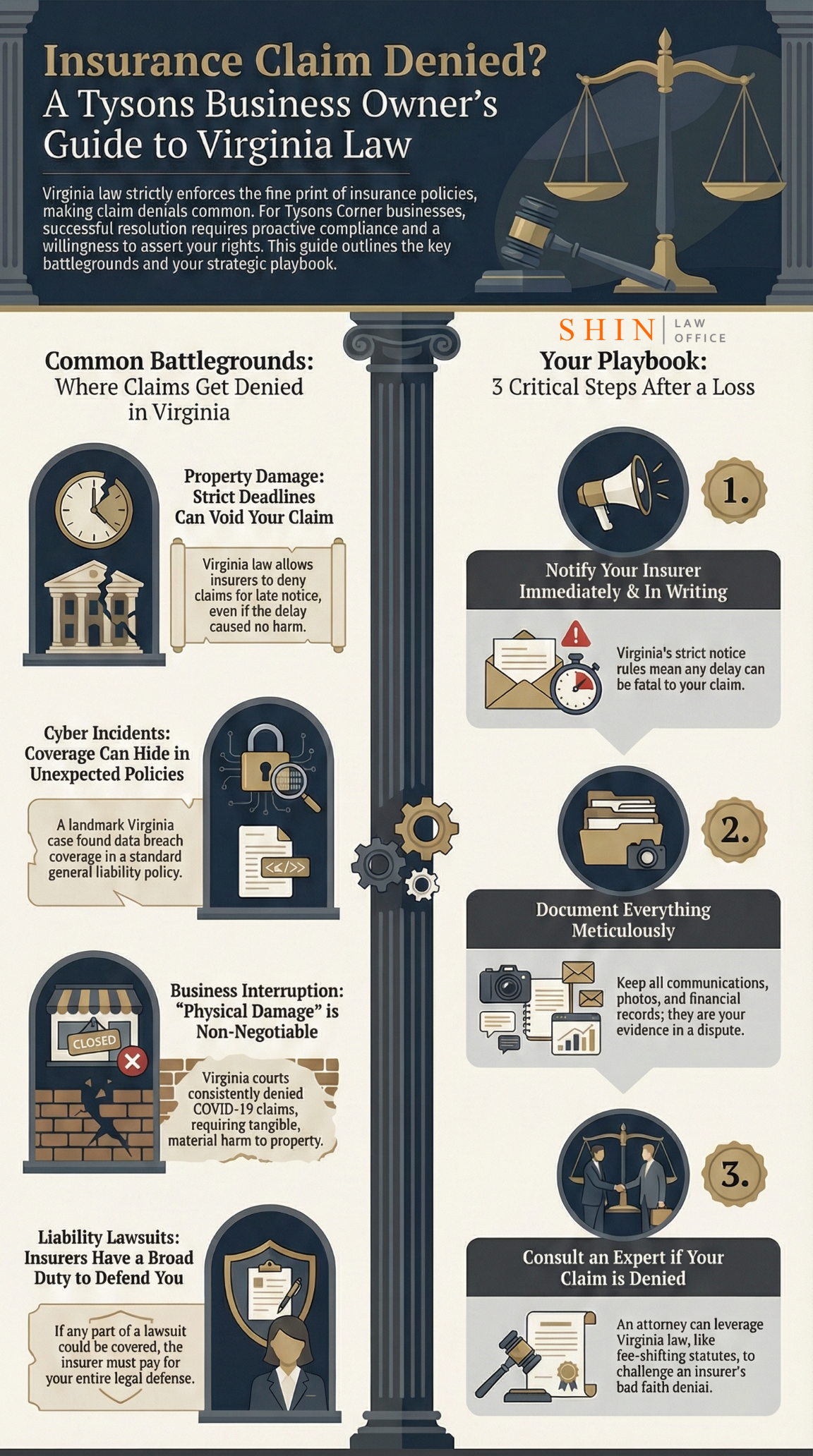

Tysons Corner, one of Virginia’s largest commercial hubs, is home to many businesses that depend on insurance for protection. When claims are denied, these policyholders often face complex legal battles over coverage. Virginia law strictly enforces policy terms, meaning details matter: timely notice, clear proof of loss, and understanding your policy are critical. While courts in Virginia generally uphold insurers’ defenses when policy language is unambiguous, policyholders can prevail with careful navigation of the law – especially when armed with knowledge of recent case precedents and state statutes that protect insureds.

In short, successful resolution of insurance disputes in Tysons Corner requires both proactive risk management and a willingness to assert your rights under Virginia law.

Table of Contents

- Chapter 1: The Landscape of Insurance Disputes in Tysons Corner

- Chapter 2: Property Damage Claim Disputes

- Chapter 3: Cyber Incident Coverage Disputes

- Chapter 4: Business Interruption Losses – The COVID-19 Aftermath

- Chapter 5: Liability Coverage and Third-Party Claims

- Chapter 6: Navigating Disputes – Tips for Policyholders

- References

Chapter 1: The Landscape of Insurance Disputes in Tysons Corner

Tysons Corner (often just called “Tysons”) is Fairfax County’s bustling central business district, with over 28 million square feet of office space and countless companies spanning tech, retail, hospitality, and more. With such a dense concentration of businesses, it’s no surprise that insurance coverage disputes frequently arise here. Commercial policyholders – from boutique retailers to Fortune 500 companies – routinely purchase policies to cover property damage, cyber risks, business interruptions, and liability. But when an insurer denies a claim, that safety net can suddenly fray, leading to high-stakes litigation.

Why are coverage disputes so common? Insurance policies are complex contracts filled with conditions, exclusions, and fine print. After a loss, insurers may interpret the policy to deny or limit coverage, citing reasons such as untimely notice, policy exclusions, or insufficient proof. Virginia law holds that insurance contracts are interpreted according to their plain language and the parties’ intent. This means if the policy wording clearly supports the insurer’s position, courts will enforce it – even if the result seems harsh. On the other hand, ambiguous terms are construed in favor of coverage. The push-and-pull over how to read policy terms often fuels these disputes.

Another factor in Tysons Corner is the high value of losses at stake. A major property damage claim from a fire or flood at a Tysons high-rise, a cyber breach exposing thousands of records, or a multimillion-dollar lawsuit against a corporation can all lead insurers to balk at paying. For the business, though, a denied claim could mean huge out-of-pocket costs or even bankruptcy, so there’s strong motivation to challenge denials.

Virginia’s legal framework for insurance disputes is something every Tysons business should be aware of. Virginia is generally considered an insurer-friendly state in some respects – for example, Virginia historically required strict compliance with policy notice requirements (insurers here do not have to prove they were prejudiced by late notice, unless the policy says otherwise). Additionally, until recently, Virginia law provided limited recourse for first-party “bad faith” claim denials. (Notably, Virginia Code § 38.2-209 allows a policyholder to recover their attorney’s fees if a court finds the insurer lacked good faith in denying coverage – a useful, but narrowly applied remedy.) The state has no broad punitive damages statute for bad faith in commercial insurance contexts, and common-law punitive damages for insurer misconduct are rare. This legal landscape means Tysons Corner policyholders must diligently follow policy rules and be prepared to advocate for themselves to secure coverage.

In the chapters that follow, we’ll explore four major categories of insurance coverage disputes that Tysons-area businesses often encounter – property damage, cyber incidents, business interruption, and liability claims – illustrating each with relatable examples and highlighting the key Virginia laws and recent cases (2023–2024) shaping outcomes. We’ll then conclude with practical tips on navigating these disputes, so that potential clients and business owners can approach their insurance claims from an informed, empowered position.

Chapter 2: Property Damage Claim Disputes

Imagine this scenario: A water pipe bursts overnight in a Tysons Corner retail store, flooding the premises and damaging inventory. The owner files a property damage claim under the commercial property policy. The insurer, however, denies the claim, asserting that the leak was due to gradual wear and tear (an excluded cause) and that the business failed to notify the insurer “promptly.” Suddenly, the owner faces a hefty repair bill alone. Unfortunately, such property damage coverage disputes are common.

Coverage Denials and Exclusions: Property insurance policies protect against perils like fire, storms, or vandalism – but not every cause of loss is covered. Insurers often deny claims by invoking exclusions (for example, standard policies exclude flooding, gradual deterioration, or faulty maintenance). In Virginia, if an exclusion clearly applies, courts will enforce it as written. However, when a covered peril and an excluded peril both contribute to a loss (known as “concurrent causes”), things get tricky. Virginia generally follows the rule that if an excluded peril is a direct cause of the loss, the claim can be denied even if a covered peril was also involved. For instance, if heavy rain (a covered peril) causes a poorly maintained roof to collapse (a maintenance-related collapse might be excluded), coverage may depend on the policy language and the primary cause. The Virginia Supreme Court’s decision in Lower Chesapeake Assocs. v. Valley Forge Ins. Co. illustrates the importance of policy language: the Court confirmed that coverage existed for damage caused by a “windstorm” and resulting “water damage,” because those terms were in the policy’s covered perils. In practice, this meant a hurricane’s wind-driven rain that caused interior damage was deemed covered – a win for that policyholder. The takeaway is that Virginia courts will honor the plain meaning of coverage grants and exclusions, so the exact phrasing in your policy matters immensely.

Notice and Deadlines: Procedural missteps are another common reason property claims get denied. Most policies require the insured to give prompt notice of loss – often phrased as notice “as soon as practicable” or even within a set number of days. If you wait too long to notify the insurer, the insurer may deny the claim outright. Unlike some states, Virginia does not require an insurer to prove it was prejudiced by late notice to deny coverage (unless the policy itself includes a prejudice requirement). In other words, late notice is late notice in the Commonwealth – a harsh rule that caught many by surprise. For example, in one Virginia case, an insurer was able to void coverage for a fire loss solely because the insured had waited an “unreasonable” amount of time to report the claim, even though the delay didn’t change the outcome of the fire investigation. The lesson for Tysons businesses is simple: notify your insurer immediately when property damage occurs, even as you take steps to mitigate the damage. As one commentator put it, an insured’s first instinct after a loss may be to fix the problem – which makes sense – but you can’t “lose sight” of the need to notify your insurer and follow policy deadlines. Many claims are denied not on substance, but because the policyholder missed a notification or proof-of-loss deadline.

Another deadline lurking in property policies is the contractual limitations period for filing a lawsuit. Virginia’s default statute of limitations for written contracts is 5 years, but insurance policies often shorten that dramatically, frequently to only 2 years from the date of loss. Such reductions are legal in Virginia. This caught a pair of homeowners off guard in a recent case: they suffered water damage in 2014 and, after a drawn-out back-and-forth with their insurer, didn’t file suit until 2017. The insurer (Nationwide) invoked the policy’s two-year suit limitation and moved to dismiss. The Virginia Court of Appeals agreed that the suit was time-barred – the policyholders had waited too long to sue**.** Although that was a homeowner’s policy, many commercial property policies in Virginia have similar 2-year suit limitations, which start running from the date of the loss or damage. Tysons Corner businesses must be mindful that failing to sue in time can extinguish even a valid claim.

Real-World Tip: Always review the “Duties After Loss” section of your property policy. It will outline notice requirements, proof of loss deadlines (commonly 60 days to submit a sworn proof of loss after requested), and suit limitation periods. Complying with these is essential. If a claim is denied for a curable issue (like insufficient documentation), respond promptly with the needed info. And if an insurer continues to deny a clearly covered claim, Virginia Code § 38.2-209 (the attorney’s fees statute) may come to your aid – it empowers courts to award you legal fees if the insurer’s denial was not in good faith. This statute essentially penalizes unreasonable denials, leveling the playing field for policyholders who might otherwise be financially deterred from challenging an insurer in court.

In sum, property damage disputes in Tysons often boil down to two questions: (1) Is the cause of loss covered or excluded under a fair reading of the policy? and (2) Did the policyholder fulfill their obligations (timely notice, suit, etc.) under the policy? If you can put a checkmark by both, you stand on strong ground. If not, expect the insurer to fight hard, and be prepared to engage legal help to argue issues like ambiguous policy wording or whether a delay truly mattered.

Chapter 3: Cyber Incident Coverage Disputes

Tysons Corner’s thriving tech firms and government contractors know that cyber incidents – data breaches, ransomware attacks, and other digital crises – are a growing threat. Many businesses carry dedicated cyber insurance. But surprisingly, coverage disputes can also arise under traditional policies (like property or general liability insurance) when a cyber event occurs. The question of who pays for cyber losses is a newer frontier in insurance law, and Virginia companies have been right in the middle of it.

Covering Cyber Losses Under Traditional Policies: One landmark case that put Virginia on the cyber insurance map was Travellers Indemnity Co. of America v. Portal Healthcare Solutions, LLC. Portal, a Virginia-based medical records storage company, was sued after confidential patient records it maintained were accidentally exposed online. Portal had a Commercial General Liability (CGL) policy (not a specific cyber policy). Its insurer denied coverage, claiming that a data breach wasn’t covered “bodily injury” or “property damage,” and arguing that publishing medical records online wasn’t the kind of “personal and advertising injury” the policy intended to cover. Portal fought back in court – and won. A federal court in Virginia, applying Virginia insurance law, held that the allegations potentially fell within the policy’s personal/advertising injury coverage (which included injury arising from “electronic publication of material that violates a person’s right of privacy”). The court reasoned that making private medical records accessible online, even if inadvertent, was an unauthorized “publication” of private information, and thus could be considered a covered privacy violation. The Fourth Circuit U.S. Court of Appeals (which covers Virginia) affirmed this decision in 2016, forcing the insurer to defend Portal in the class-action lawsuit. This outcome was a wake-up call: Yes, Virginia, there is coverage for cyber loss under a CGL policy! It demonstrated that policyholders should “examine all of their potentially applicable insurance policies” after a cyber incident – not just stand-alone cyber policies. General liability, property, crime, or even business interruption coverages might be triggered by certain cyber events, depending on policy language.

Evolving Challenges: However, it’s not always easy. Insurers have since tightened policy language and introduced specific exclusions for cyber-related risks in traditional policies. For example, many CGL policies now have a “data breach” exclusion or require that a “publication” be done by the insured, not by a hacker. Thus, if a hacker steals data (a third-party criminal act), insurers often argue that doesn’t count as the insured “publishing” the data – an argument they didn’t get to make in Portal’s scenario. We can expect insurers to continue drawing distinctions like this. A 2016 Pillsbury analysis of the Portal case noted that insurers would likely argue Portal is a narrow case limited to its facts – and that intentional cyberattacks by hackers might be treated differently. This has largely proven true: coverage for cyber incidents remains “an evolving area of law”, and insurers often fight hard against claims under traditional policies.

Cyber Insurance Policies: Given the uncertainties with traditional coverage, many Tysons businesses purchase dedicated cyber insurance policies. These typically cover first-party costs (like forensic investigations, customer notification expenses, data recovery, ransomware payments, etc.) and third-party liability (lawsuits by people whose data was compromised). Yet even with these policies, disputes occur. Common flashpoints include: whether the insured complied with security warranties in the policy (e.g. maintained certain cybersecurity protocols – insurers have tried to void coverage if the company didn’t meet an agreed standard of care), whether certain types of attacks are excluded (for instance, some cyber policies exclude acts of cyber war or nation-state attacks, which became an issue with the Russia-linked NotPetya virus in other jurisdictions), and how to quantify business interruption loss from a cyber event (if a network outage shuts down operations, calculating the lost income can be contentious).

While Virginia-specific case law on standalone cyber policies is still developing (no Virginia Supreme Court case yet squarely addressing a cyber policy dispute), general contract principles apply. Virginia courts will look to the plain meaning of the cyber policy and enforce it. One could analogize to other insurance contexts: for example, if a cyber policy requires that the insured maintain up-to-date data backups as a condition precedent to coverage, and the company didn’t – an insurer might deny a data restoration claim, similar to how a property insurer might deny a claim if you failed to maintain protective safeguards (like a sprinkler system) required by the policy.

Real-World Tip: In the event of a cyber incident, notify both your cyber insurer and any other potential insurers (GL, property, crime) immediately. As we learned from Portal, you might have overlapping coverage. Be forthcoming with information but careful – involve legal counsel if possible when communicating complex cyber details to insurers, to avoid mischaracterizations that could hurt your claim. If coverage is denied, don’t assume the insurer’s interpretation is final. The Portal case shows courts can disagree with insurers and find coverage in unexpected places. Also, keep in mind that Virginia’s broad duty to defend means if there’s any potential for a covered liability claim in a lawsuit, the insurer must defend you. So, for example, if a breach leads to lawsuits alleging both negligent security (potentially covered) and intentional misrepresentation (maybe excluded), the insurer likely still has to defend the entire suit, even if it ultimately won’t have to pay judgments for intentional acts. This “defend first, sort out payment later” principle is a powerful tool for policyholders facing litigation – essentially, you want to trigger the duty to defend because it means the insurer pays for your lawyers.

Bottom line: Cyber coverage disputes in Tysons Corner mix cutting-edge technology issues with century-old contract principles. Be prepared to make creative arguments for coverage (as Portal did), but also to meticulously follow any policy- and tech-related requirements. With high costs on the line in a data breach, expect insurers to probe whether you met every condition and to exploit any ambiguity in their favor. Staying ahead of this means reviewing your policies annually with cyber-savvy counsel and ensuring your company’s cybersecurity practices align with policy requirements.

Chapter 4: Business Interruption Losses – The COVID-19 Aftermath

Perhaps no type of insurance dispute has been more gut-wrenching for Tysons Corner businesses in recent years than business interruption (BI) claims during the COVID-19 pandemic. When the government ordered in 2020 that restaurants, hotels, and offices in Tysons shut their doors, owners naturally looked to their business interruption insurance for relief from the massive income losses. Insurers almost universally denied these claims, arguing that “physical loss or damage” – typically required to trigger BI coverage – was absent. This set off a nationwide wave of litigation, including in Virginia. The outcome, though disappointing for policyholders, has clarified how Virginia law treats business interruption coverage.

The Core Issue: Business interruption provisions in property policies usually cover lost income due to a suspension of operations caused by direct physical loss or damage to the insured property. Policyholders argued that the presence of the COVID-19 virus in the air and on surfaces, or the loss of use of property due to civil authority shutdown orders, constituted “physical loss” of the property. Insurers contended that neither virus contamination nor loss of use meets the bar – in their view, physical loss/damage requires a tangible alteration of property (like fire or structural damage).

Virginia’s Answer – No Coverage Without Tangible Harm: Early on, there was a glimmer of hope for insureds. In 2020, a federal judge in Virginia issued the Elegant Massage, LLC v. State Farm decision, one of the country’s few pro-insured rulings. That court noted the phrase “direct physical loss” was ambiguous and could include loss of use of property even without material damage. It even found that the policy’s virus exclusion didn’t clearly apply. Policyholder attorneys around the U.S. hailed Elegant Massage as a trailblazer. However, it turned out to be an outlier and was later effectively overturned. By 2022–2023, the tide in Virginia had fully turned in favor of insurers. The Fourth Circuit (appellate court) emphatically rejected the Elegant Massage reasoning, holding that under Virginia law “direct physical loss” unambiguously requires a material, tangible alteration or harm to property. In fact, in 2024 the Fourth Circuit explicitly addressed Elegant Massage on appeal and aligned with the majority rule: economic loss from COVID closures, without more, is not covered.

Reinforcing this, a September 2024 Virginia Court of Appeals decision (involving several hotel owners with properties in Virginia and elsewhere) sustained the dismissal of policyholders’ COVID-19 BI claims. The court reasoned that the hotels’ complaint failed to allege any actual physical damage – the hotels claimed losses from COVID-related restrictions, but “[a] decrease in business and temporary closures,” while economically harmful, did not equate to physical harm to the properties themselves. The court noted that Virginia courts had never interpreted “physical loss or damage” in an insurance contract to encompass a purely economic or use-based loss, and it declined to be the first to do so. Essentially, no virus particles, no broken windows, no coverage. The Virginia Supreme Court signaled agreement by refusing to hear an appeal in at least one COVID coverage case, indicating that the lower courts’ rulings (denying coverage) had no reversible error.

Civil Authority and Other Extensions: Many businesses also pointed to Civil Authority coverage, an extension that covers losses when a government order prohibits access to your property due to damage at a nearby property. Tysons companies argued that government shutdown orders were “civil authority” actions. Virginia courts, however, held that those orders were preventative health measures, not responses to physical damage at any property – thus, the civil authority coverage was not triggered (since again, the threshold issue of physical damage wasn’t met anywhere).

It’s worth noting that while pandemic BI claims failed, more traditional BI claims in Virginia remain viable when tied to physical events. For example, if a water main break floods your office (physical damage) and you can’t operate for a month, BI coverage should apply to lost income and extra expenses. Disputes in those scenarios tend to be about the amount of loss (insurers might argue you could have resumed operations sooner, or that some income loss wasn’t actually caused by the downtime). Those are more typical evidentiary fights. By contrast, COVID presented an existential coverage fight about whether anything was covered at all. The answer from Virginia’s judiciary was a resounding no for COVID-related losses absent physical alteration of property.

Real-World Tip: If you are purchasing or renewing business interruption coverage post-COVID, read the policy language closely. Some newer policies explicitly address communicable disease coverage (or exclusions). A few insurers now offer limited coverage endorsements for pandemic-related shutdowns (often with sublimits and specific triggers). If you want that protection, you must negotiate for it – standard policies likely won’t include it. Also, maintain good records of your business income and expenses; in any BI claim, solid documentation of historical revenues and the impact of the interruption is key to substantiating your losses (and pushing back on any low estimates by the insurer).

Finally, if another widespread disruption (pandemic or otherwise) hits, remember the lessons of COVID-19: Virginia courts will look for physical, tangible damage. Absent that, coverage will be a long shot. As painful as it was for many Tysons businesses to absorb those losses, knowing this rule can at least inform your risk management going forward (perhaps through diversifying insurance products or advocating for government solutions when private insurance fails). And if you believe your situation does involve property damage (for example, contamination that physically alters property), be prepared to prove it with expert evidence – that could be the difference between coverage and denial in the next big case.

Chapter 5: Liability Coverage and Third-Party Claims

When a customer slips and falls in your Tysons Corner store, or your company gets sued for allegedly mishandling a project, your Commercial General Liability (CGL) policy or other liability insurance is supposed to defend and protect you. Liability insurance disputes arise when insurers refuse to defend a lawsuit or deny coverage for a settlement/judgment. These disputes can be high stakes – if the insurer wrongly refuses to defend, the policyholder might have to fund their own legal defense and then seek reimbursement. Understanding how Virginia law treats an insurer’s duty to defend and the scope of liability coverage is crucial for any business.

The Broad Duty to Defend: Virginia follows the classic “eight corners rule” in determining whether an insurer must defend you. This means the court compares the four corners of the insurance policy to the four corners of the complaint (lawsuit) filed against you. If the facts alleged in the complaint even potentially fall within the policy’s coverage, the insurer has a duty to defend the entire lawsuit. Importantly, the duty to defend is broader than the duty to indemnify (pay settlements or judgments). For example, if a lawsuit against your business alleges a mix of clearly covered claims (say, negligence causing bodily injury) and clearly uncovered claims (say, fraud, which might be excluded as intentional misconduct), the insurer still must defend the whole case because of the covered allegations. Only if the complaint solely alleges facts unequivocally outside coverage can the insurer avoid a defense. In practice, insurers sometimes deny defense by arguing that an exclusion applies to all claims in the complaint, or that the allegations, even if worded as “negligence,” actually describe an intentional act (thus not an “accident”). These arguments lead to declaratory judgment actions in which Virginia courts decide whether the insurer’s duty to defend was triggered. Generally, Virginia courts err on the side of requiring a defense if there’s any doubt – a stance friendly to insureds at least on this one issue.

What Counts as an “Occurrence” – The AES Climate Case: A pivotal Virginia Supreme Court case, AES Corp. v. Steadfast Ins. Co. (2012), highlights how Virginia law construes the scope of liability coverage, particularly the definition of an “occurrence” (which in CGL policies is usually defined as an accident). In AES, a power company was sued in a climate change tort lawsuit, alleging that the company’s intentional emission of greenhouse gases contributed to global warming and harmed an Alaskan village. The insurer denied coverage, arguing that intentional emissions causing foreseeable climate change effects were not an accident and thus not an occurrence under the policy. The Virginia Supreme Court agreed: it held that because the lawsuits alleged knowing emissions and that the damage was the natural and probable consequence of the company’s acts, there was no “occurrence” and therefore no duty to defend or indemnify under the CGL policy. The court noted that in Virginia an “accident” is an event that produces harm not expected or intended by the insured. Even if a complaint uses the word “negligence,” that won’t bring it within coverage if the underlying facts show the harm was a foreseeable result of intentional actions. AES was a big win for insurers, and it underscores a key point: liability policies in Virginia won’t cover intentional or expected harms. This often comes up in smaller contexts too – for instance, if a complaint accuses a business owner of assaulting a customer, that likely isn’t covered (most policies have an intentional acts exclusion, and it’s not an “accident” anyway). Or if a contractor is sued for shoddy workmanship, insurers sometimes argue that the defective work wasn’t an “accident” (some states go back and forth on whether poor workmanship is an occurrence – Virginia tends to require an unexpected event beyond the faulty work itself).

Common Exclusions and Coverage Gaps: Commercial policies often include numerous exclusions that can lead to disputes. A few examples relevant to Tysons businesses:

- Professional Services Exclusion: If you have a CGL policy and a claim arises from your professional advice or services (common for consultants, tech firms, etc.), the CGL might exclude it, expecting you to carry Professional Liability (E&O) insurance. Disputes happen when it’s debatable whether the claim is “professional” in nature or more general. For instance, if an IT company is sued over a data loss, is that a professional services error (excluded) or just negligence covered by CGL? It may require legal interpretation.

- Employer’s Liability and Workers’ Comp: CGL policies exclude injuries to your own employees (those belong in workers’ compensation coverage). If an employee’s family sues the company for an injury (perhaps through a third-party claim), the insurer might deny coverage under the employer’s liability exclusion. Virginia law would uphold that exclusion – it’s pretty straightforward.

- Contractual Liability: Many Tysons businesses sign contracts requiring them to indemnify others. If you get sued due to a contract, insurers might invoke the contractual liability exclusion (which bars coverage for liability assumed under contract, with some exceptions). However, Virginia courts will look if the liability exists independent of the contract as well – if so, the insurer might still have to cover it. This can be nuanced.

- Additional Insured disputes: In construction-rich Tysons, a property owner might require a contractor to name them as an additional insured. Disputes arise over whether the additional insured is covered for a given accident (usually they are, but insurers sometimes argue the accident wasn’t in the scope of what the contractor agreed to insure). Virginia courts, as elsewhere, look at the policy endorsement wording to resolve this.

Real-World Tip: To avoid nasty surprises, coordinate your liability coverages. Ensure you have the right types (CGL, professional liability, directors & officers, etc., as applicable) and that their limits are adequate. When a lawsuit or claim arrives, tender it to all relevant insurers immediately. If an insurer denies a defense, that’s a red flag – consult coverage counsel promptly. Often, a firm letter explaining Virginia’s law on the duty to defend can persuade an insurer to step in, especially since if they refuse and are wrong, they could later owe not just the defense costs but also potentially damages for breaching the policy. Remember that under Virginia Code § 38.2-209, if you sue your insurer for coverage and win, and the court finds the insurer lacked good faith, you can recover your attorney’s fees in that coverage suit. This fee-shifting is a powerful deterrent against frivolous denials and can make an insurer think twice about shirking its duty to defend.

Finally, keep in mind that settling liability claims requires insurer involvement. If your insurer is defending under a reservation of rights (meaning they might later contest coverage), talk to your attorney about the possibility of an agreement (in some cases, insureds can negotiate a settlement that assigns the claim to the plaintiff and limits their personal exposure, then litigate coverage with the insurer – but Virginia has specific rules on that). It’s complex territory, but the main point is: don’t settle a liability claim without insurer consent if they are defending, as that could violate your policy conditions. And conversely, if an insurer unreasonably refuses to settle a clearly covered claim within policy limits and a verdict comes in higher, Virginia does recognize an insurer’s duty of good faith in settlement – the insured could have recourse against the insurer in that scenario (this is a species of common-law bad faith in third-party cases).

Chapter 6: Navigating Disputes – Seven Tips for Policyholders

After exploring the rough waters of coverage disputes, it’s clear that knowledge and proactivity are a policyholder’s best allies. Here are some actionable tips for Tysons Corner businesses (and indeed any insured) to navigate insurance disputes effectively:

- Know Your Policy (Before a Loss Happens): It sounds basic, but many do not read their insurance contracts until a crisis hits. Take the time now to review key terms in your policies – what perils are covered or excluded? What are your duties after a loss? Is there a flood or cyber endorsement? If something is unclear, ask your insurance broker or a coverage attorney. For instance, if your property policy has a 180-day deadline for deciding whether to rebuild or cash out on a claim, you need to plan for that. If your cyber policy requires using certain approved vendors after a breach, know that in advance. An ounce of prevention truly is worth a pound of cure when it comes to insurance compliance.

- Provide Prompt Notice and Mitigate Damage: The moment you suffer a loss or get hit with a lawsuit, trigger your policy protections. Virginia policies often demand immediate or “as soon as practicable” notice. Late notice can void coverage even if the delay caused no harm to the insurer. At the same time, you are expected to mitigate damages – secure your property, preserve evidence, and prevent further loss. Document these efforts, as they demonstrate your good faith. When notifying insurers, do it in writing and include as much detail as necessary, but avoid speculation. Simply state the facts of what happened and that you are making a claim or requesting defense under your policy.

- Keep Meticulous Records: In any claim, documentation is king. Maintain files of all communications with insurers (letters, emails, claim forms), proof of losses (photos of property damage, financial statements showing business income trends, invoices for repairs, etc.), and notes of phone calls. If a claims adjuster visits, follow up with a confirming email of what was discussed. These records might become evidence if a dispute escalates. They also help ensure the insurer processes your claim promptly (since you can prove when you submitted information).

- Be Wary of Quick Denials – and Leverage the Law: If you receive a denial letter, read it carefully. Insurers must explain the basis for denial, often citing policy provisions. Compare the cited reasons to your understanding of the facts. It’s not uncommon for initial denials to misapply policy language or overlook nuances. Remember, Virginia’s Unfair Insurance Practices Act (Va. Code § 38.2-510) prohibits insurers from misrepresenting facts or policy provisions and from refusing to pay claims without a reasonable investigation. While this law is enforced by state regulators (you can file a complaint with the Virginia Bureau of Insurance if you suspect bad behavior), citing it in correspondence can put pressure on an insurer to act fairly. Additionally, if the denial seems baseless or in bad faith, remind the insurer of Va. Code § 38.2-209 – their potential exposure to pay your attorney’s fees if a court later finds the denial lacked good faith. Such reminders, professionally conveyed, signal that you know your rights.

- Don’t Go It Alone – Get Expert Help: Insurance policies are densely packed with legalese and case-law-influenced interpretations. If the claim is significant or the coverage issues complex, consult an insurance coverage attorney sooner rather than later. Tysons Corner and the DC metro area have many lawyers who specialize in representing policyholders. They can analyze your policy, strategize responses to insurers, and, if needed, file a declaratory judgment action to enforce coverage. Often, the involvement of knowledgeable counsel can lead to a quicker, more favorable resolution – insurers realize you mean business and that any shaky denial will be vigorously challenged.

- Consider Negotiation or Alternative Dispute Resolution: Not every coverage fight must end up in court. Depending on the circumstance, mediation can be a useful forum to settle disputes (especially when the dispute is over the amount of loss, or a gray area in coverage). In mediation, both sides can sometimes agree to split differences or find creative solutions (for example, the insurer might agree to cover a loss under one part of the policy even if another part is debatable). Also, if you have a broker, involve them – brokers can sometimes advocate with insurers behind the scenes to resolve issues, given their relationships and desire to keep customers happy.

- Learn from Others – Stay Updated on Case Law: The insurance coverage landscape evolves. The years 2023–2024 alone brought several instructive cases in Virginia. We discussed the Jenkins case (contractual suit limits), the Virginia hotel COVID case (physical loss requirement), the Fourth Circuit’s Elegant Massage reversal, and others. Keeping abreast of such developments (through industry publications or legal updates) can help you anticipate how a dispute might be decided. For instance, knowing that courts view cyber claims under CGL policies favorably (Portal case) might encourage you to push an insurer on that front, whereas knowing that virus-related BI claims won’t fly can save you from investing in a long-shot lawsuit.

In closing, insurance is supposed to be a safety net for businesses, a way to transfer risk and sleep easier at night. When disputes arise, it can feel like the rug has been pulled out from under you just when you most need support. But Virginia law, while strict on some requirements, does provide avenues for relief. Tysons Corner policyholders who are diligent with their policies, assertive in their claims, and unafraid to use legal tools at their disposal can successfully navigate coverage disputes. Whether it’s a flooded storefront or a cyber heist, being prepared and informed is the best strategy.

And remember, the goal is not to be adversarial with your insurer from the start – in fact, many claims are resolved amicably.

But if you hit a wall, you now have a roadmap of what to consider next. Stay safe, stay insured, and know that when the unexpected happens in Tysons, you have options to ensure your insurer keeps the promise it sold you.

Principal Attorney | Shin Law Office

Call 571-445-6565 or book a consultation online today.

(This article is provided for general informational purposes and does not constitute legal advice. For advice on your specific situation, consult with a licensed Virginia attorney.)

References

- Virginia Statutes & Regulations:

- Va. Code Ann. § 38.2-209 (2025). Award of insured’s attorney fees in certain cases. (Allows recovery of reasonable attorney fees if an insurer, not acting in good faith, denies coverage or payment to an insured.)

- Va. Code Ann. § 8.01-66.1 (Supp. 2024). Remedy for arbitrary refusal of motor vehicle insurance claim. (Establishes damages up to double the judgment (max $500,000) plus attorney fees if an auto insurer unreasonably denies an uninsured/underinsured motorist claim in bad faith, effective July 1, 2024.)

- Va. Code Ann. § 38.2-510 (2010). Unfair Claim Settlement Practices. (Lists prohibited insurer practices, such as misrepresenting policy provisions or denying claims without a reasonable investigation. Enforcement by the Virginia SCC’s Bureau of Insurance.)

- 14 Va. Admin. Code § 5-400-40(D) (Virginia Insurance Regulations, 2018). Notice of Loss Prejudice Rule. (Provides that if an insurance policy requires the insurer to show prejudice from late notice, then an insured’s failure to give timely notice does not void coverage unless the insurer’s rights were prejudiced. If no such requirement, late notice alone can justify denial.)

Virginia Case Law:

- AES Corp. v. Steadfast Ins. Co., 283 Va. 609, 725 S.E.2d 532 (Va. 2012). (No coverage for climate-change lawsuit). (Held that a suit alleging intentional emission of greenhouse gases did not allege an “occurrence” under a CGL policy, since the harms were not accidental.)

- Elegant Massage, LLC v. State Farm Mut. Auto. Ins. Co., 589 F. Supp. 3d 389 (E.D. Va. 2020), rev’d, 95 F.4th 181 (4th Cir. 2024). (COVID-19 business interruption). (Trial court found “direct physical loss” ambiguous and potentially inclusive of COVID shutdown-related loss; Fourth Circuit reversed, holding physical loss requires tangible alteration.)

- Jenkins v. Nationwide Mut. Fire Ins. Co., No. 0195-23-3 (Va. Ct. App. Dec. 12, 2023) (unpublished). (Property claim suit limitation). (Affirmed dismissal of homeowners’ water damage claim filed after the policy’s 2-year contractual limitation period expired.)

- Lower Chesapeake Assocs. v. Valley Forge Ins. Co., 260 Va. 77, 532 S.E.2d 325 (Va. 2000). (Covered peril – windstorm/water damage). (Confirmed that “physical loss or damage” included damage from a windstorm and ensuing water damage, per policy terms.)

- [Hotel Owner] v. Fireman’s Fund Ins. Co., Record No. 1981-22-1 (Va. Ct. App. Sept. 24, 2024). (COVID-19 business interruption). (Virginia Court of Appeals held that loss of use of property due to COVID orders did not meet the policy’s “direct physical loss or damage” requirement; tangible harm is needed for coverage.)

- Portal Healthcare Sols., LLC v. Travelers Indem. Co. of Am., 35 F. Supp. 3d 765 (E.D. Va. 2014), aff’d, 644 F. App’x 245 (4th Cir. 2016). (Data breach covered under CGL). (Insurer had a duty to defend Portal in a class action over exposure of medical records online; exposing private data was deemed a “publication” that potentially violated privacy rights, fitting the policy’s personal injury coverage.)

- TravCo Ins. Co. v. Ward, 284 Va. 547, 736 S.E.2d 321 (Va. 2012). (Definition of direct physical loss). (While not discussed in detail above, this Virginia Supreme Court case held that toxic gas from Chinese drywall constituted a “direct physical loss,” but the loss was excluded by the policy’s pollution exclusion. It’s frequently cited on interpreting “physical loss.”)

Secondary Sources:

- Curcio, T. (2024, June 27). New Bad Faith Laws in Virginia under Virginia Code § 8.01-66.1: Effective July 1, 2024. Curcio Law Blog. (Explains recent legislation introducing bad faith remedies for first-party auto insurance claims in Virginia, overturning prior law.)

- Hite, C. (2013, April 17). Know your deadlines or lose your insurance coverage. Virginia Business. (Discusses the importance of prompt notice and awareness of policy deadlines, citing examples of reduced limitation periods and strict late notice rules in Virginia.)

- Phelps Dunbar LLP. (2022, July 29). Recent COVID-19 Decisions Favor Insurers in Virginia and the 4th Circuit. (Summarizes how Virginia state and federal courts responded to COVID-19 business interruption claims, including Elegant Massage and the Virginia Supreme Court’s refusal to hear a pro-policyholder appeal.)

- Pillsbury Winthrop Shaw Pittman LLP. (2016, April 14). Yes, Virginia, There Is Coverage for Cyber Loss under Commercial General Liability Policies. Policyholder Pulse Blog. (Analyzes the Portal Healthcare case and advises policyholders on potential coverage for cyber events under various policies.)

- Fairfax County Economic Development Authority. (2022, Oct. 1). Fairfax County: One of the Best Business Districts in the World. (Notes that Tysons is among the largest U.S. suburban business districts, with 28.3 million sq. ft. of office space, underscoring the concentration of businesses in the area.)