By Adam L. Engel, Esq. | Estate & Probate Attorney | Shin Law Office

BLUF (Bottom Line Up Front)

I know that when you’re planning your estate as a high-net-worth family, the stakes are much higher than just writing a will. You’re not only trying to protect what you’ve worked a lifetime to build, but you’re also trying to minimize estate taxes, guard against creditors and legal challenges, and make sure your wealth transfers smoothly to the people and causes you care about most. That’s why the right combination of trusts is so vital as part of your estate architecture. Trusts can help you avoid probate, provide asset protection, strategically shift growth out of your taxable estate, and preserve your family’s legacy across generations in ways that simple wills cannot. Your plan should be tailored to your unique assets, family dynamics, and long-term goals, and it’s a process that often benefits from legal, tax, and financial expertise working together.

FAQs

What is a trust and how does it work?

A trust is a legal tool that holds and manages assets for your benefit or for the benefit of others you choose. It avoids probate, gives you control over how assets are used, and can protect privacy and wealth. People often search to understand the basics of what a trust does before they get into complex strategies.

Why do high-net-worth families need advanced estate planning?

Wealthy families face greater complexity, higher estate taxes, possible creditor claims, business interests, and privacy concerns. A basic will isn’t enough for many affluent estates, so families use layered planning with multiple trust types to minimize taxes, protect assets, and secure legacy goals.

What types of trusts should I consider for my high-net-worth estate?

Commonly searched trust types for high net worth planning include:

- Revocable Living Trust to avoid probate and keep things private

- Irrevocable Trusts for tax and creditor protection

- Grantor Retained Annuity Trusts (GRATs) for gifting benefits

- Dynasty Trusts to preserve wealth across generations

- Charitable Trusts for giving and tax strategy

These answers raise more profound questions about how families protect wealth strategically.

How can trusts reduce estate and gift taxes?

Searchers often want to know how to reduce the tax burden on large estates. Tools like GRATs and dynasty trusts can transfer assets out of your taxable estate, potentially reducing federal estate taxes and helping preserve more for your heirs.

Can trusts provide income or investment benefits to beneficiaries?

Yes. Many people ask whether trust assets can be invested or used to generate income for heirs. Trusts can hold investments that provide income over time, and distribution rules can be tailored to support education, business growth, or long-term financial security.

Who should I choose as a trustee, and what should I consider?

A common follow-up question is about administering the trust: who will manage it, how decisions are made, and how distributions occur. Choosing trustees, understanding administrative roles, and aligning it with your family’s needs are critical considerations.

What happens to my estate if I don’t have trusts tied to my wealth?

People often search for the consequences of not planning carefully. Without advanced planning, estates can go through public probate, face higher taxes, and create family disputes or delays in wealth transfer. Trusts help you avoid those pitfalls.

How do I keep my estate plan up to date as my wealth changes?

Another common query is how often to review trusts and plans. Estate planning isn’t one-and-done. Changes in tax laws, family situations, and asset values mean your plan should be reviewed periodically, especially for high-net-worth families.

Wealthy families don’t just need estate plans—they need estate architecture. This guide reveals the essential trusts that protect fortunes, reduce estate taxes, and preserve legacies for generations. From the flexible Revocable Living Trust to advanced tools like Dynasty Trusts, GRATs, and Offshore Asset Protection Trusts, each option serves a distinct role. When layered together, these trusts create a robust framework that shields wealth, supports heirs responsibly, and ensures that a family’s values and legacy endure. *Many Northern Virginia affluent families utilize these wealth strategies.

Table of Contents

Estate Planning Trust Guide for High-Net-Worth Families | Protect Wealth & Legacy

High-net-worth families face unique challenges when planning their estates: minimizing estate taxes, protecting wealth from creditors, ensuring a smooth transfer of wealth, and preserving the family legacy.

The right mix of trusts and “estate architecture” can help achieve these goals. Below is a guide to the most important types of trusts to consider.

Core Estate Planning Trusts

These trusts form the foundation of a solid estate plan. A Revocable Living Trust avoids probate and keeps family matters private. An ILIT removes life insurance from the taxable estate while providing liquidity. Credit Shelter Trusts preserve tax exemptions between spouses, and QTIP Trusts let you care for a surviving spouse while controlling how wealth eventually reaches children.

[Image of Revocable Living Trust diagram]

- Revocable Living Trust (RLT)

The foundation of most estate plans. Avoids probate, consolidates assets, maintains privacy, and ensures a smoother transfer of wealth. - Irrevocable Life Insurance Trust (ILIT)

Removes life insurance proceeds from the taxable estate while providing immediate liquidity to pay estate taxes or support heirs. - Credit Shelter / Bypass Trust

Preserves the estate tax exemption of the first spouse to die, effectively doubling the couple’s tax shelter and reducing overall estate tax exposure. - QTIP (Qualified Terminable Interest Property) Trust

Provides income to a surviving spouse for life while giving the grantor control over how assets are eventually distributed to children.

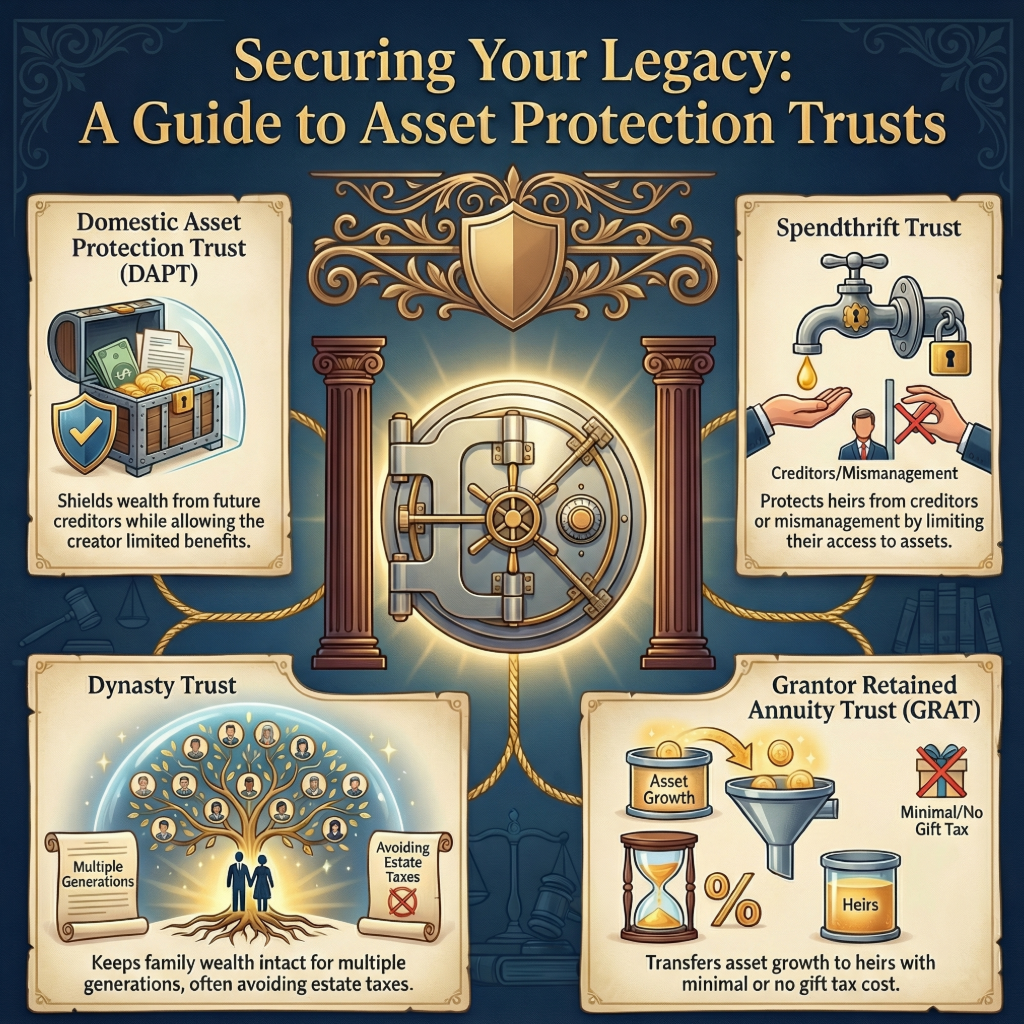

Asset Protection & Wealth Preservation.

This section focuses on shielding family wealth from creditors, lawsuits, and poor financial habits. DAPTs and Spendthrift Trusts provide legal protection, while Dynasty Trusts extend that protection for future generations. The GRAT is highlighted as a powerful way to shift asset growth to heirs at minimal tax cost.

- Domestic Asset Protection Trust (DAPT)

Shields wealth from future creditors while allowing the grantor limited benefits, depending on state law. - Spendthrift Trust

Protects heirs from financial mismanagement or creditors by limiting direct access to trust assets. - Dynasty Trust

Designed to last for multiple generations, keeping family wealth intact, and often used in states with favorable perpetuity laws. - Grantor Retained Annuity Trust (GRAT)

Transfers appreciation of assets to heirs at little or no gift tax cost, making it especially useful for rapidly growing investments.

Business & Investment Planning

For families with significant business interests or complex investments, these trusts ensure smooth succession and tax efficiency. An FLP combined with a trust centralizes management and provides valuation benefits. An IDGT freezes estate value while transferring future growth outside the estate. A CLAT blends philanthropy and tax savings by benefiting charity first, then heirs.

- Family Limited Partnership (FLP) with a Trust

Combines a family partnership structure with a trust to centralize management of family businesses, apply valuation discounts, and ensure smooth succession. - Intentionally Defective Grantor Trust (IDGT)

A powerful wealth transfer strategy that “freezes” the estate’s value by selling appreciating assets to the trust, shifting future growth outside the taxable estate. - Charitable Lead Annuity Trust (CLAT)

Provides annual income to charity for a set period, with remaining assets passing to heirs—reducing estate and gift taxes.

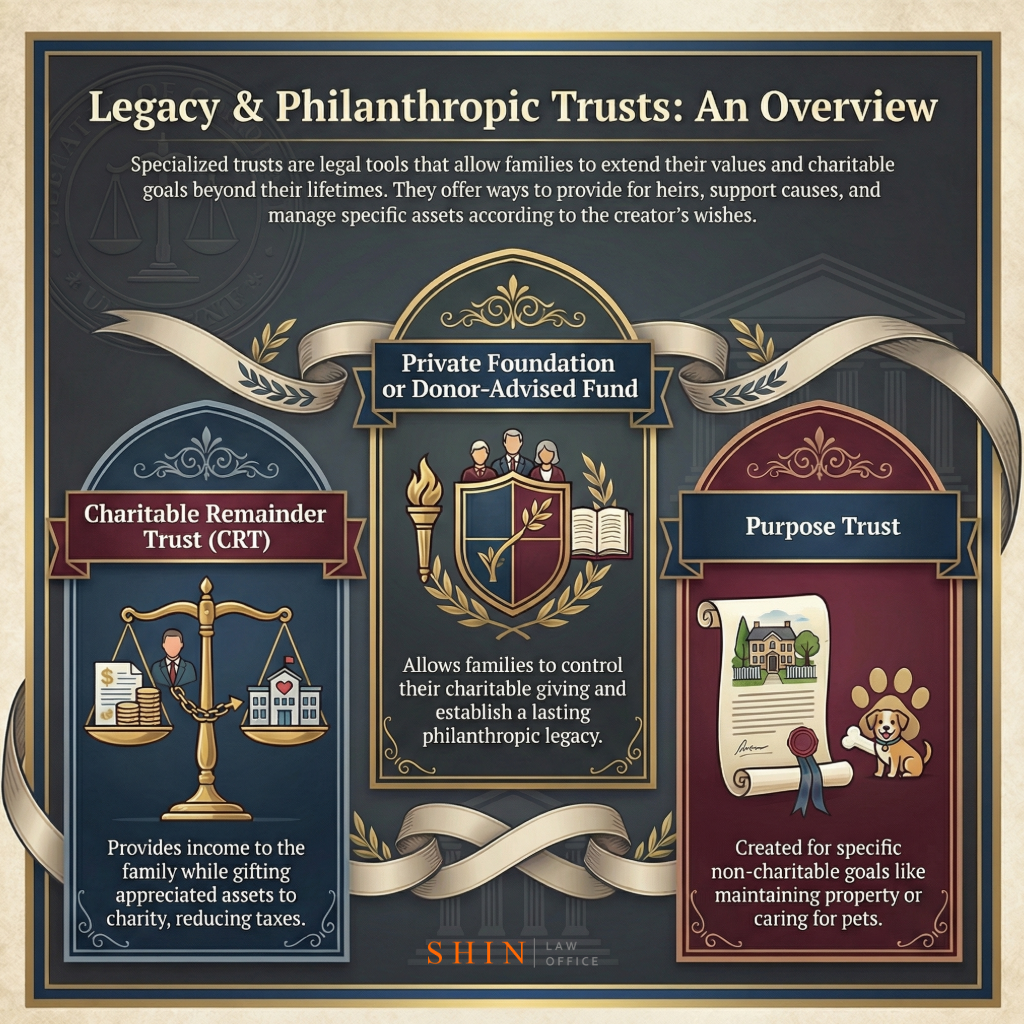

Philanthropic & Legacy Trusts

These tools extend family values and charitable goals beyond a single lifetime. A CRT provides income to the family while leaving a remainder to charity. A Private Foundation or Donor-Advised Fund paired with a trust allows families to shape long-term giving. A Purpose Trust is a unique tool for maintaining property, collections, or even pet care.

- Charitable Remainder Trust (CRT)

Pays income to the grantor or family during life, with the remainder passing to charity. Often used to gift appreciated assets while reducing capital gains tax. - Private Foundation or Donor-Advised Fund (paired with a trust)

Allows families to control their charitable giving and establish a lasting philanthropic legacy. - Purpose Trust

Created for long-term, non-charitable purposes such as maintaining a family estate, preserving artwork, or even caring for pets.

Specialized Planning Trusts

This section covers highly targeted strategies. A QPRT helps pass down a family home at a reduced tax cost. Special Needs Trusts protect disabled heirs while preserving benefits. Offshore Trusts offer maximum asset protection for ultra-high-net-worth families. An Education Trust secures future academic opportunities for generations.

- Qualified Personal Residence Trust (QPRT)

Transfers a home out of the estate at a reduced tax cost while allowing continued use of the residence for a set number of years. - Special Needs Trust (SNT)

Provides financial support for heirs with disabilities without jeopardizing eligibility for government benefits. - Offshore Asset Protection Trust

Offers maximum protection for ultra-high-net-worth families by placing assets in favorable foreign jurisdictions. - Education Trust

Specifically earmarked to fund future generations’ education, ensuring long-term educational support in a tax-efficient way.

Putting It All Together: The Estate Architecture

No single trust solves everything. High-net-worth families typically layer these trusts together: a living trust for probate avoidance, a credit shelter or GRAT for tax reduction, a DAPT for protection, and a CRT or CLAT for philanthropy. This combination creates a complete framework for protecting wealth, supporting heirs, and preserving the legacy.

High-net-worth families rarely rely on just one trust. Instead, they layer multiple trusts together:

- A Revocable Living Trust to avoid probate and centralize estate management.

- A Credit Shelter Trust and a GRAT to reduce estate and gift taxes.

- A DAPT or Spendthrift Trust to protect assets from creditors and ensure heirs don’t mismanage wealth.

- A CRT or CLAT to balance philanthropy with family wealth transfer.

- A QPRT or Education Trust for specialized planning needs.

By combining these tools, families can reduce taxes, shield wealth, preserve their legacy, and ensure a smooth transfer of assets for generations to come.

Additional FAQs on Trusts

How does a trust reduce federal estate taxes?

When I help high-net-worth families in Northern Virginia plan their estates, one of the first strategies we look at is how to reduce federal estate tax exposure. A trust can lower your taxable estate by moving assets out of your personal ownership and into a separate legal entity. Once assets are in an irrevocable trust, they are not counted as part of your estate when calculating federal estate tax at your death. This means the value that could be subject to the federal estate tax threshold is smaller, and more wealth can pass to your heirs tax-free. Trusts can also be structured to use exemptions and generation-skipping techniques so assets avoid transfer taxes as they move across generations. This approach gives wealthy families greater control and potentially significant tax savings compared to passing assets outright at death.

What trust should I use for creditor protection?

For creditor protection, I often recommend trusts designed to shield family assets from future claims. One powerful option, when available under state law, is a Domestic Asset Protection Trust (DAPT), which can protect trust assets from future creditors while still allowing you certain benefits under specific conditions. Another strong tool is a Spendthrift Trust, which keeps beneficiaries (and their creditors) from having direct access to trust assets until distributions are made. Both of these trust types help keep wealth safe from unexpected lawsuits, judgments, or beneficiaries’ financial missteps. These protections are especially valuable for families with significant business interests or complex financial exposures in high-risk sectors.

Which trust offers multi-generational protection?

When I talk with families in Northern Virginia who want to preserve wealth for grandchildren and beyond, the trust most suited for that purpose is a Dynasty Trust (also known as a generation-skipping trust). A Dynasty Trust is structured to last for many generations, allowing the assets to grow free from estate taxes at each generational transfer. That means instead of paying estate taxes every time wealth passes from parent to child to grandchild, the Dynasty Trust lets those assets remain outside of individual taxable estates while still providing for future beneficiaries. That kind of planning helps ensure lasting financial security and legacy continuity for your family without repeated tax erosion.

What is a Revocable Living Trust, and why might I need one?

A Revocable Living Trust lets me place my assets into a trust that I control during my lifetime. It helps avoid probate, keeps my family’s financial affairs private, and allows for smoother management of assets if I become incapacitated. Because it’s revocable, I can change or cancel it while I’m alive. This flexibility helps wealthy families transition wealth without the delays and publicity that come with a court-supervised probate process.

How does an Irrevocable Life Insurance Trust (ILIT) help with estate planning?

An Irrevocable Life Insurance Trust removes life insurance proceeds from my taxable estate. That means the death benefit my family receives isn’t counted for federal estate tax purposes, which can significantly reduce the overall tax burden on a large estate. An ILIT can also provide liquidity to pay estate taxes or support heirs without burdening my other assets.

What is a Credit Shelter Trust, and how does it affect married couples?

A Credit Shelter Trust (also called a bypass trust) allows me to use my federal estate tax exemption fully and preserve it for my family. When the first spouse dies, assets go into the trust up to the exemption amount, keeping them out of both spouses’ taxable estates. This strategy helps married couples reduce estate taxes when transferring wealth to children or other heirs.

How do incentive trusts work, and when might they be useful?

An Incentive Trust distributes assets to beneficiaries only after they meet specific conditions, such as graduating from college, entering a profession, or achieving personal goals. These trust terms let me encourage responsible behavior while protecting the wealth I’ve built for future generations.

Should I use lifetime gifting strategies with my trusts?

Yes. Making lifetime gifts to heirs or into trusts can reduce the size of my taxable estate and help avoid bigger estate tax liabilities later. Strategic lifetime gifting, combined with certain trusts such as GRATs, helps transfer wealth efficiently and allows beneficiaries to benefit from growth while keeping tax exposure lower.

What role does choosing the right trustee play in trust planning?

Picking the right trustee is crucial: this person or institution manages and distributes trust assets according to my instructions. A knowledgeable trustee protects the trust’s legal and tax benefits and ensures compliance with the terms I set. Whether it’s a trusted family member, professional fiduciary, or corporate trustee, the choice affects how well the trust operates for my heirs.

How often should I review my estate plan and trusts?

Estate planning isn’t “set and forget.” I should review my trusts and overall plan whenever there are significant life changes (like births, deaths, marriages, divorces) or tax law updates that could affect my strategy. This ensures my trust structure continues to align with my goals and with current federal and Virginia laws. Regular reviews help maintain tax efficiency and protect my family’s wealth for long-term benefit.

Key Virginia Statutes & Resources

1. Virginia Uniform Trust Code (Title 64.2, Chapter 7, Code of Virginia)

This is the primary body of trust law in Virginia governing the creation, administration, modification, and interpretation of trusts. It includes general trust principles and rules about fiduciary duties, spendthrift provisions, creditor claims, and trust termination. Key sections include:

- Article 5 Creditor’s Claims; Spendthrift and Discretionary Trusts – Defines how creditor claims against trust interests operate, including spendthrift provisions and protections. (Virginia Law)

- Article 6 Revocable Trusts – Rules for creating, revoking, amending, and administering revocable trusts in Virginia. (Virginia Law)

- Self-Settled Spendthrift Trusts (DAPT Equivalent) – Section § 64.2-745.1 allows for qualified self-settled spendthrift trusts, a form of Domestic Asset Protection Trust (DAPT) in Virginia, to protect assets from specific creditor claims while allowing limited benefits to the settlor. (Virginia Law)

These statutes form the core legal framework for trust planning and asset protection under Virginia law.

2. Definitions Related to Trust Interests

§ 64.2-1632 Estates, Trusts, and Other Beneficial Interests

This statute clarifies what constitutes an “estate, trust, or other beneficial interest” for purposes of powers of attorney and fiduciary authority, including trusts held for beneficiaries. It’s relevant when agents under a power of attorney are involved in fiduciary matters involving trust assets. (Virginia Law)

3. Self-Settled Trusts and Asset Protection (DAPT)

Self-Settled Spendthrift Trust Statutes (Virginia Code § 64.2-745.1)

Virginia permits self-settled spendthrift trusts (the state’s version of a Domestic Asset Protection Trust) for asset protection planning. There are conditions about insolvency, independent trustees, and the timing of transfers to ensure protection from creditor claims. (Virginia Law)

This allows wealthy families to hold assets in a trust that they (or family members) benefit from while still safeguarding those assets from future creditors under specified conditions.

4. Creditor Protection and Spendthrift Provisions

Spendthrift Provisions (General Trust Code)

Virginia’s trust code recognizes spendthrift provisions that limit a beneficiary’s ability to transfer their interest and protect those trust assets from attachment by creditors until distribution. (Virginia Law)

A spendthrift trust is one in which the trust contains language preventing beneficiaries (and their creditors) from accessing or compelling distribution until the trustee decides.

5. Trust Administered Income Tax Rules

Virginia Fiduciary Income Tax Rules

Estates and trusts in Virginia have specific tax filing and payment requirements under state law, including the due dates for estimated payments of fiduciary income tax. These rules apply to trusts administered in the Commonwealth and affect planning for high-net-worth families with complex trust structures. (Virginia Tax)

6. Federal Trust Interactions (Internal Revenue Code)

Although not a Virginia statute, many trust types (such as QTIP trusts for marital and estate tax planning) are governed by the Internal Revenue Code (e.g., IRC Section 2056 for QTIP treatment). Virginia courts and practitioners apply state trust law while considering federal tax effects for estate tax planning. (Wikipedia)

Relevant Legal Entities in Virginia Estate Planning

1. Trustee

A trustee is the fiduciary entity (individual or institution) that manages trust assets for the benefit of the beneficiaries. Virginia’s Uniform Trust Code outlines duties and standards for trustees. (Virginia Law)

2. Settlor / Grantor

The person who creates the trust under Virginia trust law and transfers assets into it. The terms “settlor” and “grantor” are often used interchangeably in trust planning contexts. (nvepc.org)

3. Beneficiaries

Individuals or entities entitled to benefit from a trust. Spendthrift provisions directly affect how and when beneficiaries receive trust distributions. (Virginia Law)

4. Independent Qualified Trustee (for DAPT)

In a Virginia self-settled spendthrift trust (DAPT), an independent qualified trustee must be designated to administer the trust and exercise discretion over distributions to ensure asset protection qualifies under the statute. (Arlington Law Group)

5. Conservator or Guardian

Under certain circumstances (such as incapacity), a court-appointed conservator may exercise powers relating to trust revocation or asset transfers, but usually with court approval. (Virginia Law)

Other Legal Considerations

- Rule Against Perpetuities and Dynasty Trusts: Although Virginia generally allows long-term trust planning, federal generation-skipping transfer tax rules (GST tax) often interact with state law for dynasty planning. Regulations beyond Virginia statutes may affect the duration of the trust and its tax treatment. (Wikipedia)

- Tax Residency for Trusts: Virginia changed how trust residency is determined for state tax purposes, which affects whether a trust administered in Virginia is subject to Virginia state income tax. (DC Tax Law Attorney)

Resource Summary

For wealthy families in Northern Virginia planning complex trusts, the Virginia Uniform Trust Code (Title 64.2) is foundational, covering revocable and irrevocable trusts, spendthrift protections, and creditor claims. Self-settled spendthrift trust statutes (DAPT structures) provide asset protection tools, but must be carefully planned to meet statutory criteria. Trust income tax rules and federal tax codes also play an essential role in implementing effective estate planning strategies.

Adam L. Engel, Esq.

Attorney | Shin Law Office

Call 571-445-6565 or book a consultation online today.