BOTTOM LINE UP FRONT (BLUF)

The Core Reality: For Virginia’s business leaders, government contractors, and high-net-worth families, wealth accumulation is only half the battle. Without active legal intervention, the default laws of the Commonwealth (Title 64.2) will dismantle what you have built through public probate, unnecessary taxation, and family fragmentation.

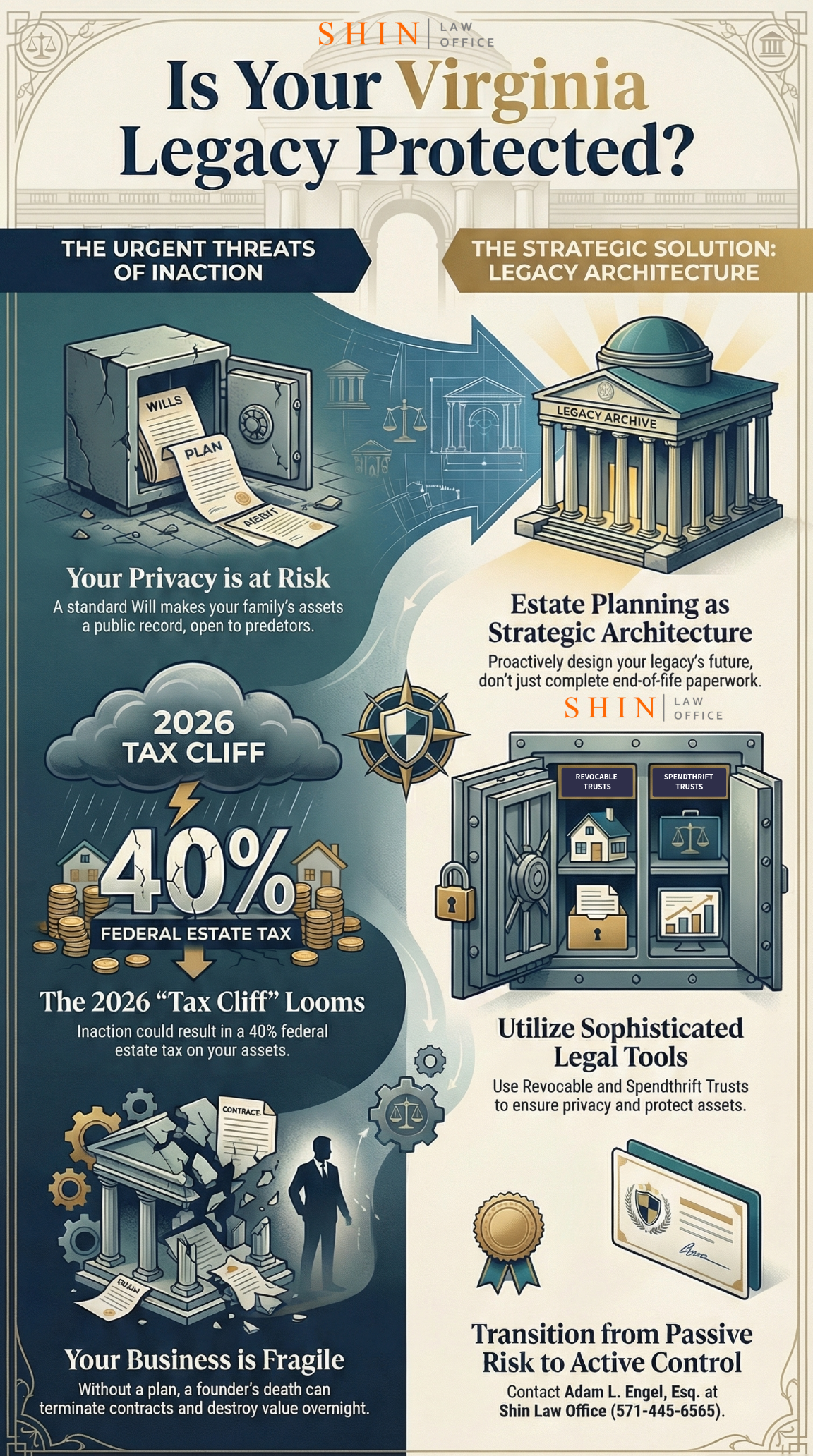

The Urgent Threats:

- Privacy is a Casualty: Relying on a Will ensures your asset inventory becomes public record, exposing beneficiaries in Great Falls, Roanoke, and Virginia Beach to creditors and “probate predators.”

- The 2026 Tax Cliff: The federal estate tax exemption is scheduled to be cut in half at the end of 2025. Inaction now could result in a 40% confiscatory tax on your legacy.

- Business Fragility: For Government Contractors and tech executives, the death of a founder without a specific succession plan (and security clearance contingency) can trigger contract termination and immediate value destruction.

The Strategic Solution: Estate planning is not merely end-of-life paperwork; it is legacy architecture. By utilizing Virginia’s sophisticated legal tools—specifically the Revocable Living Trust (RLT) for privacy and the Qualified Self-Settled Spendthrift Trust (QSSST) for asset protection—you can decouple your family’s financial security from business risks and market volatility.

The Bottom Line: Your wealth requires the same level of strategic management as the business that created it. This report outlines the specific legal mechanisms required to secure your assets, minimize your tax burden, and ensure your legacy survives the friction of generational transition.

Immediate Action Required: Do not leave your life’s work to the interpretation of a rigid statutory code. Contact Adam L. Engel, Esq. at Shin Law Office (571-445-6565) to transition from passive risk to active control.

This report demonstrates that for the tech executives of McLean, the government contractors of Alexandria, and the business leaders of Virginia Beach and Roanoke, estate planning is not a passive end-of-life task but an active component of wealth management. It is the legal architecture that ensures a legacy survives the friction of taxation, litigation, and generational transition. The following analysis details the specific legal tools and strategies required to protect Virginia’s diverse forms of wealth, from real estate and intellectual property to federal contracts and digital assets, arguing that professional legal counsel is indispensable for securing both financial assets and family harmony.

Table of Contents

- Chapter 1: The Virginia Legal Landscape and the Risks of Inaction

- Chapter 2: The Revocable Living Trust: The Engine of Privacy and Efficiency

- Chapter 3: Advanced Asset Protection: The Virginia Self-Settled Spendthrift Trust

- Chapter 4: Business Succession Planning: Securing the Virginia Enterprise

- Chapter 5: Estate Tax Minimization and Wealth Transfer Strategies

- Chapter 6: Industry-Specific Planning: Government Contractors and Technology Executives

- Chapter 7: Regional Wealth Profiles: Hampton Roads, Roanoke, and the Southwest

- Chapter 8: Protecting the Vulnerable and the Legacy: Guardianships and Special Needs

- Chapter 9: Niche Asset Strategies: Digital Assets, Firearms, and Companion Animals

- Chapter 10: Philanthropic Strategy: Land Preservation and Tax Credits

- Appendix A: Research Methodology and Analytical Framework

- Works Cited: References

Chapter 1: The Virginia Legal Landscape and the Risks of Inaction

1.1 The Default Framework: Intestacy and Its Perils

In the Commonwealth of Virginia, the absence of a valid estate plan constitutes tacit acceptance of the state’s default rules. Codified in Title 64.2 of the Code of Virginia, these laws of intestate succession are designed to approximate the intent of the average decedent. However, the financial lives of wealthy individuals and business owners are rarely “average,” rendering these defaults not just insufficient but actively harmful.

The statutory distribution scheme is rigid. If a decedent dies without a will, their assets are distributed according to a fixed hierarchy of heirs. In a nuclear family in which all children are the surviving spouse’s biological descendants, the spouse inherits the entire estate. While this appears straightforward, it fails to account for the nuanced tax planning often required for high-net-worth couples to utilize their full federal estate tax exemptions. The “portability” of the deceased spousal unused exclusion amount (DSUE) is not automatic; it requires filing a timely estate tax return, a procedural step often overlooked amid the chaos of an intestate administration.

The situation becomes significantly more perilous for blended families—a demographic reality for many clients in Loudoun and Fairfax Counties. Under Virginia Code § 64.2-200, if a spouse and children survive a decedent from a prior relationship, the surviving spouse receives only one-third of the estate. The remaining two-thirds pass directly to the decedent’s children. For a business owner, this statutory fracture can be devastating. Imagine the owner of a thriving government contracting firm in Alexandria who passes away unexpectedly. If the business interest is a probate asset, ownership is split between a spouse who may rely on the business income for support and adult children from a previous marriage who may harbor resentment or lack business acumen. This division creates an immediate deadlock in corporate governance, potentially triggering change-of-control clauses in contracts or the revocation of security clearances, thereby destroying the asset’s value before it can be transferred.

1.2 The Public Nature of Probate in Virginia

Probate is the court-supervised legal process of validating a will, inventorying assets, paying debts, and distributing the remainder to beneficiaries. In Virginia, this process is administered by the Clerk of the Circuit Court and overseen by a Commissioner of Accounts. While the probate system provides a necessary forum for resolving disputes, its defining characteristic is transparency—a trait that is antithetical to the privacy needs of wealthy families.

Upon qualification of a personal representative, an inventory of the decedent’s assets must be filed with the Commissioner of Accounts. This document lists every bank account, brokerage holding, real estate parcel, and business interest owned solely by the decedent, along with their values. This inventory becomes a public record. For residents of affluent enclaves like Great Falls or The Waters Edge in Penhook, this exposure invites scrutiny from creditors, predators, and the media. A “probate predator” can easily identify cash-rich beneficiaries or locate valuable tangible personal property.

Furthermore, the probate process is administratively burdensome and costly. The Commissioner of Accounts is entitled to statutory fees based on the value of the estate, and the personal representative is entitled to reasonable compensation. Combined with court costs and the potential for surety bond premiums—which are required unless waived by a valid will—these expenses can erode a significant portion of the estate’s liquidity. The timeline for probate in jurisdictions like Fairfax or Virginia Beach can stretch for 12 to 18 months or longer, delaying the distribution of assets to heirs who may need them for education or maintenance.

1.3 The Fiduciary Standard and the Prudent Investor Rule

Virginia law imposes high standards of conduct on fiduciaries, including executors and trustees. The “Prudent Investor Rule,” adopted under the Uniform Prudent Investor Act, generally requires a fiduciary to diversify investments to minimize risk. While sound in theory for a general portfolio, this rule can threaten the integrity of a family legacy built on concentrated assets.

Consider a client in Roanoke whose wealth is tied entirely to a multi-generational family farm or a specialized medical practice. A strict interpretation of the Prudent Investor Rule might compel a court-appointed administrator to liquidate these assets to “de-risk” the portfolio, effectively dismantling the family’s primary source of wealth and identity. An expertly drafted estate plan can override these default duties, granting the fiduciary specific authority to retain concentrated positions, operate a closely held business, or hold non-income-producing assets like raw land for conservation purposes. Without such specific authorization, a trustee operates under the constant threat of surcharge liability for failing to diversify, incentivizing them to sell the very assets the grantor wished to preserve.

1.4 The Augmented Estate: Protecting Against Disinheritance

Virginia law provides robust protection against spousal disinheritance through the concept of the “augmented estate” (Virginia Code § 64.2-308.4). This statute allows a surviving spouse to claim a portion of the decedent’s estate regardless of the terms of the will, calculated based on the length of the marriage. The augmented estate includes not only probate assets but also certain non-probate transfers, such as gifts made shortly before death or assets held in revocable trusts.

For high-net-worth individuals entering second marriages, particularly those with established wealth or children from prior relationships, this statutory right presents a significant planning challenge. A client may wish to leave the bulk of their estate to a charitable foundation or to their biological children, providing only a modest stipend to a new spouse. Without a premarital agreement or a carefully structured estate plan that includes waivers of the elective share, the surviving spouse can disrupt the entire distribution scheme by claiming their statutory share. This legal reality underscores the necessity of integrating marital agreements with estate planning documents to ensure that the client’s intent is honored and that asset distribution is predictable.

Chapter 2: The Revocable Living Trust: The Engine of Privacy and Efficiency

2.1 The Strategic Core of Modern Wealth Management

The Revocable Living Trust (RLT) has emerged as the central “operating system” for high-net-worth estate planning in Virginia. Unlike a Last Will and Testament, which is a dormant document that only becomes effective upon death and requires court intervention to activate, an RLT is a living contract effective immediately upon execution. It creates a separate legal entity capable of holding title to assets, managed by a Trustee for the benefit of beneficiaries.

At Shin Law Office, we advise clients that the RLT is not merely a tool for post-mortem distribution but a vehicle for active wealth management. It consolidates diverse assets—real estate, investment accounts, business interests—under a single governance structure that persists through the Grantor’s life, incapacity, and death. This continuity is vital for business owners and executives whose financial lives are complex and interconnected.

2.2 Mechanism of Probate Avoidance

The primary functional advantage of the RLT is the total avoidance of the probate process. Because assets titled in the name of the trust are legally owned by the Trustee rather than the individual decedent, they are not part of the “probate estate” subject to the jurisdiction of the Circuit Court.

This benefit is particularly acute for real estate owners. If a client in Loudoun County owns a primary residence, a vacation home in Virginia Beach, and a mountain cabin in Nelson County, relying on a Will would require “ancillary probate” proceedings in each jurisdiction where property is located. This multiplies court costs, legal fees, and administrative delays. By transferring title of all these properties into the Virginia RLT, the estate is administered centrally and privately, bypassing the multi-jurisdictional bureaucracy entirely. The transfer of real estate into the trust is generally exempt from recordation taxes under Virginia law, making the funding process cost-effective.

2.3 Incapacity Planning: The “Living” Aspect

The “Living” in Revocable Living Trust refers to its crucial function during the Grantor’s lifetime. High-net-worth individuals face the statistical reality that a period of incapacity often precedes death. If a business owner in Fairfax becomes incapacitated due to a stroke or dementia, the RLT provides a seamless transition of control that a Power of Attorney cannot match.

A Power of Attorney is an agency relationship that terminates at death and can be rejected by financial institutions if it is deemed “stale” or lacks specific language. In contrast, a Successor Trustee operates as the legal owner of the trust assets. They can step in immediately to pay bills, manage investments, and vote business shares without seeking court approval. This avoids the nightmare scenario of a court-appointed Conservatorship—a public, humiliating, and expensive legal proceeding where a judge determines incapacity and appoints a guardian to manage the estate under strict court supervision. For a private family, a public declaration of incompetence is a reputational risk that an RLT effectively mitigates.

2.4 Privacy and the High-Profile Client

For high-profile clients—politicians in Northern Virginia, C-suite executives at major regional employers like Huntington Ingalls or Carilion Clinic, or professional athletes—privacy is a non-negotiable asset. A Will becomes a public document the moment it is submitted to probate. Journalists, data aggregators, and curious neighbors can access the distribution scheme, the names and addresses of beneficiaries, and the inventory of assets.

An RLT acts as a privacy shield. It is a private contract that is generally not filed with any court. The nature of the assets, the identity of the beneficiaries, and the terms of the distribution remain confidential. This opacity protects beneficiaries from solicitation by financial advisors, charities, and fraudsters. For families residing in exclusive neighborhoods like McLean or Middleburg, keeping the details of intergenerational wealth transfer private is a primary security measure.

2.5 Flexibility and Control: The “Dead Hand”

Virginia’s trust laws allow for extraordinary flexibility in drafting distribution terms. A Grantor can exercise “dead hand control,” dictating the terms of inheritance long after their passing. Instead of an outright distribution—which can be dangerous for young or financially immature heirs—an RLT can structure distributions based on behavior, age, or need.

Trust Design Options:

- Incentive Trusts: Provisions that match distributions to the beneficiary’s earned income (e.g., “The Trustee shall distribute $1 for every $1 the beneficiary earns”), encouraging productivity and discouraging reliance on trust funds.

- Milestone Distributions: Releasing portions of the principal at ages 25, 30, and 35, allowing beneficiaries to learn from financial mistakes with smaller amounts before receiving the bulk of their inheritance.

- Spendthrift Provisions: These clauses prevent a beneficiary from pledging their interest in the trust to a creditor. If a beneficiary is sued or files for bankruptcy, the assets remaining in the trust are generally protected from seizure because the beneficiary has no legal right to demand a distribution.

This level of granular control ensures that the wealth empowers the next generation rather than creating “affluenza,” preserving both the financial capital and the human capital of the family.

Chapter 3: Advanced Asset Protection: The Virginia Self-Settled Spendthrift Trust

3.1 The Evolution of Virginia Trust Law

For decades, the bedrock principle of American trust law was that an individual could not create a trust for their own benefit and simultaneously shield those assets from their own creditors. This changed in Virginia with the adoption of legislation authorizing the “Qualified Self-Settled Spendthrift Trust” (QSSST), commonly known as a Domestic Asset Protection Trust (DAPT). This legislative evolution, codified in Virginia Code § 64.2-745.1, places Virginia among a select group of states offering top-tier asset protection vehicles.

For wealthy professionals in high-liability fields—neurosurgeons in Roanoke, architects in Charlottesville, or real estate developers in Virginia Beach—the QSSST is a critical defensive tool. It allows a Grantor to transfer assets into an irrevocable trust, remain a discretionary beneficiary eligible to receive distributions, and yet legally separate those assets from the reach of future unknown creditors.

3.2 Statutory Requirements for a Valid Virginia QSSST

The protection afforded by a QSSST is not automatic; it requires strict adherence to the statutory requirements outlined in Virginia Code § 64.2-745.2. A failure to comply with these formalities can render the trust “voidable” by creditors. The essential elements include:

- Irrevocability: The trust must be irrevocable. The Grantor cannot retain the power to amend or revoke the trust unilaterally to reclaim the assets.

- Independent Qualified Trustee: At least one trustee must be a Virginia resident or a corporation authorized to engage in trust business in Virginia. Crucially, this trustee must be “independent”—meaning they cannot be related or subordinate to the Grantor. Only this independent trustee can have the authority to make discretionary distributions to the Grantor.

- Discretionary Interest: The Grantor’s interest must be purely discretionary. The Grantor cannot have a mandatory right to income or principal; they can only receive what the independent trustee decides to distribute. This legal separation is what creates the asset protection.

- Solvency Affidavit: At the time of funding, the Grantor must execute a qualified affidavit stating that the transfer will not render them insolvent and is not intended to defraud any specific known creditor.

- Look-Back Period: Virginia law imposes a five-year statute of limitations on transfers to a QSSST. Existing creditors at the time of the transfer have five years to challenge the transfer as fraudulent. After this period, the assets are generally secure from all future creditor claims.

3.3 Strategic Applications for Business Owners

For the Virginia business owner, a QSSST functions as a catastrophic insurance policy that sits above commercial liability coverage. Business risks are inherently unpredictable; a single lawsuit or economic downturn can exceed insurance limits and threaten personal assets.

By moving a portion of “rainy day” liquidity, investment portfolios, or non-business real estate into a QSSST during profitable years, a business owner effectively creates a “lockbox” that is decoupled from business risk. For example, a developer in Hampton Roads facing a market correction and subsequent loan defaults would find that the assets seasoned in their QSSST for over five years are likely beyond the reach of lenders seeking deficiency judgments. This ensures that the family’s core lifestyle and financial security remain intact even if the business enterprise fails.

3.4 Limitations and Exclusions

While powerful, the Virginia QSSST is not a shield against all obligations. The statute specifically creates public policy exceptions. Assets in a QSSST are not protected from:

- Child support obligations.

- Alimony or spousal support orders.

- Pre-existing torts or debts known at the time of funding.

- Federal tax liens.

Additionally, the QSSST is typically structured as a “Grantor Trust” for income tax purposes. This means the Grantor continues to pay income tax on the trust’s earnings, even if those earnings are not distributed. While this may seem like a disadvantage, it is a powerful estate planning benefit: the Grantor’s payment of the tax effectively allows the trust assets to grow tax-free, while reducing the Grantor’s taxable estate by the amount of the tax paid—a tax-free gift to the trust’s ultimate beneficiaries.

3.5 Comparison to Other Jurisdictions

Virginia’s DAPT statute is generally considered more conservative than those of “aggressive” jurisdictions like Nevada or Delaware, particularly regarding the five-year look-back period (which is shorter in some other states). However, for a Virginia resident, utilizing a Virginia-situs trust offers significant “home court advantage.” Creating a trust in a distant jurisdiction with no genuine connection to the assets or the Grantor can be challenged in court as a sham. By using Virginia law, supervised by Virginia courts and managed by a Virginia trustee, the structure is more robust against conflict-of-law challenges, providing greater predictability and stability for Shin Law Office clients.

Chapter 4: Business Succession Planning: Securing the Virginia Enterprise

4.1 The Intersection of Corporate and Estate Law

For the thousands of privately held companies driving Virginia’s economy—from the technology startups in the Dulles Corridor to the maritime contractors in Norfolk—business succession planning is the most critical, yet often neglected, component of estate planning. It is essentially “estate planning for the commercial entity.” The death or incapacity of a founder represents a singular point of failure that can destroy the value of a business overnight.

Effective succession planning requires a synthesis of estate law and corporate law. It involves integrating the personal estate plan (Wills and Trusts) with the business’s governing documents (Operating Agreements, Bylaws, Shareholder Agreements) to ensure a seamless transition of both management control and economic value.

4.2 The Buy-Sell Agreement: Controlling the Exit

The Buy-Sell Agreement is the foundational document of business succession. It functions as a pre-nuptial agreement for business partners, dictating exactly what happens to an owner’s shares upon specific triggering events: death, disability, divorce, retirement, or bankruptcy.

Without a robust Buy-Sell Agreement, shares in a closely held business will pass according to the decedent’s will or intestacy laws. This often results in shares passing to a spouse who has no interest or expertise in the business, or to children who may actively conflict with the surviving partners. This scenario creates paralysis in decision-making and can devalue the company.

Key Buy-Sell Mechanisms:

- Right of First Refusal: Prevents shares from being sold to unknown third parties, ensuring the remaining partners retain control over who enters the partnership.

- Mandatory Buyout: Obligates the estate to sell, and the company (or surviving partners) to buy, the deceased owner’s interest. This provides immediate liquidity to the estate and consolidates ownership for the survivors.

- Valuation Formula: One of the most litigated areas in probate is the value of a private business. A Buy-Sell Agreement should establish a clear method for valuation—such as a fixed price updated annually, a multiple of EBITDA, or a formula based on book value—to avoid costly appraisals and disputes during administration.

For government contractors in Alexandria, where ownership may be tied to specific “set-aside” statuses (e.g., Service-Disabled Veteran-Owned Small Business, 8(a)), a Buy-Sell Agreement is mandatory. If shares pass to an ineligible heir, the company can lose its certification and its contracts. The agreement must restrict transfers solely to eligible individuals to preserve the company’s revenue stream.

4.3 Funding the Plan: The Role of Life Insurance

A Buy-Sell Agreement creates a financial obligation, but it does not create the cash to satisfy it. If a partner dies and the business is valued at $10 million, the surviving partners or the company must come up with the cash to buy out the estate. Without liquidity, the business may have to be sold or liquidated to pay off the heirs.

Life insurance is the primary tool for funding these agreements.

- Cross-Purchase Agreements: Each partner buys a policy on the others. Upon a death, the surviving partners receive the death benefit tax-free and use it to purchase the decedent’s shares. This structure provides the survivors with a “step-up” in cost basis for the acquired shares, reducing future capital gains taxes.

- Entity Purchase (Redemption) Agreements: The company itself buys a policy on each owner. Upon death, the company receives the proceeds and redeems the deceased owner’s shares. This is administratively simpler for companies with multiple owners but does not offer the same basis step-up benefits.

4.4 Family Limited Partnerships (FLPs) and Family LLCs

For families wishing to retain a business or a portfolio of investment real estate within the family line, the Family Limited Partnership (FLP) or Family LLC is a powerful structural tool.

Structure:

- General Partner (GP): The senior generation (Parents) holds the GP interest, often representing only 1% of the equity but 100% of the management control.

- Limited Partners (LP): The Parents gift non-voting LP interests to their children or to trusts for their benefit.

Benefits:

- Centralized Control: Parents maintain absolute control over investment decisions, distributions, and business operations, despite having transferred the majority of the economic equity to the next generation.

- Asset Protection: Creditors of a Limited Partner (e.g., a child going through a divorce) generally cannot force a liquidation of the partnership to satisfy a debt. Their remedy is limited to a “charging order,” which entitles them only to distributions if they are made. Because the GP controls distributions, they can withhold funds, giving the creditor a “hollow” victory.

- Valuation Discounts: Because LP interests lack voting rights and cannot be easily sold on an open market, they are valued at a discount (often 20-35%) for gift tax purposes. This allows wealthy families to transfer significantly more value under the gift tax exemption cap.

4.5 The Human Element: Successor Identification and Governance

Legal documents facilitate the transfer of ownership, but they cannot transfer leadership. A comprehensive succession plan must address the human element of identifying and training successors. This is particularly vital for the “blue collar” wealth found in construction and contracting firms in regions like Roanoke or Hampton Roads, where the founder’s personal relationships and technical expertise are the business’s core assets.

We advise clients to establish a “governance board” or “advisory council” within the estate plan. This body, composed of trusted advisors (CPAs, attorneys, industry peers), serves to mentor a young or inexperienced heir who inherits a controlling interest. This interim governance structure bridges the gap between the founder’s sudden absence and the heir’s readiness to lead, ensuring business continuity.

Chapter 5: Estate Tax Minimization and Wealth Transfer Strategies

5.1 The Tax Reality for Virginia Residents

While Virginia does not currently impose a state-level estate tax, having repealed it to remain competitive for wealthy retirees, the federal estate tax remains a significant threat. As of 2025, the federal exemption stands at $13.99 million per individual. However, this high exemption is a temporary provision of the Tax Cuts and Jobs Act and is scheduled to “sunset” at the end of 2025, reverting to approximately half that amount (adjusted for inflation) unless Congress acts.

For affluent families in Northern Virginia, where residential real estate values and business valuations are exceptionally high, an estate exceeding $6-7 million is common. Without strategic planning, estates exceeding the exemption are taxed at a confiscatory rate of 40%. This creates a “use it or lose it” urgency for implementing advanced wealth transfer strategies before the law changes.

5.2 The Credit Shelter Trust (Bypass Trust) Strategy

For married couples, the primary objective is to fully utilize both spouses’ estate tax exemptions. While “portability” allows a surviving spouse to use the deceased spouse’s unused exemption, relying solely on portability has a flaw: it does not shelter the appreciation of the decedent’s assets from estate tax in the survivor’s estate.

The “Credit Shelter Trust” (CST) solves this. Upon the first spouse’s death, an amount equal to their unused exemption is funded into the CST.

- Benefit: These assets, and crucially all future appreciation on them, are permanently removed from the survivor’s taxable estate. If the assets in the CST double in value during the survivor’s remaining lifetime, that growth passes to the heirs estate-tax-free.

- Access: The surviving spouse is not cut off; they can serve as Trustee and receive income and principal for their health, education, maintenance, and support (HEMS). This strategy balances tax efficiency with spousal security and is a standard recommendation for couples in McLean or Virginia Beach with net worths approaching the exemption limits.

5.3 Irrevocable Life Insurance Trusts (ILITs)

A common misconception is that life insurance proceeds are tax-free. While the death benefit is generally free of income tax, it is fully includable in the taxable estate of the insured if they possess “incidents of ownership” over the policy. For a client with a $5 million term policy, this inclusion could trigger a $2 million estate tax liability.

The Irrevocable Life Insurance Trust (ILIT) is the solution. By establishing a trust to own the policy, the death benefit is removed from the insured’s estate.

- Mechanism: The Grantor makes annual cash gifts to the trust to cover premiums. These gifts utilize the annual gift tax exclusion (using “Crummey” withdrawal notices to beneficiaries to qualify the gifts).

- Result: Upon death, the full insurance proceeds are paid to the trust estate-tax-free. This creates a pool of tax-free liquidity that can be used to pay estate taxes on other illiquid assets, such as a family business or real estate holdings, preventing a forced sale.

5.4 Grantor Retained Annuity Trusts (GRATs)

The GRAT is a sophisticated tool favored by investors and executives expecting significant appreciation in specific assets (e.g., pre-IPO stock or commercial real estate).

- Structure: The Grantor transfers assets into an irrevocable trust for a short term (e.g., 2 years). The trust pays the Grantor an annuity based on the initial value of the assets plus a statutory interest rate (the IRS § 7520 rate).

- The Win: If the assets appreciate faster than the statutory rate (the “hurdle rate”), the excess appreciation passes to the beneficiaries (children) at the end of the term free of gift and estate tax. If the assets underperform, they simply revert to the Grantor. It is a “heads I win, tails I tie” strategy for transferring wealth.

5.5 Intentionally Defective Grantor Trusts (IDGTs)

An IDGT is a trust that is “defective” for income tax purposes (meaning the Grantor pays the income tax on trust earnings) but “effective” for estate tax purposes (assets are removed from the estate).

- Strategy: The Grantor sells income-producing assets to the trust in exchange for a promissory note.

- Benefit: The asset’s growth occurs outside the Grantor’s estate. Furthermore, the Grantor’s payment of the trust’s income tax liability acts as an additional, tax-free gift to the beneficiaries, allowing the trust principal to compound without tax friction. This is arguably the most potent tool for multi-generational wealth transfer for business owners.

5.6 Qualified Personal Residence Trusts (QPRTs)

For clients whose wealth is concentrated in high-value personal real estate—such as a historic estate in Middleburg or a waterfront compound in Virginia Beach—the QPRT offers a way to transfer the home at a discounted value.

- Mechanism: The Grantor transfers the residence to the trust but retains the right to live in it for a fixed term (e.g., 10 or 15 years). The value of the gift for tax purposes is the current value minus the value of the retained usage right.

- Outcome: If the Grantor survives the term, the home passes to the beneficiaries. The Grantor can then rent the home from the trust, further transferring wealth to the heirs income-tax-free (via rental payments) while removing the asset from their taxable estate.

Chapter 6: Industry-Specific Planning: Government Contractors and Technology Executives

6.1 The Unique Wealth Profile of Northern Virginia

The economy of Northern Virginia creates a distinct wealth profile centered on government contracting (GovCon) and the technology sector. Clients in this region hold assets that are legally complex, often tied to federal regulations, security clearances, and volatile equity markets.

6.2 Managing Equity Compensation: RSUs, ISOs, and NSOs

Executives in the Dulles Technology Corridor often receive a substantial portion of their compensation in equity: Restricted Stock Units (RSUs), Incentive Stock Options (ISOs), and Non-Qualified Stock Options (NSOs). These instruments generally cannot be transferred to a trust during the executive’s lifetime without violating plan rules or triggering immediate taxation.

- The Problem: If an executive dies holding unvested or unexercised options, the estate must act quickly. However, standard power of attorney documents or wills may not provide the specific authority required to exercise options, borrow funds to pay the strike price, or manage the tax consequences.

- The Solution: Estate planning documents must grant the Executor/Trustee explicit authority to deal with equity compensation. We often draft “pour-over” provisions that direct the proceeds from exercised options into specific sub-trusts. Executors must also be empowered to make strategic decisions regarding the timing of exercise to manage Income in Respect of a Decedent (IRD) tax liabilities.

6.3 Security Clearances and Fiduciary Eligibility

For owners of GovCon firms, the identity of the successor is a matter of national security. If a business holds a Facility Security Clearance (FCL), the transfer of ownership to an un-cleared individual or, worse, a non-US citizen trustee, can trigger an immediate review by the Defense Counterintelligence and Security Agency (DCSA). This puts the company’s FCL—and its revenue—at risk.

- Strategy: We utilize “Special Trustees” or “Voting Trusts” for GovCon assets. A Voting Trustee, who possesses the necessary clearance and citizenship, holds the voting rights and control over the GovCon stock, while the economic benefits flow to the beneficiaries (who may be un-cleared). This structure decouples “control” (security) from “equity” (wealth), preserving the company’s eligibility to perform classified work.

6.4 Intellectual Property (IP) Valuation and Protection

Many businesses in Arlington and Alexandria are essentially IP holding companies, deriving value from proprietary software, patents, or specialized processes.

- Valuation Risks: The IRS often contests the valuation of IP in estate tax audits.

- Planning: We work with specialized appraisers to establish defensible valuations. Furthermore, placing IP into separate Limited Liability Companies (LLCs) or trusts can insulate these “crown jewel” assets from the operational liabilities of the contracting business. If the operating company is sued, the IP remains protected in a separate entity and can be licensed back to the business.

6.5 Data Center Executives and Land Leases

Loudoun County is “Data Center Alley,” and many local landowners and executives derive wealth from data center operations or long-term ground leases.

- Lease Succession: These ground leases are effectively high-yield bonds. Assigning these leases to a dedicated LLC or Trust ensures that the income stream is distributed efficiently to heirs without partitioning the underlying land, which would destroy its value for data center use.

Chapter 7: Regional Wealth Profiles: Hampton Roads, Roanoke, and the Southwest

7.1 Hampton Roads: The Military-Industrial Complex

The military and maritime industries define the economy of Virginia Beach, Norfolk, and Newport News.

- Defense Contractors: Similar to Northern Virginia, contractors here face security clearance issues. However, they also face the unique risks of maritime law.

- Deployment and Incapacity: For military officers and contractors who deploy, the risk of incapacity or absence is high. A robust Revocable Living Trust is superior to a Power of Attorney for managing assets during deployment, as trustees have clearer legal standing to act on the Grantor’s behalf.

- Shipyard Contractors: Executives and owners of firms supporting Newport News Shipbuilding face specific compliance requirements. Their estate plans must ensure that successors meet the stringent vendor qualification requirements (e.g., Avetta prequalification) to maintain contracts with major prime contractors.

7.2 The Roanoke Valley: Medical and Educational Wealth

Roanoke is a hub for healthcare (Carilion Clinic) and higher education.

- Medical Professionals: Doctors face high exposure to malpractice liability. While insurance covers most claims, a catastrophic verdict can exceed policy limits. For these clients, the Virginia Self-Settled Spendthrift Trust (Chapter 3) is a vital tool for shielding personal assets from professional liability.

- University Assets: Professors and administrators often have unique retirement assets (TIAA-CREF) and intellectual property rights that require specific beneficiary designations to avoid adverse tax consequences.

7.3 Southwest Virginia: Land and Natural Resources

In rural Southwest Virginia, wealth is often held in land—farms, timber, and mineral rights.

- Land Rich, Cash Poor: These estates face a liquidity crisis at death. The land is valuable, but there is no cash to pay estate taxes.

- Conservation Easements: We utilize Virginia Land Preservation Tax Credits (discussed in Chapter 10) to monetize the development value of the land, generating cash and tax credits while preserving the family farm for future generations.

Chapter 8: Protecting the Vulnerable and the Legacy: Guardianships and Special Needs

8.1 Guardianship for Minor Children

For young, wealthy families in Ashburn or Burke, the primary anxiety is not taxes, but the welfare of their children.

- Nomination: A Will is the only legal document where parents can nominate Guardians for their minor children. Without this, the court will decide custody, potentially sparking a bitter battle between in-laws.

- Separation of Powers: We advise separating the roles of Guardian of the Person (who raises the child) and Trustee (who manages the money). This check-and-balance system ensures that the inheritance is used for the child’s benefit and prevents the Guardian from becoming financially dependent on the child’s assets.

8.2 Special Needs Trusts (SNTs)

If a beneficiary has a disability, a direct inheritance can be a curse, disqualifying them from essential government benefits like Medicaid or SSI.

- Third-Party SNT: We create a dedicated trust funded with the parents’ assets. The Trustee has the discretion to use funds to “supplement but not supplant” government benefits—paying for advanced therapies, travel, electronics, and quality of life enhancements.

- Protection: Because the beneficiary has no legal claim to the funds, the assets are generally protected from the state’s “payback” requirements upon the beneficiary’s death.

8.3 The Blended Family Dilemma

Remarriage creates complex dynamics. In a “Brady Bunch” scenario, a standard “I love you” will (leaving everything to the surviving spouse) puts the biological children of the first marriage at risk of disinheritance.

- QTIP Trusts: A Qualified Terminable Interest Property (QTIP) Trust is the solution. It allows the surviving spouse to receive income from the assets for life, maintaining their standard of living. However, the principal is legally locked down for the deceased spouse’s biological children. This ensures that the spouse is supported, but the legacy ultimately returns to the grantor’s bloodline.

Chapter 9: Niche Asset Strategies: Digital Assets, Firearms, and Companion Animals

9.1 Digital Assets and RUFADAA

In the modern era, substantial wealth exists in the cloud: cryptocurrency, domain names, monetized social media accounts, and sentimental digital photos.

- Legal Barrier: Federal privacy laws (like the Stored Communications Act) and Terms of Service agreements often prohibit service providers from granting access to unauthorized users—even executors.

- The Virginia Solution: The Uniform Fiduciary Access to Digital Assets Act (Code of Virginia Title 64.2, Article 3.1) allows a user to grant a fiduciary legal authority to access and manage digital assets. However, this consent must be explicit in the estate planning documents. Our plans include specific “Digital Asset Authorizations” to ensure Bitcoin isn’t lost to the void and that digital legacies are preserved.

9.2 The Virginia Gun Trust (NFA Trust)

Virginia has a robust culture of firearm ownership, including Title II (NFA) items like suppressors and short-barreled rifles.

- The Felony Trap: NFA items are registered to a specific individual. If that individual dies, possession by an heir (even a spouse) without immediate ATF transfer paperwork can technically constitute a federal felony.

- The Trust Solution: We establish a specialized Gun Trust to hold title to these items. This allows multiple trustees (e.g., spouses, adult children) to legally possess and use the items. It also streamlines the inheritance process, bypassing the need for a Chief Law Enforcement Officer (CLEO) signature in some transfer contexts and avoiding probate for these highly regulated assets.

9.3 Pet Trusts: Statutory Protection for Companions

For many clients, pets are family members. Virginia Code § 64.2-726 specifically authorizes enforceable trusts for the care of animals.

- Application: This is essential for clients with high-maintenance animals, such as horses in Middleburg’s equestrian community or parrots with long lifespans. A Pet Trust designates a caregiver and sets up a trust to pay for the animal’s food, vet bills, and boarding for the animal’s lifetime. It creates a legal obligation to care for the animal, preventing it from being surrendered to a shelter.

Chapter 10: Philanthropic Strategy: Land Preservation and Tax Credits

10.1 Strategic Philanthropy

For the wealthy, philanthropy is a dual-purpose tool: it achieves social impact while providing significant tax mitigation. Virginia offers unique incentives that can be integrated into the estate plan.

10.2 Virginia Land Preservation Tax Credits (LPTC)

Landowners in Western Loudoun, Albemarle, or Roanoke who place a conservation easement on their property (voluntarily restricting future development) can unlock immense value.

- The Benefit: The donor receives a Virginia income tax credit equal to 40% of the fair market value of the easement.

- Transferability: Crucially, these credits are transferable. If the donor cannot use the full credit, they can sell the unused credits to other Virginia taxpayers. This creates immediate cash flow for the land-rich, cash-poor estate while permanently preserving the land.

10.3 Neighborhood Assistance Program (NAP) Credits

Business owners and professionals can receive tax credits (up to 65% of the donation value) for contributing to approved non-profit organizations that serve low-income populations.

- Leverage: By routing charitable giving through NAP-eligible organizations, a high-income client in Virginia Beach or Richmond can achieve a significantly deeper tax benefit than a standard charitable deduction. This effectively allows the client to direct their state tax dollars to the local charities of their choice rather than the general treasury.

10.4 Charitable Remainder Trusts (CRTs)

The CRT is a powerful tool for clients holding highly appreciated assets (e.g., low-basis stock or real estate).

- Mechanism: The asset is transferred to the CRT and sold by the trustee. Because the trust is a tax-exempt entity, no capital gains tax is paid on the sale.

- Outcome: The full pre-tax proceeds are reinvested to pay an income stream to the Grantor for life. Upon death, the remainder passes to a charity. This structure converts a highly taxed asset into a lifetime income stream and a significant philanthropic legacy.

Conclusion: The Cost of Inaction

The complexity of Virginia’s legal landscape matches the complexity of the lives led by its most successful citizens. For the wealthy individual or business owner, “doing nothing” is an active decision to accept the state’s default plan—a plan that is public, expensive, tax-inefficient, and blind to the nuances of family dynamics.

At Shin Law Office, we view estate planning as the ultimate act of stewardship. It safeguards the wealth you have built, protects the people you love, and ensures that your business and values survive you. Whether leveraging a Self-Settled Spendthrift Trust to firewall assets from liability or utilizing a complex Trust architecture to minimize federal estate taxes, the goal remains the same: Control, Clarity, and Peace of Mind.

We invite you to treat your estate with the same strategic rigor you apply to your business. The legal tools exist. The path is clear. It is your move to walk it.

Call Shin Law Office today at 571-445-6565 or use our online contact form to schedule a consultation with me.

Adam L. Engel, Esq.

Partner, Estate Planning & Probate

Shin Law Office, PLC

Leesburg, Virginia

Appendix A: Research Methodology and Analytical Framework

1. Overview: This report, “Estate Planning for the Virginia Elite,” was developed through a multi-disciplinary analysis of statutory law, judicial precedent, federal tax regulations, and regional economic data. The objective was to move beyond generic estate planning advice and provide a targeted, actionable framework for high-net-worth individuals, business owners, and families domiciled in the Commonwealth of Virginia.

2. Primary Legal and Statutory Analysis: The core recommendations of this report are grounded in a rigorous review of current Commonwealth statutes and federal codes.

- The Code of Virginia: A systematic review of Title 64.2 (Wills, Trusts, and Fiduciaries) was conducted to identify the precise mechanisms of intestate succession, the powers of fiduciaries, and the statutory requirements for the creation of valid trusts. Special attention was paid to Article 3.1 (Uniform Fiduciary Access to Digital Assets Act) and § 64.2-745.1 (Self-Settled Spendthrift Trusts) to ensure all asset protection strategies are compliant with the most recent legislative updates.

- Federal Tax Code (IRC): The report analyzes the intersection of Virginia law with the Internal Revenue Code, specifically regarding the Federal Estate Tax exemption limits (scheduled to sunset in 2026), Gift Tax exclusions, and the taxation of Grantor Trusts.

- Judicial Precedent: Analysis of relevant case law from the Supreme Court of Virginia and the Circuit Courts was used to understand how judges interpret ambiguous statutory language, particularly regarding the “Prudent Investor Rule” and challenges to the validity of trusts.

3. Comparative Jurisdictional Benchmarking: To validate the efficacy of Virginia-specific tools, we employed a comparative methodology.

- Asset Protection Comparison: We benchmarked Virginia’s Qualified Self-Settled Spendthrift Trust (QSSST) statutes against established “asset haven” jurisdictions such as Nevada, Delaware, and South Dakota. This analysis focused on statute-of-limitations (look-back) periods, exception creditors, and the “home court advantage” of domestic litigation to determine when a Virginia-situs trust is preferable to an offshore or out-of-state alternative.

4. Socio-Economic and Sector-Specific Profiling: Recognizing that wealth in Virginia is heterogeneous, we categorized planning needs based on regional economic drivers rather than just net worth.

- Government Contracting & Defense (Northern Virginia/Hampton Roads): We analyzed Department of Defense (DoD) regulations and Defense Counterintelligence and Security Agency (DCSA) guidelines to determine how facility security clearances (FCLs) interact with estate transfers, identifying the specific risks of foreign or un-cleared trusteeship.

- Technology & Equity Compensation (Dulles Corridor): We reviewed standard vesting schedules and restricted stock unit (RSU) agreements common among public tech companies to develop strategies for managing illiquid equity in estate administration.

- Agricultural & Land Holdings (Southwest Virginia): We integrated data on Virginia Land Preservation Tax Credits to model liquidity solutions for asset-rich, cash-poor estates.

5. Practical Application & Scenario Modeling: The strategies outlined are not theoretical; they are derived from the practical application of law at Shin Law Office.

- Archetype Synthesis: We created composite client archetypes (e.g., “The Blended Family Executive,” “The Unmarried Tech Founder”) to stress-test standard estate plans against complex variables like divorce, incapacity, and creditor claims.

- Risk Assessment Matrix: We evaluated the “Cost of Inaction” by modeling the financial impact of probate fees, commissioner of accounts fees, and potential estate taxes against the cost of implementing a Revocable Living Trust structure.

6. Limitations: This research assumes the current legal framework as of 2025. It is noted that tax laws are subject to political shifts (specifically the 2026 TCJA sunset) and that individual client circumstances require bespoke analysis that a general report cannot provide.

References

- Title 64.2. Wills, Trusts, and Fiduciaries. – VACODE

- Estate Tax Planning Strategies for Virginia Residents – Edelman Financial Engines

- Leesburg – Estate Planning Made Simple for Blended Families – Shin Law Office

- Government Contracts | Reston Law Group

- Code of Virginia Code – Chapter 5. Personal Representatives and Administration of Estates

- Estate Planning & Probate | Adam L. Engel, Esq. – Shin Law Office

- Estate Planning Attorney in Richmond, Virginia – PJI Law

- The Most Expensive Neighborhoods in Roanoke | Stacker

- Virginia Code Title 64.2. Wills, Trusts, and Fiduciaries § 64.2-2021 – FindLaw

- Code of Virginia

- Protecting Your Family-Owned Business In Estate Plans | TrustBuilders Law Group

- What is a Revocable Living Trust in Virginia? | Parks Zeigler

- Estate Planning Trust Guide for High-Net-Worth Families – Shin Law Office

- Leesburg Wills & Trusts: How to Protect Your Family’s Future – Shin Law Office

- 9 Questions Everyone Has About Revocable Living Trusts – PJI Law

- Leesburg Real Estate and Inheritance – Shin Law Office

- Northern Virginia Trusts & Estates: Estate Planning Attorney

- Common Questions About Living Trusts in Virginia – Speedwell Law

- § 64.2-2023. Estate planning – Virginia Law

- Trust Attorney in Alexandria | King, Campbell, Poretz, and Mitchell

- Estate Planning Considerations for Business Owners – Spencer Fane

- Asset Protection: What You Really Need to Know | TPC Estate

- Virginia Self-Settled Spendthrift Trusts – Arlington Law Group

- Virginia’s New Domestic Asset Protection Trust Law – Dominion Law Group

- Using Asset Protection Trusts in Virginia Estate Planning | Promise Law PLLC

- § 64.2-745.1. Self-settled spendthrift trusts – Virginia Law

- Virginia Beach Business Succession Planning Lawyer – Parks Zeigler

- Adam L. Engel, Esq. | Shin Law Office

- Meet Our Team at Shin Law Office

- Business Succession Planning Fairfax & Northern VA – General Counsel, P.C.

- Business Succession Planning – McCarthy & Akers, PLC

- Estate Planning Strategies Used by High-Net-Worth Individuals – Lauenstein Law

- The History of Hudgins Contracting

- Why Loudoun County Families Should Consider a Testamentary Trust – Shin Law Office

- Comprehensive Estate Planning for Tech Executives – Heritage Law Office

- Estate Planning Guide for High-Net-Worth Families in Northern Virginia – Shin Law Office

- Data Centers in Virginia – JLARC

- Virginia’s Data Centers and Economic Development | Richmond Fed

- Newport News Shipbuilding Supplier Management Program – Avetta

- Estate & Trust Planning Virginia | YHB CPAs & Consultants

- Land Preservation Tax Credit – Dcr.virginia.gov

- Trusts FAQs | Estate Law Center

- Code of Virginia Code – Article 3.1. Uniform Fiduciary Access to Digital Assets Act

- What Happens to Your Digital Assets When You Die? | TPC Estate

- Virginia – Gun Trust Guru

- Highest Rated Virginia NFA Gun Trust Paperwork – National Gun Trusts

- § 64.2-726. Trust for care of animal – Virginia Law

- Pet Trusts…What Happens to Fido When I’m Gone? – Melone Law PC

- Tax Benefits – Stafford County

- Neighborhood Assistance Act | Virginia Department of Education

- NEIGHBORHOOD ASSISTANCE ACT TAX CREDIT – Division of Legislative Services